At a global gathering in Germany last month, Bayer gave attendees an enticing glimpse of what innovation will look like after it’s joined with Monsanto. CPM probes into just how much of this will be heading to the UK.

Bayer won’t feed the world, nor save the world, but we will make a significant contribution.

By Tom Allen-Stevens

The world can look forward to a slew of innovations from Bayer across technologies you probably wouldn’t associate with the agchem giant. But if you’re a North European farmer and expecting new chemistry, or even exciting new seed traits from the Bayer stable this side of 2020, you may be in for a disappointment.

At its Future of Farming Dialog, held with the world’s press at the Bayer headquarters in Monheim, Germany, the company presented not only its product pipeline, but a vision for the future, following the acquisition of Monsanto, and invited leading industry experts to discuss how this may shape up.

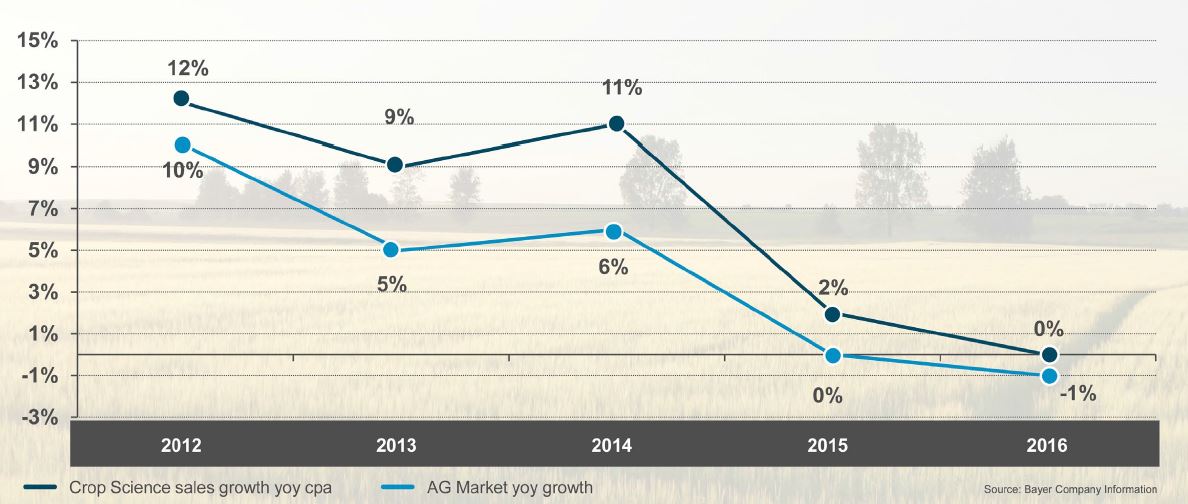

Bayer Crop Science division sales growth vs market

The outlook for 2017 is a low single-digit decline in sales growth.

Liam Condon, president of Bayer’s crop science division, underlined the challenge of feeding a global population of ten billion by 2050 when half the current population is already malnourished. “Just to stand still, we need to raise productivity by 17%. Bayer won’t feed the world, nor save the world, but we will make a significant contribution,” he pledged.

“We believe that through the application of innovation we can improve the quality and supply of food and do so in a resource-efficient way. But we can’t do it without science and innovation.”

That’s what the company does, and will do even more once the acquisition of Monsanto completes, he said. The marriage of these global giants is due to take place on or around 22 Jan 2018, which is when the process to obtain antitrust approval from the European Commission is due to complete.

Partnering with Bosch, Bayer aims to develop ‘Smart Spraying’ technology that can tell the difference between a plant and a weed and apply herbicide precisely.

The combined business may well be looking for an upturn in sales prospects, however – since 2012, year-on-year growth for Bayer has slowed from 10% to a decline of 1% last year (see chart above). Liam said the market in 2017 remains volatile after a weak prior year and put this down to a dip in insecticide and fungicide sales in Brazil. But he predicted a rise in fortunes next year.

He was short on detail about exactly how the two companies would come together – there’s still plenty that needs to be addressed in terms of product portfolios and possible divestments. But he presented broad aims, based on “three pillars” – an innovation engine, complete commitment to sustainability and social responsibility.

“We will be financially successful but if it’s only about numbers, that won’t be enough. We will also do good,” he chimed. So what do the two companies bring to the table? “Monsanto has innovative seeds and traits. Bayer has an innovative chemical pipeline. Both have a digital platform to get to a customised solution.”

And this is what lies at the heart of the strategy and what you can expect to see a lot more of in the future: customised agronomic solutions. These are demonstrated on Bayer’s Forward Farms, he said, where the company works with growers to achieve higher yields and greater profits from more sustainable arable systems. Another example is digital farming. “This is a tremendous way to deliver sustainable farming because it’s more targeted.”

Liam cited the company’s collaboration with Bosch, announced last month. The partnership aims to develop ‘Smart Spraying’ technology. “This involves super-sensitive sensor technology that can tell the difference between a plant and a weed. It’s so advanced the tractor goes through the field and identifies it fast enough so that the weed is sprayed precisely, then and there.”

Adrian Percy, Bayer’s global head of R&D for the Crop Science division then took to the stage to give a little more insight into these customised agronomic solutions. He hinted it may take less than the traditional ten years for tomorrow’s agronomic answers to hit the market place.

“New discoveries are making their way into agriculture within months not years, from IT, military and engineering, for example. There’s the internet of things, drones and robots. Uses for these technologies come to market very quickly and it’s incredible how fast they’re being taken up. New breeding technologies also allow us to bring new varieties to market in ways we couldn’t in the past.”

But, judging from Bayer’s product pipeline, there’s not much of this innovation heading for North European and UK growers before 2020 at least. Across the company’s agronomic portfolio, there are 17 big product launches that have taken place or are planned from 2015-2020 – four small molecule active ingredients, two biologicals, five native seed traits and six GM traits. Of these, only the already launched fungicide Ascra Xpro (bixafen+ fluopyram+ prothioconazole), an insecticide for potatoes and veg crops, and clubroot and pod-shatter resistance in the InVigor oilseed varieties will touch UK shores.

In addition, there are some new developments in roots, including a new nematicide, and some tweaks to its herbicide portfolio. But with so few goodies coming to Europe and with Brexit looming on the horizon, will Bayer actually be interested in putting its innovations into the UK after 2020? “The UK is still an important market for us, and we deal with many countries that have independent regulatory systems all around the world,” said Adrian.

But finding new active ingredients that meet EU regulatory standards was becoming much harder, he pointed out, as a result of hazard-based assessments. “It’s very hard from a discovery aspect to know what we’re aiming for. We need to know from an early point whether a product will make it through the regulatory hurdles. There is a danger there will be innovations lost to European farmers that will be available to farmers elsewhere because of the regulatory system we face in Europe.”

One of his concerns about Brexit is what role the CRD will have. “The UK has had a very practical approach to regulation, and it’s not clear what influence it will have within the EU after Brexit. I’d love to see that contribution continue,” he said.

But perhaps the UK could adopt a new approach, he suggested. “It would benefit not just Bayer but UK farmers if the Government did not put in place blanket bans, such as we’ve seen with neonics and could potentially see with glyphosate. The UK Government could take a more risk-based approach to regulation after Brexit if it wanted to retain a strong agricultural sector. There are obviously benefits from a harmonised approach to regulation across Europe, but I’m not sure that’s what people in the UK had in mind when they voted for Brexit,” he pointed out.

But the idea drew mixed opinions from an expert panel that discussed regulation later on. “It’s a real conundrum,” said Graeme Taylor of the European Crop Protection Association. “Let’s take glyphosate – if it was banned across Europe but still used in the UK, what would happen then? But this is broader than Brexit – the tools that farmers have access to in Europe are being arbitrarily reduced, while restrictions on imports are being lifted – there’s no clear way forward.”

Garlich Von Essen of EuroSeeds noted that the “golden age” of the EU common market where all member states were ready to accept a common rule of law was coming to an end and Brexit is the tip of the iceberg. “But is this an opportunity? Probably not. Practically speaking, if you have two different standards, the cost of authorisation will rise and if you reinstate barriers, you break down all the benefits of a common market.”

Michael Keller of the International Seed Federation was more blunt. “We simply don’t know what’s happening in Europe any longer, so companies don’t look to Europe to introduce their innovations,” he said.

Machine learning gets heavy investment

A large global player buying a small technology start-up isn’t usually all that newsworthy. But when last month, Deere and Company put up $305M (£233M) to acquire Blue River Technology, that specialises in machine learning in agriculture, it put such innovations sharply into focus.

Deere’s president of agricultural solutions, John May, claims John Deere is a leader in precision agriculture and recognises the importance of technology to its customers. “Machine learning is an important capability for Deere’s future,” he says.

Blue River Technology has successfully applied machine learning to agricultural spraying equipment. It’s designed and integrated computer vision and machine learning technology that will allow growers to reduce the use of herbicides by spraying only where weeds are present. It’s an advance in itself, but John May reckons similar technology can be used in the future on a wider range of products.

Farm management decisions are moving from field level to plant level, says co-founder and CEO of Sunnyvale, California-based Blue River Jorge Heraud. “We are using computer vision, robotics and machine learning to help smart machines detect, identify and make management decisions about every single plant in the field.”

Already in 2017, Blue River has been listed among Inc Magazine’s 25 Most Disruptive Companies, Fast Company’s Most Innovative Companies, CB Insights’ 100 Most Promising Artificial Intelligence Companies in the World and the Top 50 Agricultural Innovations by the American Society of Agricultural and Biological Engineers.

If nothing else, the acquisition may offer a boost of hope to any budding engineer fiddling with drones, sprayers and printed circuit boards.