Cereals 2017 was an opportunity for the 20,000 or so visitors who attended to prepare their businesses for Brexit, and to glimpse innovations set to pave the way. CPM gleans the political direction and gathers the advice on offer.

There’s an opportunity for us to embrace technology.

By Tom Allen-Stevens and Lucy de la Pasture

Businesses that invest wisely, embrace new technology and innovate will be the ones to reap the rewards post Brexit. That was the message to farmers from politicians, farming leaders and business advisors at Cereals 2017.

Farming minister George Eustice has indicated he intends for regulation on agricultural inputs to return to a risk-based approach, built on sound science and one that encourages innovation. Having kept the post in Government he held before the general election, he made a brief visit to Cereals held at Boothby Graffoe, Lincs, to tour some of the research-based stands.

George Eustice said he was keen for the UK to move towards a regulatory environment that “embraces” innovation.

Afterwards, he told CPM he aims to deliver on his vision of a UK Agriculture that’s free to explore the technologies presented to it. “Leaving the EU is a real opportunity to completely redesign our agricultural policy and adopt something that’s fit for purpose,” he said.

“We want to design an agricultural policy that’s so successful other countries in the world are going to want to copy what we’re doing. I’ve always been really clear that there’s an opportunity to increase our focus and emphasis on knowledge transfer and also research and development.”

Defra and its agencies, such as CRD, have always taken a risk-based approach to crop protection products and modern genetic techniques in plant breeding and the like, he said. “We frequently have a different view to the EU on these – we believe that some of their methodology is wrong. While there are times when you should adopt a precautionary approach, you should do so on the basis of an understanding of the risk, rather than on the basis of theoretical hazards.”

He said he’d seen some of the “really interesting” work on display at the AHDB and Rothamsted Research stands, for example. “There’s an opportunity for us to embrace technology. The truth is, if we want to reduce our reliance on chemical pesticides, a lot of the solutions will be in adopting and embracing new breeding techniques that enable us to get the genetic advances that can breed in resistance to certain pests and diseases.”

When asked whether the UK could become a testbed for innovation, he said it was “absolutely a possibility”, although the government is focused on ensuring a comprehensive free-trade agreement and wouldn’t want to implement anything that could result in phytosanitary trade barriers. “But we’ve always had a belief in the science and an approach rooted in the science, and that’s what we’re going to maintain going forward.”

This approach was endorsed by Rothamsted director Achim Dobermann. He said the institute was looking to work with key partners to deliver its new science strategy and importantly ensure this is delivered out in the field. “There is an opportunity to become policy innovators in this country, if the government is prepared to take advantage of the scientific expertise we have,” he noted.

Monitor Farms are the ideal route to roll out agricultural innovations, pointed out Paul Temple.

AHDB Cereals and Oilseeds chair Paul Temple said Monitor Farms are the ideal route to roll out agricultural innovations. “The way our farmers look at solving problems is far more integrated than in the past. They work with the environment in an innovative way and that puts us in a good position.”

But industry leaders expressed concern over the current lack of innovation. Chief executive of the Agricultural Industries Confederation (AIC) David Caffall said the damage the EU had done to the crop protection industry went way beyond a precautionary approach and had created an uncertain market. “Europe is no longer a target for innovation,” he said.

NFU president Meurig Raymond spoke of the need to move away from hazard to a risk-based approach. “But the UK government refused to allow a derogation on neonicotinoids. It needs to give a consistent message.”

But most concern at Cereals was reserved for forthcoming trade negotiations. In the wake of the general election and the resulting hung parliament, Meurig Raymond called for a “conciliatory approach based on collaboration” from the Conservatives. They should work with other parties to get a consensus of views and towards an outcome that’s mutually beneficial for industry and civil society.

“Government must deliver continued tariff-free access to the Common Market, and continued access to the workforce UK Agriculture relies on,” he said.

There was strong support for continued membership of the EU Customs Union. David Caffall pointed out that businesses in the EU that currently traded with the UK would also want to see this continue. “But there are things that can gum up trade that don’t come into the discussion – phytosanitary restrictions could torpedo us.”

But Andersons head of business research Richard King warned that membership of the Customs Union was not the “magic answer”. “You could end up with a whole series of problems because it comes with many of the various legal and regulatory restrictions that are currently felt to restrict progress – we wouldn’t be free to be so swash-buckling on the world stage, for example.”

He said there was a strong danger that individual arable businesses would use the uncertainty over Brexit as an excuse to do nothing. “Prepare for Brexit now – you should focus on making your business as efficient as possible. Invest in paying down debt, or in items that have a demonstrable return, such as drainage. What would your accounts look like if 50% of your support payments goes?”

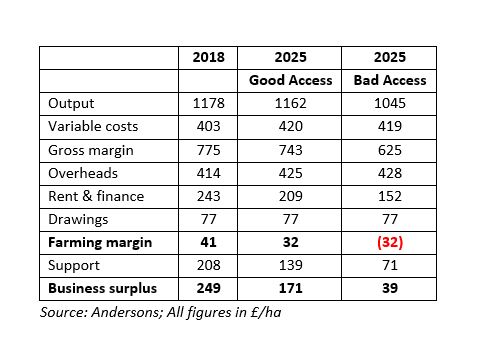

Even with good market access and favourable trade agreements, profitability on Andersons’ Loam Farm Model, a 600ha arable farm, would drop by 2025 (see table below). No deal with the EU, but free trade agreements with other countries letting in low-cost imports and a restriction on migrant workers would conspire to put the farm in a perilous state, he argued.

Even with good market access and favourable trade agreements, profitability on Andersons’ Loam Farm Model would drop.

Bidwells’ analysis of contract farming results shows 2016 was the most challenging year for a decade, with both income and net profits falling, mainly as a result of the lacklustre harvest. But there’s a range of financial performance levels, noted Jonathan Armitage, showing some businesses are able to weather the storm better than others.

“There are always some businesses consistently nearer the top than the bottom,” he pointed out. “It’s not really about soil type or crop or equipment. It’s about people – they have a focus of attention on productivity and appropriate investment. The people who are better placed for the challenges posed by Brexit aren’t frightened to invest, and do so wisely.”

- There’ll be more technical highlights from Cereals in the July issue.

Pants way to improve profitability

If you were given £20 to spend to increase your farms profitability, how would you spend it? This was the question put to Brian Barker and Russell McKenzie, Stowmarket and Huntingdon Monitor Farm hosts, in a debate held on the AHDB stand at Cereals.

As well as their Monitor farms connection, both growers have something else in common – a penchant for burying cotton underpants. Brian Barker was one of the early pioneers of #soilmyundies, which has caught the imagination of many of the agricultural Twitterati in recent months, but, on this occasion, it was Russell McKenzie’s pants that stole the show.

“Soil health has become a hot topic, but the question is how do you assess it? Digging holes is the only way to see what’s really going on underground, so a spade is essential to start to discover the state of the soil,” he said.

Improving soil health on his Cambs farms is at the heart of Russell McKenzie’s farming practice as he moves towards a zero-till strategy. The change has been step-wise, with an initial move from deep till to a shallow cultivation system, followed by a progression to min-till before reaching the no-till goal.

“The soil needs to be ready before you can make a successful change in cultivation strategy and so far, three of our five farms still aren’t ready to move to no-till,” he explained.

And this is where the pants have come in useful – the simple experiment highlights the state of soil health, he reckoned. “If the microbial activity is good, then the cotton pants are full of holes after being buried for eight weeks. We’re going to continue to use undies to monitor our soils on our journey towards no-till.”

Brian Barker firmly believes that the best investment you can make in the farm business is in furthering your own knowledge and to that end his notes went into the creation of a 50cm quadrant, which he has already thrown more than 820 times this year.

“If you don’t measure things then you can’t change them. We should be benchmarking all the crops on the farm, so I decided to start measuring plant populations in every field of winter wheat this year,” he explained.

The exercise has already highlighted some useful information. One important factor that Brian Barker’s identified is that establishment losses were being underestimated.

“I estimated that seed losses would be 15% but in fact they were 25%. This was in an easy, open autumn where crops went in well so I may have to increase seed rates more this year, especially if conditions are tricky,” he said.

“Losses overwinter were 7% but this was reduced to 4% where fertiliser was in place under crops, so this is another factor to take into account. I also discovered a huge variation across crops when it came to the number of shoots/m², which raises questions such as can I influence the yield potential and if so, how?”

Omnia highlights problem patches

Agronomy company Hutchinsons launched some fascinating developments to its Omnia system, now in commercial use across 150,000ha, that could help growers pinpoint parts of their farm that could be improved.

Field Performance is intended to make use of the yield maps generated year on year but seldom put to good use, explained their precision technology manager, Oliver Wood.

“The difficulty with yield maps is to interpret them and make meaningful comparisons of a field over several years, as it’s planted in different crops through the rotation. With Omnia, it’s now possible to standardise yield maps for any crop by setting an acceptable yield range using a traffic light system, green areas being in the good range and red highlighting areas where yields are unacceptably poor,” he explained.

The data from different crops in different seasons can then be compared in a meaningful way and amalgamated into one map that represents the performance of the field across all the crops in the rotation, drawing attention to any areas that have performed inconsistently, or consistently badly, as well as areas where the yield potential is high.

“This provides a starting point to discover if there’s a problem and whether it can be rectified. Using the performance map, it’s possible to pinpoint a problem area and, using GPS, dig a hole in the field and take a look.

“It may be that there’s a shallow depth of soil, so yield potential is inherently low. Perhaps there’s a problem with nutrient availability or the area has poor drainage which can then be rectified,” explained Oliver Wood.

Armed with this information, managing areas within the field to their full potential becomes possible. But the Omnia system goes a step further and links productivity with costs of production, producing a ‘Costs of Production Map’, which leaves nowhere to hide when it comes to potential profit and loss, he said.

Growers can create average cost of production information by crop, market outlet, variety or by field using known or predicted costs, with known or predicted yields.

“Where growers have variable inputs or yield map data, it makes sense that they want to manage costs and their crops on a more site-specific basis.”

Used in combination, these new features provide growers and agronomists with a unique and powerful way of addressing variability across the farm business, and eliminating loss-making areas that impact overall farm profitability, he said.

NIAB launches digital platform

NIAB has launched a new interactive farm software platform, giving farmers and agronomists the ability to map, manage, store, share and compare farm, crop and research data.

Working with data science firm KisanHub, NIAB Digital’s introductory package of subscription services – ‘Farm’, ‘ActivSmart’, ‘Potato Crop Management’ and ‘Trials’ –are designed to sit alongside crop decision support tools.

New subscribers to the ‘Farm’ service have access to digital field mapping, disease modelling tools, satellite imagery, farm and crop data storage, field specific weather forecasting, and crowd-sourced crop, pest and disease information.

NIAB’s Bill Clark said that many of NIAB Digital’s services start with geo-locating the farm. “The system knows where you are, and by mapping your farm fields NIAB Digital can provide real-time farm or field-specific weather information – both actual and forecast.”

The weather information can then be used for oilseed rape sclerotinia alerts and fusarium ear blight risk. “The Fusarium Ear Blight service ranks the risk into high, medium and low and gives recommendations based on the predicted risk.”

‘ActivSmart’ is a stand-alone cloud-based pesticide database, designed to allow users to compare products which may appear similar but could have different legislative requirements, such as different buffer-zone requirements or crop restrictions. It includes a database of over 2200 arable plant protection products, product labels, tank mixes, safety data sheets and environmental information.

‘Potato Crop Management’ is a collection of digital products to capture, store and process the potato crop data needed to run NIAB CUF yield and quality predictions, and irrigation scheduling decision support tools. The NIAB Digital ‘Trials’ service includes specialist software to create experimental protocols, map trial locations and download, report and publish data in addition to the field mapping and geo-spatial analytics, including satellite imagery and UAV data.

Annual subscriptions start at £250 with NIAB TAG Farm Local members automatically gaining full access to the NIAB Digital ‘Farm’ service as part of their package. ‘ActivSmart’ is available as a standalone package at £66/yr. Www.Niabnetwork.Com