Bayer has revealed a bold vision for global agriculture following its acquisition of Monsanto. CPM asks what this can achieve in Europe, given relatively limited tools.

We’ve brought Bayer and Monsanto together because the world needs a transformation in agriculture.

By Tom Allen-Stevens

Bayer is looking to “transform” agriculture across the globe and will deliver “tailored agricultural solutions” the company believes will benefit farmers, consumers and the planet. But its vision for the future of farming, outlined for the first time since it came together with Monsanto, contains comparatively fewer solutions tailored for the European farmer.

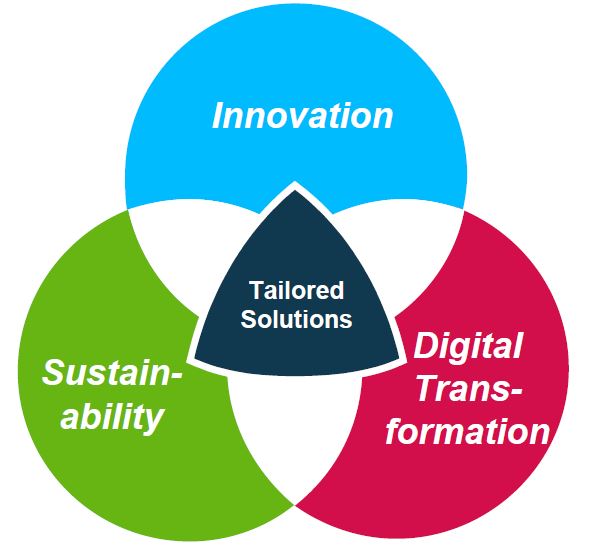

Innovation, sustainability and digital transformation are where the conjoined company is focused, said Liam Condon, president of the Crop Science division at its recent Future of Farming Dialogue with the world’s press and other stakeholders, held at its base in Monheim, Germany.

Bayer wants to set new standards in the market in three key areas.

“We’ve brought Bayer and Monsanto together because the world needs a transformation in agriculture. Everyone at Bayer believes in a better life, and the way to achieve that is through science and innovation. To us, crop science is about shaping agriculture to benefit farmers, consumers and our planet,” he said.

Bayer is now the world’s leading agchem and biotech manufacturer, with annual sales of around €20bn (£17.5bn). It operates in 89 countries with a workforce of 35,000, more than a fifth of whom are involved in R&D. The company boasts it holds the number one market position in corn and soy, horticulture and cereals. That’s across not just chemical and biological crop protection, but seeds and traits and now digital farming, too, Liam pointed out.

“But just to be number one doesn’t make any sense. We want to set new standards in the market.” And they’re looking to do this in three key areas.

Innovation provides the backbone, explained Dr Bob Reiter, formerly of Monsanto and now head of research and development at Bayer. He pointed out the synergies of bringing the leading company in seeds and traits together with the world leader in small molecule chemistry.

“The magic in innovation typically happens at the interface of these sciences, but traditionally they don’t talk to each other. We’re bringing our research teams together and then we’ll capture the magic I’m fundamentally sure will come as a result.”

To illustrate, he pointed out that with herbicide tolerance, previously it could take Bayer around 10-14 years to develop a herbicide, and then Monsanto another 10 years to breed a seed-trait tolerance to it – potentially 20-25 years in total. “We can now develop the chemistry and the crops together, drive the innovation faster and deliver solutions to farmers a decade earlier.”

The next iteration in this innovation pipeline is digital farming, and Bob noted that Climate FieldView is already bringing the benefits of this to growers in the Americas.

“Digital science is a fast-growing investment space, and it represents the fastest-growing skill set we have,” he noted.

“Growers typically make about 40 big decisions about how to grow a crop each season. All decisions are interconnected, but currently they’re based on experience – they’re not data-driven. What’s more you only get 30-40 growing seasons to learn.

“But what if there was a rich dataset of hundreds of thousands of crop scenarios that could inform those key cropping decisions? We can supply the data and analytics to make the decisions more successful. What’s more, we use machine learning to improve the way those tools refine and analyse the data.”

But this transformation will take place responsibly, assured Liam. Among Bayer’s biggest growth markets are the smallholders of Asia and Africa, and the company has coined the phrase ‘social innovation’ for the way in which it develops products for these farmers.

“We have made a huge commitment to raise the bar on sustainability, and this will be tracked as rigidly as financial targets,” he said.

He stressed this emphasis on responsible, sustainable transformation is reflected throughout Bayer’s activities. “We have a deep sense of wanting to do the right thing.”

Bayer recognises it faces some tough opposition on glyphosate, for example, and a challenging regulatory environment in Europe, and Liam believes promoting strong values and engaging in dialogue with society will ease the path to progress.

“There are three elements to this: we want to be collaborative in our approach and genuinely seek to understand what society expects from us. We will be transparent, and our PRISMA initiative is making all of our regulatory data easily available to people in a manner that is easy to understand and navigate. And we want to be inclusive, which embraces our commitment to social innovation – we’re working with NGOs to raise the level of activity here, for the benefit of smallholders.

“Clearly, we’re a large global business, but if we can help shape agriculture in a way that will enable farmers, that’s truly a good solution. So we’re a company that is committed to deliver for the long term, although we need to deal with the short term – just like the farmers we work with,” concluded Liam.

Dialogue needed to mend innovation pipeline in Europe

Bob Reiter promoted Bayer’s strong product portfolio, focused on growing “breakthroughs” in seeds, crop protection and digital farming. But while there are solutions to deliver a smooth innovation pipeline in the Americas, Asia and Africa, few of the products highlighted are likely to come to Europe, let alone the UK.

“All is not lost for the European grower, and we’re continuing to develop crop-protection products suitable for this market. But there are roles for both genetics and crop protection – regulation is becoming more of a challenge, and that restricts the products we can bring to Europe,” he said.

The recent ruling by the Court of Justice for the EU that classes gene-edited crops as GMOs is a good example, he noted. “We’re looking at how we can influence this decision – it flies in the face of scientific advancement and it’s to the detriment of farmers. But dialogue is critical – we need a science-based conversation.”

Liam Condon echoed this view. “The judgement was very unfortunate, but from a legal point of view, based on the current GMO regulations, it was a very rational decision to take. The way to address this is to look at the 2001 legislation and ask whether it’s still relevant in its current form. There’s a tonne of data generated since then to show there’s never been a safety issue with GMOs, so is it really necessary to have such restrictive regulations?”

And it’s these science-based conversations Bayer is looking to encourage and inform, especially within Europe. “There’s a general sense that technical innovation is not a good a thing, and food produced without it gets a premium. We’re keen to help educate and show the role of science and innovation in ensuring a healthy, plentiful and secure food supply,” said Liam.

Initiatives such as Bayer’s Forward Farms, that show politicians and stakeholders the latest innovations in practice go a long way towards informing this conversation, pointed out Dr Michael Preuss, head of communications at Bayer.

It’s an area where the company is looking to increase its activity and wants to work more with farmers to broaden the conversation. “Every single new product we get through is a comms challenge we’ve overcome, but there’s a lot of education to be done and we need all stakeholders aligned. It’s very valuable to have farmers coming forward explaining why the products they use are important.”

Bitter-sweet Brexit?

Losing the UK as a member state within Europe will make registration in the EU for new products and technologies even harder, warned Liam Condon. “The UK has always been relatively scientifically focused in its approach to product approvals – we’re losing an ally and a sane voice in an uncertain political environment.

“There is the possibility that outside the EU, the UK could set a slightly different course on regulation. On gene-editing, for example, the UK could be more innovation-friendly and that would attract more innovation to the UK. It would certainly improve trade relations with the US.”

Data improves crop decisions

There are around 40 decisions growers makes for every crop, and each one affects output, noted Dr Michael Stern, head of Climate Corporation and digital farming. “Growers don’t know for sure if they’re making the right decision, but have to make a decision.”

The combination of genetics and environment results in a high degree of variability, with the top US corn growers achieving more than 35t/ha against a national average of around 11.5t/ha. That’s a gap Climate FieldView can and is helping to bridge, said Michael. “The tool helps make informed decisions.”

With Seed Advisor, this now works down to a sub-field level for corn in the US. Based on a knowledge of environmental conditions and how an individual variety will perform, an algorithm works out the best hybrid for a particular location and advises on a treatment plan to optimise performance. “Every year with more data that algorithm gets better and improves the yield advantage.”

Introduced in 2015, there’s an impressive 24M ha across the US, Canada and Brazil currently using Climate FieldView. It effectively replaces your crop-recording software, building in decision support based on location, soil type, cropping history and local climate data. It’s been tested for the past two years in Europe, and is due for roll-out across France, Germany, Ukraine, Italy, Romania and Spain in 2019. “We’re also interested in expanding into the UK,” said Michael.

Split-field comparisons are carried out every year, and across 10,000 trialled ha in 2017, 80% of growers using the system achieved a yield advantage, averaging 0.4t/ha.

But would it work in the UK’s more complex climate? “We’re currently working on validating the model in European climates and across other crops. But wherever there’s a gap between the yield you’re getting and the best site potential, FieldView will help you close it.”

The software license for US growers is $1000/year (£780), although an area-based subscription is likely to be introduced in Europe. There’s also the question of whether European farmers would be willing to share their data. “Farmers’ data remains theirs. We find that farmers soon see the benefits, in terms of higher yields and as a tool to drive innovation, and this overcomes any fears over sharing data,” noted Michael.