The arable landscape in which oilseed rape sits has shifted on many UK farms, but growers remain committed to the crop, according to a recent CPM survey carried out with BASF and Dekalb.

Winter OSR seems certain to remain popular wherever it can be grown with sufficient reliability.

By Rob Jones

Despite last season’s disappointing performance, growing flea beetle problems in the absence of neonicotinoids and an increasing level of spring cropping to counter the blackgrass threat, winter oilseed rape is set to retain a major place in most arable rotations for the foreseeable future.

However, this seems certain to be at a lower level than the recent past for many. At the same time, the axis of UK production may well shift northwards and westwards as growers beyond the crop’s traditional heartlands make the most of what appear to be clear performance advantages under today’s conditions.

This is the overall picture painted by a timely national study of winter OSR attitudes and intentions undertaken by CPM with Dekalb and BASF this spring.

The study involved 230 growers from 46 UK counties, together managing an arable area of well over 100,000ha with an average of 97ha of winter OSR apiece currently in the ground.

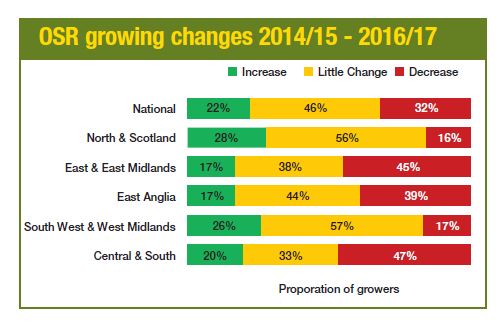

While the overall average OSR area has remained remarkably similar over the past three years, almost a third of producers have reduced their OSR growing noticeably in this time with two in every 10 increasing it.

Very much in line with other national estimates, yields over the past three harvests have averaged 3.67t/ha, falling from an average of 3.89t/ha in 2015 to just 3.29t/ha last harvest.

Highest yields

At 3.87t/ha, growers in the North and Scotland achieved the highest three-year average yields, followed by those in the South West and West Midlands (3.83t/ha) with central and southern growers recording the lowest average at just 3.32t/ha.

Unsurprisingly perhaps, given recent production difficulties, markedly more growers than average in the Central and South, East and East Midlands and East Anglia have reduced their OSR areas in recent years.

In clear contrast, in the South West and West Midlands and North and Scotland the number of growers increasing their OSR area over the past three years substantially exceeds the number decreasing it (see chart).

The $64,000 question, though, is what will happen in the future? Well, while the vast majority of growers (93%) say they’re sticking with the crop, a minority intend to stop growing it altogether – almost all of these from the central and eastern counties.

Including those planning to stop growing OSR, just under 60% are likely to reduce their future area of the crop, with just over 40% intending to maintain or increase it. Again, the main focus of this reduction is set to be in the central and eastern counties.

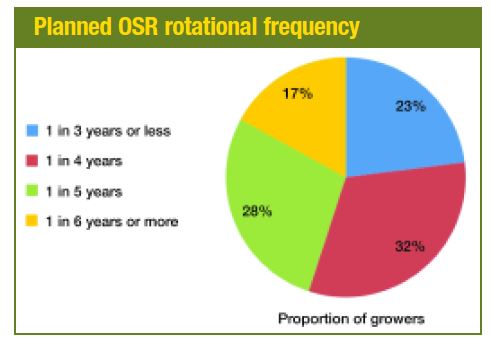

On average, growers are looking to include OSR in their rotations once in every four or five years, with sizeable minorities planning rotations of one in three years or less and one in six years or more (see chart).

Interestingly, the number of growers still planning relatively tight OSR rotations exceeds the number looking to rather longer rotations, and these are by no means all confined to western and northern areas.

“OSR plantings have fallen substantially over the past five years from over 700,000ha to around 550,000ha currently and could well fall back again in the immediate future if growers over-react to last autumn’s particularly poor establishment in some areas,” suggests study co-ordinator, Deryn Gilbey of Dekalb.

“Ironically, this is at a time when the market prospects for UK rapeseed look relatively rosy. There continues to be strong European demand for both rapeseed oil and meal. And because Europe remains far from self-sufficient in vegetable oil production, OSR is less vulnerable to world market fluctuations than feed grains. At the same time, it offers valuable opportunities to replace imports of palm oil with healthier and more environmentally sound home production.

“Of course, changes in the value of sterling will be important in determining future UK prices. But these will impact commodity markets to the same extent, and have little or no effect on the relative position of rapeseed against alternative crops.

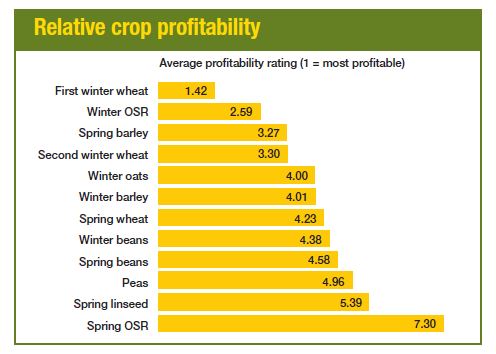

“In this context, it’s timely to have confirmation from our study that winter OSR continues to remain second only in profitability to first wheat for UK growers, maintaining its clear advantage over all alternative cereal breaks with the possible exception of winter oats (see chart).

“Under these circumstances, winter OSR seems certain to remain popular wherever it can be grown with sufficient reliability,” Deryn Gilbey observes.

“With their clear performance advantages, growers in the West and North look better placed than most to take advantage of opportunities in the UK market resulting from issues with the crop in other parts of the country. Particularly so with the even more resilient, yield-protected varieties coming from our leading European breeding programme and OSR’s other clear farm management advantages.”

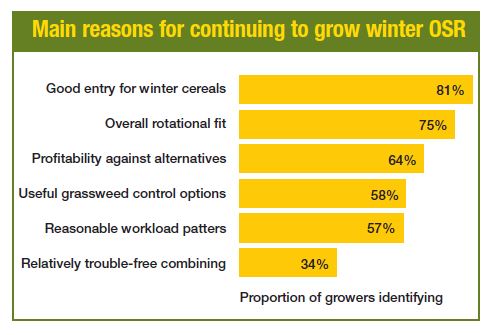

Apart from relative profitability, foremost among the benefits of winter OSR identified in the current study by growers sticking with the crop are the good entry it provides for winter cereals; its overall rotational fit; the useful grassweed control opportunities it offers; and the reasonable workload patterns it involves (see chart).

Alongside this, insect, slug and pigeon pressures and unreliable crop performance – almost certainly due, in part, to these pressures – were the main reasons cited for reducing their OSR growing by those intending to do so.

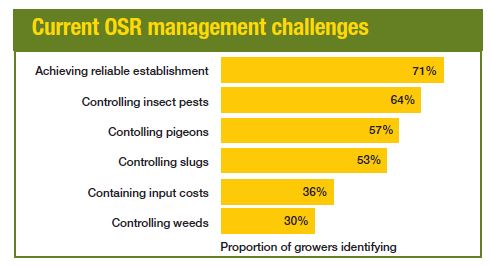

The extent to which establishment difficulties are influencing attitudes to the crop is underlined by the most important winter OSR management challenges identified in the study (see chart).

Not only is achieving reliable establishment identified by nearly three quarters of growers, the only other challenges reported by more than half – controlling insect pests, pigeons and slugs – all relate to crop establishment. As, indeed, do both the other most important challenges – containing input costs and controlling weeds – in great part.

“Establishment has long been the number one challenge with winter OSR,” says BASF agronomy manager, Clare Tucker. “While the neonicotinoid ban hasn’t helped matters here, slugs, pigeons and weeds – not to mention dry autumns – play as much of a part in limiting the crop’s potential for most.

“So, the best early agronomy has to be our main management imperative. After all, crops that establish rapidly and robustly are far better placed to withstand flea beetles, slugs and pigeons. They’re also better able to tolerate early phoma infections, compete with weeds and survive difficult winter conditions.”

As well as vigorously establishing varieties with the ability to grow away from pests far more effectively than those taking longer to get going in the autumn, Clare Tucker sees the right seedbed conditions and the early removal of weeds as key priorities.

“Soil conditions are always more important than calendar date in drill timing,” she stresses. “Good straw management, small soil crumb size and effective consolidation are the three most important essentials to ensure the good seed-to-soil contact and adequate moisture supply OSR needs throughout the germination period.

Greatest defence

“Flea beetle is a threat throughout the drilling period – the greatest defence the grower has is to sow in conditions when the crop can get away as quickly as possible and so more able to tolerate adult damage. These crops will develop into strong plants more able to tolerate the later larval burden.

“In my experience, increasing the sowing rate to combat early pest attack is seldom advisable. If flea beetle, slug or pigeon populations are sufficient to compromise a crop, they’ll do so regardless of the number of plants. So, increasing the seed rate dramatically will merely produce weak individuals with poor rooting, increase disease problems and may even compromise subsequent canopy management.

“Removing weeds early on allows crops to become more competitive for the most sustained weed control as well as the greatest establishment effectiveness,” adds Clare Tucker.

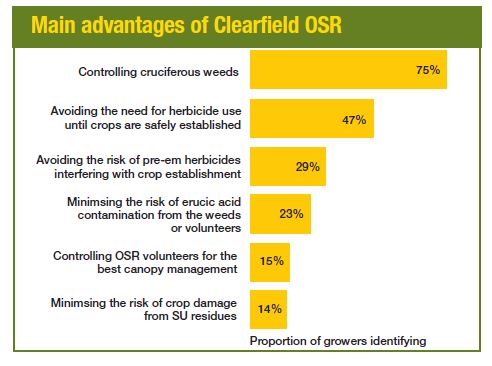

“For those who want to avoid the need for herbicide use until their crops are safely established but still remove weeds early enough to protect yield, the Clearfield system provides an ideal solution. All the more so now the best CL varieties combine highly competitive gross outputs with excellent all-round agronomic packages.

“Under these circumstances, it’s not surprising the system is bucking the trend of declining OSR growing, with the area grown more than doubling to over 30,000 ha in the past year alone and Clearfield standing out as the most popular specialist OSR in our study”

- For more on effective OSR establishment and early management, see the Precision OSR supplement, included with this month’s issue.