Higher yielding Group 3 varieties with good agronomics may be tempting growers back into the premium biscuit and export market for soft wheat. CPM sifts through the results of a recent survey.

There’s nowhere else in the world that grows these soft wheats.

By Tom Allen-Stevens

Group 3 wheats could be set for a revival after more than 90% of growers said they were considering growing them in a recent survey carried out by CPM and KWS. But poor yield performance of existing Group 3 varieties and a perceived lack of markets have held growers back from the sector that currently has only a 5-6% market share.

The survey was carried out online through the CPM website and also filled in by growers visiting the KWS stand at the Cereals event. Over 460 participants gave their views, with 92% saying they would consider growing a Group 3 variety if it offered the same yield performance and disease ratings as the leading feed wheats.

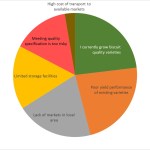

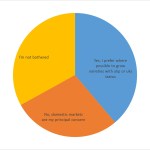

The most common reason given for not growing a Group3 variety, at 23%, was the poor yield performance of current varieties. One in five growers said a lack of markets held them back, while 17% said their storage facilities were limited.

New entries

“I’d completely agree that the barrier stopping most growers entering this market has been yield, but that’s now changed,” says Frontier’s Chris Piggott. “New entries on the AHDB Cereals and Oilseeds Recommended List like KWS Barrel yield on a par with the top feed wheats. So I suspect we’ll see growers looking again at what Group 3 has to offer.”

Claire and Scout, now yielding below the RL controls, had led the Group 3 sector for years, points out Will Compson of KWS. “Zulu’s appeared more recently, but at 102% of controls, that’s still way off a feed wheat yield. But varieties like KWS Barrel and KWS Basset have the marketability with no yield drag.”

Almost a quarter (23%) of growers in the survey said they were currently growing biscuit-quality varieties – significantly above the 5-6% reportedly in the ground. “Many growers don’t differentiate between a Group 3 variety and a soft Group 4,” notes Andrew Bourne of Kent-based T Denne and Sons.

“Our view is that Group 3 is a specific classification for domestic biscuit milling and specific export outlets, but soft Group 4 varieties such as Viscount and Leeds are seen as multipurpose and have picked up some of those contracts as Group 3 availability has dwindled. Now there are varieties yielding on a par, I’d expect that to rekindle interest in genuine Group 3s.”

Geoff Williams of Notts-based Williams Seeds agrees. “It all changed when Alchemy came in. Biscuit millers found they didn’t have to rely on the traditional Group 3 varieties and switched into soft Group 4 types instead. The Group 3s weren’t competing on yield, so growers switched out of them too.”

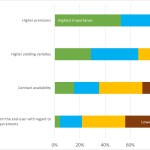

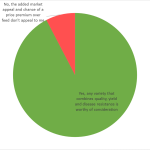

But when asked what would encourage them to grow more biscuit wheats, 52% of growers said a higher premium was the most important factor. Higher yielding varieties was seen as less important, with 29% choosing that as the number one factor.

“There has to be premium to bring growers back into the market,” reckons Geoff Williams. “It’s £5-10/t at present, but I’d expect that to drop back as growers take up the new higher yielding Group 3s on offer. But I don’t think it’ll be a mad dash into the sector – more a drift, and they’ll drift back out if Group 4 yields pick up again.”

Will Compson agrees there has to be the prospect of a premium to bring growers back in. “The advantage now is

KWS Barrel and Basset have the marketability with no yield drag, says Will Compson.

that you’re not relying on that premium to deliver the margin over a feed wheat, because you’ll still get the yield.”

Chris Piggott adds: “It’s important to note that although there is a clear premium for milling quality wheat, achieving the spec for biscuit wheat is relatively more simple, so the associated premium reflects this.”

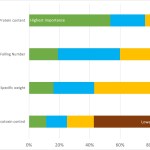

Achieving the protein content is the main aspect growers consider the most difficult to achieve with a quality wheat – 54% said it was the most difficult in front of Hagberg (19%) and specific weight (16%). Meeting the quality specification was also seen as too risky by 15% of growers, who gave that as their main reason for not growing Group 3 wheats.

Quality wheat

Andrew Bourne notes the quality market is more flexible now. “You don’t have to hit 13% for a hard milling premium – low-grade contracts are available at 11.5-12%. A lot of growers in the South and East struggle to achieve full Group 1 spec, so with a range of premium quality varieties now available, matching your variety choice to local markets with readily achievable premiums, there is a much wider choice, especially in the Group 3 sector.”

Geoff Williams notes that Group 1 and 2 milling markets can be a risky proposition. “But meeting the quality spec of 10.5-11% protein on a Group 3 contract is not so difficult. Choose the right variety and you’re 75% of the way there.”

Will Compson agrees. “If you’re not confident you’ll hit the top quality spec on protein, a biscuit wheat contract at 11.5% makes a lot of sense. With the newer varieties, you’re not losing in terms of yield, either.”

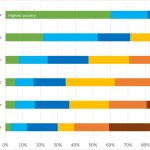

But when it comes to choosing a variety, end-market suitability is not the driver – only 21% of growers said it was. Way out in front, with 60% of respondents choosing it as the highest priority feature, is disease resistance.

The disease pressure seen this season, particularly on yellow rust, has set a lot of hares running, notes Andrew Bourne. “Growers are looking for good agronomics as well as good marketability, and there are simply more options in Group 1, 2 and 3 than there are in Group 4.

- The popularity of biscuit wheats of the Group 3 category has fallen considerably in recent years. What is the main reason stopping you growing a biscuit-quality wheat?

- After yield potential, which feature will you prioritise when selecting varieties for drilling in the 2016-17 season?

- Is your variety selection determined by end-user demand?

- What would encourage you to grow more biscuit wheats?

- Which aspect of growing a quality wheat do you consider the most difficult to achieve?

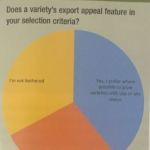

- The UK is, historically, a net exporter of wheat, does a variety’s export appeal feature in your selection criteria?

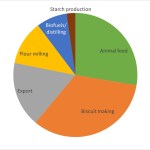

- Group 3 wheats have broad market suitability, which of the following markets most applies to you?

- Would you consider a Group 3 variety if it offered the same yield performance and disease ratings as the leading feed wheats?

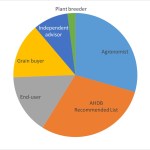

- Who influences your variety choice? Please select the one which most applies

. A switch away from feed types to the likes of KWS Siskin, RGT Illustrious, KWS Zyatt or KWS Basset, for example, is the intelligent move for growers looking to reduce their exposure to risk.”

Trends are changing, points out Geoff Williams. “The current mood is to move to anything that will save money on the cost of production.”

While a number of varieties appear to be breaking down to yellow rust, KWS Basset and KWS Barrel are holding out, assures Will Compson. “They have a 9 and 8 respectively for the disease. It’s all very well growing a variety that yields, but you’ve got to have the agronomics, too. They’re also short and stiff, so in terms of resilient varieties that deliver a combination of factors, they do so in spades.”

Claire and Scout have suffered this year, however, notes Chris Piggott. “Disease susceptibility will have a bearing on variety choice this year, but there are plenty of options for growers looking for good agronomics. I’d say considering your end market’s requirements should be a higher priority – if your crop doesn’t sell for the maximum value you can go for, it’s wasted.”

Over half of growers (51%) have a combination of end-market suitability and farm situation in mind when selecting variety, according to the survey. A third are driven solely by those with established end-market appeal.

“Both aspects should be taken into consideration,” agrees Will Compson. “KWS Basset meets all the Group 3 criteria for biscuit and export, and initial feedback from end users has been very positive. It appears to perform best in the East and South.

“KWS Barrel is a good biscuit wheat and has phenomenal yields in the North. It didn’t quite make distilling, but it’s being retested, so we’re hopeful this’ll change.”

Export potential appeals to 39% of growers, according to the survey, who prefer where possible to grow varieties with ukp or uks status. It’s a significant market for growers in the south-eastern corner of the UK, notes Andrew Bourne.

“Group 3 varieties are a very good fit for this market and KWS Basset is the one that ticks the boxes for us. Exchange rates are very volatile at present, but if currency gives us a competitive edge and we have the right varieties, the UK will be in a very strong position in the international market.”

The UK is good at growing soft wheats, notes Chris Piggott. “If we can grow this market and export it, that’ll help both the domestic and export premium.”

Geoff Williams reckons the Group 3 market could rise to 10%, but if exports were reignited, that would raise premiums and could easily see Group 3s take 15% market share. “There’s nowhere else in the world that grows these soft wheats. They’re a unique grade and they do well here. We should expand that opportunity.”

North African and European buyers who used to represent key markets have switched away from the UK in recent years, notes Will Compson. “They do like the quality of UK Group 3 soft wheats, but there hasn’t been the availability.

“KWS Basset and KWS Barrel are game changers – they offer UK growers the chance to produce for what the market really wants. The survey suggests there’s a shift in attitude towards this market and that’s hugely encouraging – it’s a fantastic opportunity for UK Agriculture.”

Flying high after survey entry

Congratulations to Keith Caswell of Pond Farm near Spalding, Lincs, who’ll be getting a bird’s-eye view of his wheat crop after winning a fantastic DJI Phantom 3 drone, worth £900, in the CPM/KWS Group 3 wheats survey.

He responded to an email inviting him to take part in the online survey. To take part in the next survey, make sure we have the correct details for you by emailing info@cpm-magazine.co.uk