There could be exciting prospects on the domestic market for beans in both animal feed and for human consumption. CPM rounds up some of the latest advances.

It’s a bit of a no-brainer in the animal feed market – there’s no obvious reason why you shouldn’t grow an LVC variety.

By Tom Allen-Stevens

With a market price that fluctuates as widely as its yield, beans are a crop which, for many growers, rarely feature in the rotation, despite their agronomic benefits and low carbon footprint. But is the domestic market developing a taste for the crop?

The UK cropped area of pulses is currently the highest it’s been for well over a decade, and set to creep a little higher for 2021, according to the AHDB Early Bird Survey of cropping intentions. A disappointing bean harvest last year has pegged back UK supply, but following a bumper Australian crop, Pulses UK reports that the human consumption export trade has effectively closed. This has depressed prices relative to wheat, and according to AHDB, the feed bean premium in mid Feb was languishing at a disappointing £23.90/t.

However, there have been significant EU-based export trades, reports Pulses UK, and the current premium for new crop feed beans is about £30/t over Nov wheat futures. What’s more, initial figures for beans used in animal compound feed for the 2020/21 marketing year indicate an upswing in demand, compared with the same period in the previous season.

While much of this may simply be down to the high price of competing grains, breeders may at last be supplying to the market beans that are more attractive to the end user, for both animal feed and human consumption. Four of the varieties on the latest PGRO Descriptive List have LVC (low vicine/convicine) characters.

“It was one of the outcomes of the Optibean project that completed in 2015,” explains Peter Smith, pulse market development and seed manager at Agrii. One of the aims of the four-year £2M government and industry-funded project was to displace some of the 1M tonnes of soya currently imported into UK animal feed rations.

“The difficulty is that beans contain vicine and convicine, anti-nutritional compounds that accumulate in the cotyledons, making them difficult for animals to digest.” For a small minority of humans, particularly in certain parts of Africa, Asia, the Mediterranean, and the Middle East, they can cause favism. This is an inherited disease in which a person lacks a certain enzyme which causes them to develop a condition called hemolytic anemia when they eat fava beans. Symptoms include headache, vomiting and nausea.

“Within Optibean we looked at the agronomy and feeding aspects, with partners looking at bringing on varieties and Waitrose Producer Groups carrying out feeding studies across a number of different markets. Agrii identified LSPB’s spring bean Tiffany as the most promising LVC variety which currently commands a premium in certain animal feed markets.

“Tiffany was joined by Victus which was pretty much at the top of the PGRO Descriptive List on yield until this year. Now Allison and Bolivia have joined the list, bringing good agronomics and earliness,” notes Peter.

“It’s a bit of a no-brainer in the animal feed market – there’s no obvious reason why you shouldn’t grow an LVC variety. But the real market is human consumption. I’ve always said there will be big opportunities in the market, and prospects for vegetable protein currently look very exciting.”

Once the North African market becomes available to UK beans again, Peter expects LVC beans to trade well as favism is a problem in those countries. Within the UK, demand historically hasn’t been that strong, but he reckons this is set to change with domestic processing capacity building on the back of rising demand for vegetable protein.

Another opportunity in beans, but one that’s still several years from commercial reality, is haricot beans. Used in products such as national favourite baked beans, the UK currently ships in around 100,000t for processing and canning. “End users are very keen to have a sustainable UK source and would likely pay a premium. We now have varieties that show real promise,” notes Peter.

Three beans have been developed by scientists at the University of Warwick – Capulet is a small white-seeded type, Godiva is a large brown variety while Olivia is a black bean.

“We’re scaling up seed at the moment, but they’re not without their agronomic issues. Capulet’s not very tall with pods close to the ground, making it difficult to harvest the whole crop. If you do, it yields around 3.5t/ha. They’re sensitive to cold, so you’d plant later than peas in late April, but they’re quick growing. Crop protection products are currently very limited because they’re a different type to field beans, so we’ll need some EAMUs,” he adds.

Head of pulse trading at Frontier Andy Bury is less upbeat about LVC beans, noting it’s still a relatively small part of the overall feed pulse market. “Demand for beans is driven by the price of alternative mid proteins, such as rapemeal and dried distillers grains with solubles (DDGS). However, beans make a very good feeding pellet.”

Andy explains they’re particularly valuable for aquaculture, that requires a high protein pellet. Fish food compounders can use wheat to bind the pellet but dehulled beans are a better binder and don’t dilute the protein. So Frontier’s been trying to develop a high protein bean.

“It’s a work in progress. We thought it would be an agronomic issue, like boosting protein in wheat, or that we could use biostimulants. But we’re not getting the results and think it’s actually a genetic issue. LG Cartouche stands out as a high protein bean, 1.5-2% above the rest, and can command a premium.”

But he believes the way to improve returns from beans is through the farm factor. “There are growers who consistently produce crops above the UK average because they give the crop the attention it deserves. It’s not about using a lot of inputs but establishing the crop well and ensuring it has good root development.”

Growers in the south of England face levels of bruchid beetle that are now so high, most human consumption markets would be unachievable, he says. “Think carefully before spraying – it often fails to get a result and does more harm to beneficials.

“The most lucrative outlet may be the one on your doorstep – supplying beans for a home-milled ration to a next-door neighbour looking to switch their dairy herd away from soya.”

And growers could soon be processing their own value-added straight from their bean crop. Lincs-based McArthur Agriculture has developed on-farm equipment that heats beans to a high temperature for a short period.

“The process significantly increases bypass protein and allows soya bean meal to be completely removed from high performance dairy diets,” explains John McArthur. “The equipment can be a small 200kg/hr unit or a large contractor unit processing 10t/hr into flakes, meal or whole roasted beans.”

John’s looking for bean growers who’ll try out the pre-commercial units and plans to carry out feeding studies later this year.

LIN gives leg-up to legumes

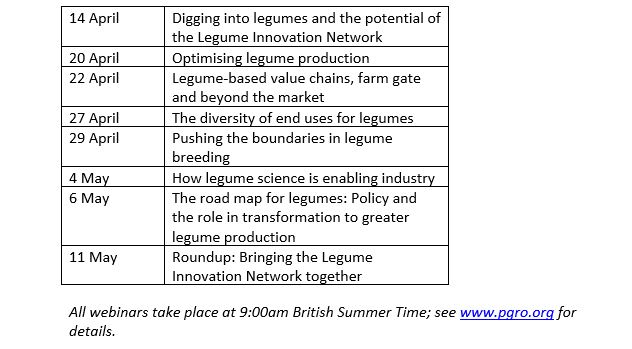

The PGRO has launched the Legume Innovation Network (LIN) and is presenting a series of eight free webinars that will explore the global opportunities, barriers and success stories surrounding legume production.

The webinars are part of the LegValue and TRUE project – a high-level programme of events hosted by experts from across Europe who aim to unlock the potential for greater production across the globe.

“Pulses have an incredibly bright future, both for farmers who want to grow a sustainable, diverse rotation, and for consumers seeking a versatile, protein-rich food with multiple health benefits,” says PGRO chief executive Roger Vickers.

“I believe they can fit hand-in-glove with the UK’s new Environmental Land Management (ELM) schemes, so now is an opportune time to re-double our efforts in sharing information and understanding which is what this project is all about.”

The online events mark the end of two collaborative EU Horizon-2020 funded projects which aimed to empower legume-supported food and feed production in across Europe. LIN will build on the projects’ legacies, says Roger, becoming a stakeholders’ forum. This will promote awareness of new insights, services or requirements for commercially competitive production and consumption of legume crops in Europe.

“I hope it will link people with similar interests, provide opportunities for challenges to be resolved more easily, with potential partners finding resources for mutual benefit, and directly help realise more sustainable agri-food systems.”

LegValue and TRUE project webinar programme

Seedbed nutrition offers a pulse of performance

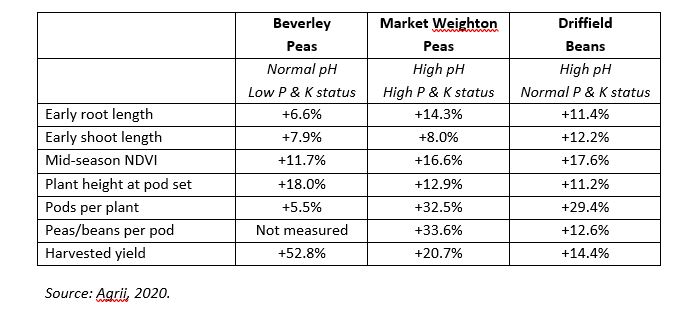

Recent trials suggest tailored seedbed nutrition can bring a 30% boost in yield to spring pea and bean crops.

The trials were run by Agrii’s northern R&D team across 18ha of commercial vining pea and bean crops around Beverley, Market Weighton and Driffield in Yorkshire. These set out to test a blend of phosphate, potash and sulphur, protected with P-Reserve, in the seedbed. Yield increases averaging 30% were accompanied by improvements in a number of crop growth and development aspects from sowing to harvest.

The trials underline findings from the Critical P project that PGRO and NIAB (funded by AHDB) previously carried out, with results published in 2015. This showed a benefit from the application of fresh phosphate particularly in soils with lower indices, with the work on pulses carried out on vining peas.

Strong and rapid early crop growth in spring peas and beans is key to performance, but often neglected by growers, notes Agrii R&D manager, Jim Carswell who co-ordinated the work.

“So, last season we set out to build a clearer picture of early spring pulse nutrition and the potential for improving it. We used vining crops as our most convenient local testbed, but the fundamental growth and development responses we recorded are more widely applicable.

The trial sites had very different pH levels and P and K indices. Phosphate lock-up can also be a problem in many cases, which would improve the performance of the blend, notes Jim. “But the extent and consistency of improvements over the standard farm programmes really surprised us.”

In all three trial crops, visually obvious improvements in plant rooting and shoot growth were evident within three weeks of sowing. These carried through to noticeably faster leaf production, higher plant chlorophyll levels (recorded with an N tester and NDVI satellite imagery) and both taller and stiffer pea canopies. Markedly better podding and pod fill were obvious in the run-up to harvesting too, confirmed by the recorded yield increases.

Alongside these improvements, tissue analyses throughout the growing season showed higher levels of up to seven of the 11 key nutrients measured. What’s more, despite the dilution effect of higher yields, analysis of the harvested produce also showed increased nutrient levels in many cases.

“With the exception of the beans at Driffield which received no spring fertiliser due to a history of chicken manure applications, we adjusted our specialist starter fertiliser rates to match the main nutrient provision of the standard farm practice as closely as we could,” Jim explains. “As all other elements of the crops’ agronomy were identical we can be sure the responses resulted from the change in spring fertilisation.

“The phosphate protection provided by P-Reserve clearly worked well in boosting both root and shoot growth. To such an extent that both the pea crops receiving it were almost a full leaf pair ahead of the farm programme from a month after sowing. The differences in plant height and stiffness were also very obvious here.”

Jim suggests there’s a chelating action of the P-Reserve which put higher levels of trace elements like manganese, zinc, molybdenum and boron into the treated plants, even though these micronutrients weren’t applied.

Agrii has now introduced the P-Reserve treated formulation as Agrii-Start Pulses for the coming spring. This is best placed with the seed rather than incorporating it into the seedbed ahead of drilling. The Bishop Burton-based R&D team are also extending their trialling to include a specialist molybdenum coating in their 2021 pulse nutrition work.

Seedbed nutrition in pulses trials results

Pulse Progress

This article is part of PGRO’s delivery of knowledge exchange on its activities to support pulse crops and their cultivation in the UK. CPM would like to thank PGRO for its support and in providing privileged access to staff and others involved in helping put these articles together.