Standing out from the crowd is one of the biggest challenges for Nikita, so what characteristics make it an advantageous choice when deciding what oilseed rape to grow?

It’ll be a welcome addition to the breadth of choice in the conventional variety category.

By Melanie Jenkins

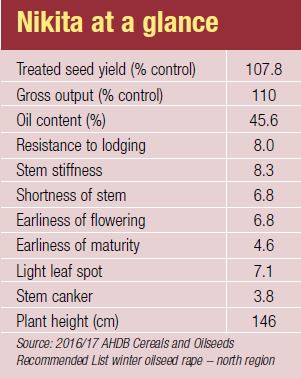

Nikita is a high yielding conventional variety notable for its short straw and light leaf spot (LLS) resistance score. It’s been approved for the AHDB Cereals and Oilseeds North region Recommended List (RL) but many commentators believe it has clear potential for oilseed rape growers across the UK.

According to Simon Kightley at NIAB, Nikita’s combination of very high oil content and the lowest glucosinolate on the North RL makes it almost perfect for end users. “In the North it’ll be a welcome addition to the breadth of choice in the conventional variety category, matching Anastasia and Campus for gross output,” he says. “It adds diversity with earlier flowering, superior LLS resistance and, in the case of Campus, shorter crop height.”

Les Daubney, oilseed product manager at Limagrain, says conventional varieties are seeing a resurgence at the moment and reckons Nikita has come along at the right time. “Conventional varieties are now matching hybrids in

Nikita has the right combination of traits to make it attractive to growers, says Les Daubney.

yield and agronomic features and Nikita has the right combination of traits to make it attractive to growers,” he says.

Unfortunately, the variety didn’t make it onto the RL for the East/West region, which could make future sales somewhat challenging. The main reason that it wasn’t recommended was its phoma score: At 4 it’s among the bottom scoring varieties on the list. However, there are other varieties that scored similarly across the E/W and North lists, with Incentive scoring a 4 on both lists, and with a lower gross output and oil content than Nikita.

Agronomically competitive

“Despite this, Nikita is still very saleable and of interest to growers, and our sellers from last year are still keen,” assures Les Daubney. “Nikita is agronomically competitive with hybrids and as a conventional has a lower price and gives growers the option of farm-saving seed.”

It’s not just for the North, says Vasilis Gegas – Limagrain still plans to market Nikita in the East and West regions as it did well there last year.

Dr Vasilis Gegas, senior OSR breeder at Limagrain, says the firm still plans to market Nikita in the East and West regions as it did well there last year and has received keen interest from growers and sellers. That’s a sentiment that’s reflected by Agrii and NIAB, who both report that growers have seen good results in these areas.

According to David Leaper at Agrii, it’s a real disappointment that Nikita didn’t get onto the East/West RL. “It did well in trials but was pipped at the post by Elgar. It has really good LLS resistance, which is the disease of the moment. The phoma score is the only weakness to the variety.”

Phoma is not a disease that appears to be getting worse, and an autumn fungicide application should have no trouble clearing up any outbreaks, says Simon Kightley. “There are good fungicides available and most farmers are likely to apply sprays whatever the resistance of the variety they’re growing.”

LLS resistance could well be Nikita’s key feature, with a score of 7 coming second only to Barbados – another new conventional entry – on the North RL. “LLS is more of a problem and more troublesome than phoma,” says Les Daubney.

Excellent LLS resistance

Ron Granger of Limagrain agrees that LLS is only going to get worse across the UK. “Nikita has excellent LLS resistance and this is going to be an important disease to manage in all areas of the UK.”

Agrii has looked at the relative performance of varieties in a way that isn’t replicated in AHDB trials, focusing on autumn vigour and Green Area Index (GAI). Of the conventional varieties, Nikita has proven itself when considering autumn vigour and the speed of growth in the spring.

“Nikita is equal to the top four conventional varieties on the East/West RL – Elgar, Charger, Picto and Campus – in its ability to grow away in the spring,” says David Leaper. “It’ll be interesting to see how the varieties perform this year due to the wet and mild winter. As a business, it’s good to be mindful of good autumn vigour as once a variety gets away and establishes, it’s less likely to fail.”

David Leaper adds that Nikita outperformed Elgar for autumn vigour in Agrii’s trials, and Barbados had the least autumn vigour. However, Elgar has the advantage in maturity as it’s earlier than Nikita. “Both are similar in height but Elgar is a little stronger in standing,” he adds.

The oil content of Nikita is another key factor as it has the highest level of the conventional varieties on the North RL and one of the highest even among the hybrid varieties, at 45.6%. On the AHDB’s list of varieties not added to the East/West RL, Nikita had an oil content of 46%, the highest content on the not added list.

“I’d rather have high oil levels than high seed levels, and Nikita has come up as having the highest oil content in trials,” says David Leaper. “It has stable characteristics, so it’s a real missed opportunity that it didn’t make it onto the East/West RL, as the phoma can be managed.”

Nikita is also a stiff variety and it’s the shortest on the North RL, except for Troy, a semi-dwarf hybrid variety. Stem stiffness and resistance to lodging both received a score of 8, putting it in the main pack of varieties, he adds. “It’s not too big and nor is it a low biomass type.”

High yield potential

Ron Granger says the short and stiff canopy means the variety is nice to handle in the field. It generally suits soils with high yield potential and has the capacity to take extra fertiliser and nutrients in order to yield more. “It’s performed well on both poorer and heavier soils, which gives farmers peace of mind that it can cope,” he adds.

It has performed well in the tough North conditions and its yield from year-to-year has been pretty stable, agrees Vasilis Gegas. “Nikita is a farmer friendly variety – it offers good returns while mitigating the risks.”

In 2015, Nikita commanded around 3-4% of the market, according to Les Daubney. “We’d like to see this increase this year, preferably double.” The prospects for Nikita are good, with the market looking for this type of conventional variety, he adds. “The market is quite segmented, with lots of varieties holding small shares; it would be very nice to see Nikita gain 8-10%.”

Simon Kightley adds: “In comparison to varieties on the East/West RL the only conventional variety with better performance figures is Elgar at this stage, but Elgar itself is new to the RL and still needs to prove itself.”

In the North, Limagrain already has a stable and established variety in Anastasia. Since it hit the market, the area grown has increased each year, making it the biggest selling new conventional variety last year, says David Leaper. “It went into the North region and took the lion’s share.”

According to Les Daubney, growers like what they see and have encouraged others to add Anastasia to their rotation. “It’s a reliable variety, with good autumn vigour. All of our conventional varieties have similar characteristics as growers need varieties that are short, stiff and early.” Growers in the North will probably stick to Anastasia, he reckons, but as Nikita has performed well in trials in the East and West he’s encouraging farmers in those regions to consider growing it.

Ron Granger says that growers always comment on how healthy Nikita looks right through the growing period. “It always looks healthy and a dark green which growers like. If it does well this year on farm, then growers are likely to continue growing it.”

Limagrain has had a lot of success on the Continent, but also has one of the few schemes that breed and select varieties based only on UK conditions. “It’s nice that our UK-based breeding programme has produced Anastasia, Nikita and Amalie specifically for the UK market,” says Les Daubney. “It’s a testament to the breeder.”

According to David Leaper, many people are questioning the profitability of OSR. “It’s about ensuring you pick a variety with a high gross output, consistent agronomic traits and yields above 4t/ha. The oil bonus is also part of the equation as it can be a significant contribution to the profits due to the lower commodity prices,” he says.

Simon Kightley adds: “Nikita would have been, and in reality is, the second best conventional variety available, with all good characteristics, except for stem canker which can be managed easily and efficiently. NIAB TAG have retained it in trials to maintain a flow of data for the southern half of the country.”

Robust performer for Yorks Wolds

Adrian Hatchett, farm manager for Velcourt across 1350ha on the Yorks Wolds, began growing Nikita in 2014 after he was approached by Limagrain to grow seed. The first crop covered a 14ha site, with 7ha grown for seed and another 7ha for commercial use. Having first looked at the profile of Nikita he decided there was no reason not to grow it.

The crop yielded 5t/ha and the commercial crop achieved 43% oil content when it was harvested at the beginning of Aug last year. Adrian Hatchett also grew DK Extrovert and Incentive – both hybrid varieties – and had an average yield across all varieties of 5.2t/ha against an historical farm average of 4.5t/ha.

The farm rotation is to grow oilseed rape one year in six, on thin soils over chalk. The Nikita established well following a winter wheat crop. It was planted on the back of a Väderstad TopDown cultivator and was drilled with a BioDrill at a rate of 2.1kg/ha to achieve 50 seeds/m² on 2 Sept 2014.

A pre-emergence broadleaf-weed herbicide was applied, with slug pellets going on as the slugs began to appear. On 25 Sept, Falcon (propaquizafop) was applied to tackle any volunteer cereals alongside a Permasect C insecticide (cypermethrin). Refinzar (penthiopyrad+ picoxystrobin) with liquid Boron was applied on 31 Oct, and then Kerb (propyzamide) on 25 Nov.

In the spring, Prosaro (prothioconazole+ tebuconazole) was applied on 17 Mar and then again on 26 May. An application of Proline (prothioconazole) was used on 23 Apr. Reglone (diquat) was applied on 23 Jul pre-harvest and the crop was then harvested at the beginning of Aug.

In total, the crop had around 250kg/ha of N, with the first dressing applied as urea with 90kg/ha of sulphur applied on 25 Feb. A further 95kg/ha of Omex liquid N was applied on 31 Mar and the balance of liquid N on 25 Apr.

“The crop was fairly easy to combine as it didn’t get too tall,” says Adrian Hatchett. “The seed rate could have been higher but there was limited availability.” Nikita had a good resistance to lodging and wasn’t too early to flower, he adds. There were no particular issues with disease – only minor phoma and light leaf spot challenges, and not too

many flea beetle problems.

Adrian Hatchett currently has 40ha of Nikita planted, 8ha for seed and the remaining 32ha as a commercial crop. It was planted on 22 Aug after a winter wheat and looks to be a good crop so far. He has also planted DK Extrovert, Incentive and Amalie for its resistance to Turnip Yellows Virus. “Nikita does what it says on the tin,” says Adrian Hatchett. “It had good resistance to lodging and was overall a robust variety.”