Judging by the promising prospects in candidate trials, Elsoms Wheat has made a strong debut to the UK winter wheat market. CPM travels to Germany to meet its partners and explore the breeding innovations they’re bringing to market

By Tom Allen-Stevens

If you’re a grower who keeps an eye on the AHDB Recommended List winter wheat candidate varieties, there’s one breeder you’ll probably have noticed. While the familiar names in the UK wheat market have up to three feed varieties vying for a space on next year’s RL, newcomer Elsoms Wheat has four.

Vegetable growers will be familiar with the Spalding-based family-owned business that has around 85-90% UK market share of carrot varieties, for example, and varieties such as Trinity and Elgar have put Elsoms Seeds on the map for oilseed rape. But in the past, success in wheats has been limited, admits the firm’s Adrian Hayler.

To be a major player in the UK wheat market, you need to enter 10 new lines into National List trials each year.

“Growers may know us for Welford and Brompton. 70% of our business is in the vegetable seed range, but our agricultural division is growing dramatically, and the four RL wheat candidates are proof of this.”

It’s the fruit of a conscious effort, made around 8-10 years ago, to become a major player on the UK wheat market, he says, and these four promising newcomers are just the very start of some interesting new material, much of which has been bred using cutting-edge technology.

Currently the breeder has 2000 wheat lines across 8000 plots on relatively fertile soils just west of the Wash. It’s a

yellow rust hotspot, with high septoria levels, being near the coast, while the fertile soils are capable of high yields, but are also a test of straw strength. That means it’s the perfect environment to pull apart the differences between varieties, says head wheat breeder at Elsoms Wheat, Stephen Smith.

“When I joined Elsoms ten years ago, I introduced new material and worked hard to develop promising lines, continuing to focus on the feed and biscuit market,” he recalls.

The breeding programme was ramped up, and this has resulted in the four RL candidates (see panel on pxx). But it still relied on traditional breeding techniques, notes Adrian Hayler.

“It was a solid programme, delivering results, but to be a major player in the UK wheat market, you need to enter 10 new lines into National List trials each year, and Elsoms just wasn’t big enough to do this by itself. What it did achieve through the innovations we’d already introduced, however, was the interest of one or two potential European partners.”

One of these was Nordsaat, another family-owned business based in Bӧhnshausen, Germany on what used to be the border between East and West. The company specialises in cereals, with barley, triticale, and oats joining wheat in an extensive programme that stretches across Europe from the Ural Mountains to the Atlantic. This includes hybrid wheat and triticale, with seed production covering 2200ha, while the business farms a total of 10,950ha.

It’s part of the Saaten Union group of breeders, a pan-European business with a turnover of €200M, and this gives it access to marketing and other services, notes Nordsaat head of conventional wheat breeding Dr Martin Kirchhoff. “We focus on breeding and producing our own varieties and channel these through Saaten Union, which is a bigger force in marketing.”

Extensive pipeline

Most of Nordsaat’s success has been in Germany, where it has five varieties on the country’s equivalent of the RL, with an extensive pipeline coming through National List trials. “We target bread-making traits, since this makes up 50% of the German market. Nordkap is a new variety with a high yield and extraordinarily high protein, for example.” There’s also Hyvento, a hybrid that’s also the highest yielding quality variety on the German list.

More than 50% of turnover comes from sales outside Germany, across Europe and into Russia, and the breeder has varieties on sale or in National List trials in 12 countries. But getting a toehold in France and the UK has been a struggle, reveals Nordsaat managing director Wolf von Rhade.

“We have tried for decades to develop varieties for the UK and France and never succeeded – there have been too many near misses. In some ways it’s like going into a casino, and never being quite sure whether to put your money on red or black. But we could see that Elsoms had a strong breeding programme and looked to be doing the right thing.”

In France, another Saaten Union partner, Saaten-Union Recherche was in a similar position, and discussions about a possible partnership between the three companies got underway. This culminated in 2013 with the formation of Elsoms Wheat, equally owned by the three breeding companies.

For Stephen Smith it’s resulted in a huge boost in resources. “With the partnership agreed, I outlined to the board of directors what we’d need to take things forward, and to my surprise they agreed. We’re now three times the size and there’s been a lot of investment. We exchange material with the partner breeders from the beginning to the very end, and that’s presenting a lot of opportunities in how we develop new lines.”

Some of Elsoms’ Bennington and Dunston has been multiplied up by Nordsaat, for example, and varieties have been taken into the Europe-wide breeding programme – the wheat lines work well as females in the hybrid programme. Likewise, there’s some valuable genetic material to use in the Elsoms plots, notes Stephen Smith.

But perhaps the most exciting opportunity in breeding terms comes from the access Elsoms now has to doubled-haploid technology. “It can have a huge impact, not just in terms of numbers, but in the speed with which you can get a variety to market,” he points out.

This is provided through Saaten-Union Biotec, a subsidiary company set up in 1984 by a group of seven German plant-breeding companies specifically to allow them access to new breeding technologies. These include the use of modern breeding methods like molecular markers to identify traits. But it’s in tissue culture that its research facility at Gatersleben, about 35km east of Nordsaat’s breeding station, has particular flair.

“We use the ability of plants to regenerate completely from immature pollen in vitro – in a Petri dish in the lab,” explains Dr Heike Gnad, one of the lead scientists at the laboratory. “It means we can reliably produce 100% homozygous material from a cross of two parents in just one year.”

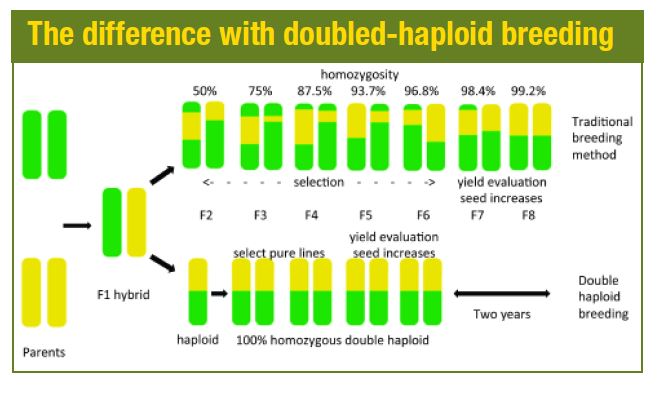

One of the reasons it takes so long – up to ten years – to bring a new wheat variety to market is that when you cross two lines, there’s natural variability in the progeny. Only 50% of an F2 line – two generations down from the parent lines – will carry the desirable traits, which is why the seed of a hybrid crop performs so badly if it’s saved and planted the following year.

Traditionally, plant breeders spend about six years selecting from the progeny of each generation until they have a near-100% homozygous or pure line (see panel on pxx). Genetic markers now help breeders spot the desirable traits in their lines among the also-rans with greater reliability, but this still doesn’t deliver complete homozygosity.

Doubled-haploid breeding removes this variability by taking plant material from the germ line of the F1 cross that has only half the chromosomes of the diploid wheat plant – pollen in the anthers or the unfertilised embryo comprise this haploid material. This can be grown into a new plant, and its cell division is interrupted so that the haploid doubles into a complete, fully functioning and homozygous wheat.

“The process of doubled-haploid production was first discovered in thorn apple in the 1960s,” says Heike Gnad. “It’s been practiced commercially in wheat since the 1990s, but mostly through pollination with maize pollen and rescuing the immature wheat embryos to produce doubled-haploids in vitro. It would work on most lines but was very labour intensive and you’d get a limited number of plants per spike.”

Optimised medium

The staff at SU Biotec, however, have progressed the system for the group’s partner breeders using the anthers of the crossed plants and developing the raw material for a new doubled-haploid plant, or callus, on an optimised medium in a Petri dish under controlled and sterile conditions. “We now have 80-90% reliability with our crosses and use the system successfully with material grown from the Mediterranean to Scandinavia. Across oilseed rape, barley and wheat, we process nearly half a million doubled-haploid plants every year.”

Around 30,000 of these are future wheat lines for Elsoms, sent in as 122 crosses by Stephen Smith in March. “From the F1 seed to the doubled-haploid plants takes 51 weeks,” she adds.

Once they arrive back in the UK, the pure lines are evaluated at Spalding and also at the Saaten-Union plant-breeding station at Cowlinge, Suffolk, says Stephen Smith. “It’s a useful site with an expert team who can rapidly identify lines for NL-1 trials. It’s also on heavy clay, which gives us a different aspect to the fertile silt at Spalding.”

Elsoms currently has 90 wheat varieties at NL-1 and 800 at NL-2 and is on target to meet its aim of 10 varieties entered into National List trials from 2017, he says. “This support has been a game-changer for us. Without doubled-haploid breeding, we’d have only 30 lines at NL-1.

“But it’s not just the numbers, it’s the speed. Yields go up by an average of 1.5% each year, so if I can shave two years off the time it takes to get a variety to market, I instantly gain 3% yield.

“Then we can take Dunston, that’s a potential 2017 RL leader, cross it and have its progeny back in NL-1 trials within three years – this is real seat-of-the-pants stuff and growers are set to see some very interesting material come through in years to come.”

Capable candidates and a pipeline of promise

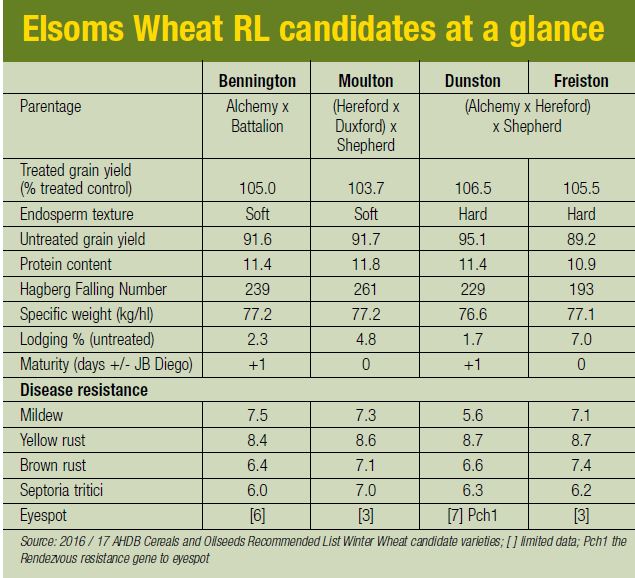

Two soft and two hard Group 4 wheats are on offer from Elsoms Wheat for planting this autumn. “Our aim has been to deliver very solid disease resistance with a high yield,” says Stephen Smith.

Alchemy and Hereford feature in the crosses. “These bring the yield – equivalent to Oakley – but they have a problem with brown rust. That’s where Shepherd comes in, which is also a parent of Revelation.”

Bennington’s a soft wheat boasting an untreated yield of 92%, compared with controls, with good agronomic characteristics and grain quality, he says. “We’re pretty sure it’ll get a ‘uks’ classification for export. It’s a bit on the tall side, but stands well, and will suit growers in the East.”

Moulton has a similar untreated yield with a soft endosperm. “It’s suitable for distilling and for export and has sound physical grain qualities. There’s an excellent score for septoria, but the disappointing eyespot rating doesn’t manifest itself in our plots. I think growers in the North and South West will favour it,” says Stephen Smith.

Dunston is a hard Group 4 wheat and sits among the highest yielders on the candidate list with the highest untreated yield. Freiston is the same cross, and although it doesn’t match its stablemate on yield, it’s slightly earlier to mature and has a marginally better specific weight.

Agrii has been growing the varieties in its trials – Bennington for just one year and two years with the others. “We aim to test varieties to destruction,” reports David Leaper. “What’s exciting about these wheats is that they have high treated and untreated yields, but combine this with a good specific weight.”

Freiston was one of the top three performers in Agrii trials in terms of disease performance, while Bennington and Moulton were near the top of Agrii’s soft wheat line-up, he says. “Despite Freiston’s performance, we don’t think farmers will go for it, so we are considering multiplying Bennington and Dunston in autumn 2016.”

Elsoms Wheat has six varieties in NL2, including four possible biscuit types. “We reckon at least two of these six should make onto the RL candidate list,” he says.

The ten entries in NL1 are all soft wheats and include five Revelation crosses. Eight of them are doubled-haploids.

Elsoms Wheat RL candidates at a glance