Five years on from the last CPM/Monsanto national survey into the subject, second cereal production is showing a remarkable resilience. CPM assesses the results.

More often than not, it’s the second cereal that drags down farm wheat performance.

By Rob Jones

The past five years has seen a clear change in cropping emphasis, according to the 2016 National Second Cereal Grower Study, conducted in association with Monsanto in April. However, responses from over 300 respondents, together managing more than 100,000ha of arable cropping, indicate some worrying warning signs for second wheat management, say experts.

Like the previous CPM exploration into second wheats in spring 2011, the latest study was designed to highlight recent and planned rotational changes, together with current second cereal growing experiences and management priorities.

Varying from 15-5000ha, the average arable area at 429ha is noticeably larger than the 350ha of 2011. First winter wheat remains the most important cereal crop with almost 90% of farms also growing a second cereal of some description.

Although the second wheat area has fallen back slightly from around 38% of the first wheat area in 2011 to 33% today, it remains by far the most important second cereal, being grown on more than 70% of farms. Just under half of farms are now growing winter barley as a second cereal, a third spring barley and slightly less than 20% spring wheat.

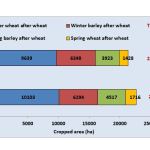

The area of second cereals being grown is currently increasing by 2-4% per year – from just under 21,350ha last year (2015 harvest) to nearly 21,800ha this season with more than 22,600ha planned for 2017 harvest (see chart below)

Remaining stable

The second wheat area is remaining stable in the face of increasingly disappointing prices, not to mention grassweed control pressures. At the same time, winter barley growing seems to be in slight decline while the areas of both spring barley and spring wheat are increasing noticeably – by 15% and 20% respectively.

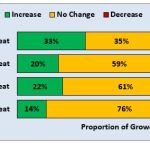

The overall figures do, however, mask some fairly substantial individual rotational changes. Around two thirds of growers are currently changing their area of winter wheat after wheat, for instance, but the number decreasing it are almost exactly balanced by those increasing it (see chart on pxx). The number of growers increasing their area of winter barley after wheat is also almost identical to those decreasing it.

“While spring crops are less expensive to grow and have an obvious place where blackgrass is a serious issue, these findings underline that winter cropping in general and wheat in particular remains the preferred option for most growers,” points out Dr Tudor Dawkins of ProCam.

“Our 4Cast records show second wheats continue to offer the best rotational opportunity for many, providing they’re not drilled too early. In most cases, mid-Oct rather than Sept sowing allows better weed control ahead of planting. More time also generally means more opportunity for strategic use of ploughing. And cooler, wetter conditions tend to give more prolonged residual herbicide activity.

“Under these circumstances, where autumn sowing conditions remain reasonable, it’s not surprising growers keep on drilling rather than taking their chances with spring planting.”

The top reason for rotational change, identified by nearly 80% of growers, is improved grassweed control, with increasing profitability not far behind it at almost 70% and spreading workloads also identified by more than half the respondents. Although noticeably less important, meeting the three crop rule, getting a better entry for winter oilseed rape and improved cashflow are cited as key reasons for their changes by more than two in every 10 growers.

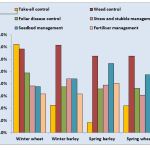

Regardless of rotation, the study confirms weed control as the biggest across-the-board challenge when growing a second cereal today, more than 60% of growers rating it as a key challenge in each crop (see chart below).

Second in importance to weed control in winter barley, spring barley and spring wheat is seedbed management. Straw and stubble management is seen as especially challenging in winter barley with fertiliser management the third most pressing concern in spring barley and foliar disease control in spring wheat.

Although increasing markedly in importance since 2011 – when it was identified by just under half the growers as a key issue – weed isn’t the most significant challenge for second wheat growers. It takes second place to take-all control, ahead of foliar disease control.

While rated as much less important in other second cereals, take-all is, however, recognised as a particular challenge in both winter barley and spring wheat by more than 20% of growers.

- Second cereals area (ha) at 2015 harvest and area planned for 2017

- Second cereal changes – 2015 (actual) compared with 2017 (planned)

- Main challenges of growing a second cereal

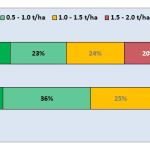

- Yield gap between first and second wheats

Key imperative

“Better grassweed control is the key imperative driving most of the rotational change we’re seeing across the country,” comments Agrii’s David Leaper. “And, even where there’s less rotational change, it’s prompting significant

Better grassweed control is the key imperative driving most rotational change, reckons David Leaper.

shifts in winter wheat agronomy.

“Our Stow Longa research shows that growing a spring cereal offers an excellent opportunity to get on top of even the most resistant blackgrass, especially where preceded by a suitable winter cover crop. Spring cereals can give valuable production economies too, but both barley and wheat must be supported with the right balance of nutrition and crop protection as well as given the best seedbed start possible.

“Drilling a competitive winter barley early or delaying winter wheat drilling until mid-Oct and using the most competitive varieties has also proved hugely valuable at Stow Longa, as has rotational ploughing,” he adds.

As well as improved grassweed control, combining a greater emphasis on spring sowing with delayed winter wheat drilling and better variety choice should, in David Leaper’s experience, take the pressure off what has always been the primary challenge of growing a second cereal – take-all.

Even so, he urges growers not to take their eye off this particular ball if they’re to make the most of their preferred second cereal, insisting that take-all can be every bit as much of a yield robber in late-sown second wheats.

“We know that the mild winters we’re increasingly seeing, as well as winter waterlogging and a slow spring, all encourage the disease and restrict root growth,” he observes. “So growers really must keep up their defences here.”

But the second cereals study suggests this isn’t happening in the field. Selecting good second wheat varieties, using a take-all seed treatment, applying earlier spring nitrogen and delaying drilling until at least Oct are still being used by 70% or more of growers to optimise crop performance. However, the proportion employing these key management techniques is lower today than it was five years ago.

This wouldn’t be worrying but for the fact that the yield gap between first and second wheats has also increased noticeably in this time (see chart on pxx). At an average 1.18t/ha, the current gap is a good 13% greater than it was in the 2011 study. What’s more, the proportion of growers with a yield gap of less than 1.0t/ha has fallen from 53% to 43%, while 33% have a gap of more than 1.5t/ha today compared with 22% previously.

“It’s encouraging to see slightly more growers with a first to second wheat yield gap of less than 0.5 t/ha these days,” notes Monsanto’s Barrie Hunt. “But this is more than offset by the worrying rise in the proportion seeing a gap of more than 2t/ha. This highlights just how serious any slippage in management can be.”

A key plank of second wheat management for more than a decade, take-all seed treatment remains standard practice, the 2016 study shows, with over 80% of growers treating some of their crops and more than half treating all of them.

But growers appear to have become more restrictive in their treatment use as well as less diligent in other areas of their second wheat management, according to survey results. The proportion having all or most of their seed treated for take-all has, for instance, fallen from 77% in 2011 to 62% today.

“This is quite understandable with today’s intense pressure on margins,” says Barrie Hunt. “In many cases, though, I’ve no doubt – and the study figures seem to confirm – that cutting back on seed treatment is a false economy.

“Extensive trials over many years show an average yield gain of 0.55t/ha from specialist take-all treatment with silthiofam (as in Latitude). Yet, even with wheat at £100/t, break-even costings indicate a return of little more than 0.3t/ha is needed to make treatment worthwhile. So it has to be a priority wherever the disease poses a significant threat.

“The 2016 study shows the vast majority of those using a take-all seed treatment (70%) are using silthiofam, as they were in 2011. Interestingly, this seems set to increase to over 75% in the coming season. This may be because growers are seeking better protection than they get from the general dressing, fluquinconazole or because stocks of this alternative are limited in the final season of its availability. Either way, it’s good news for take-all management.”

Against the background of the concern over the disease shown by a number of winter barley and spring wheat producers, the current study reveals 20% and 15% of these growers respectively treating all or most of their crops for take-all. This suggests valuable benefits are being obtained from seed treatment beyond its primary second wheat value, notes Barrie Hunt.

Richard Torr agrees that winter barley is at risk from take-all, “not least as it needs to be sown early, and the best autumn growth is so critical to performance. So, like early-sown wheats, Latitude treatment can be very valuable.

“The main role for the take-all seed dressing continues to be second wheats, though. It’s a performance protector that our best second wheat growers insist upon, even with margin pressures as intense as they are.

“Second wheat yields should be as close as possible to first wheats to achieve the lowest costs/tonne. More often than not, it’s the second cereal that drags down farm wheat performance. So this has to be the key focus for improvement efforts.”

Survey winners

Andrew Mahon from Beds has won up to 100ha of his second wheat treated with Latitude (silthiofam) free of charge for the coming season for his entry in tie-breaker question of the survey.