At a time when innovations in crop protection are thin on the ground, Corteva Agriscience is bringing an array of new products to market with plans for integrated solutions combining the best of its heritage brands. CPM gets exclusive insight.

We can do more together with the larger base we now have.

By Tom Allen-Stevens

There’s a sense of reassurance you get when you reach for a trusted brand. It has a good track record of doing the job, to the extent you’d be prepared to try out a new product carrying that same brand. What happens, though, when three brands you’ve come to know and trust become one, and will the new products carry that same level of dependency?

“It’s innovation that drives us,” states Adrian Gough, who heads up Corteva Agriscience in the UK and Ireland. This is the company that brings together the agricultural elements of Dow AgroSciences, DuPont and Pioneer.

“For 100 years our heritage brands have stood for integrity and reliability. We have a fantastic pipeline of products coming to market in the UK, and in the short term, it’s our innovations that set us apart. But looking ahead, we can do more together with the larger base we now have.”

Innovation drives Corteva, says Adrian Gough, and its pipeline of products set the company apart.

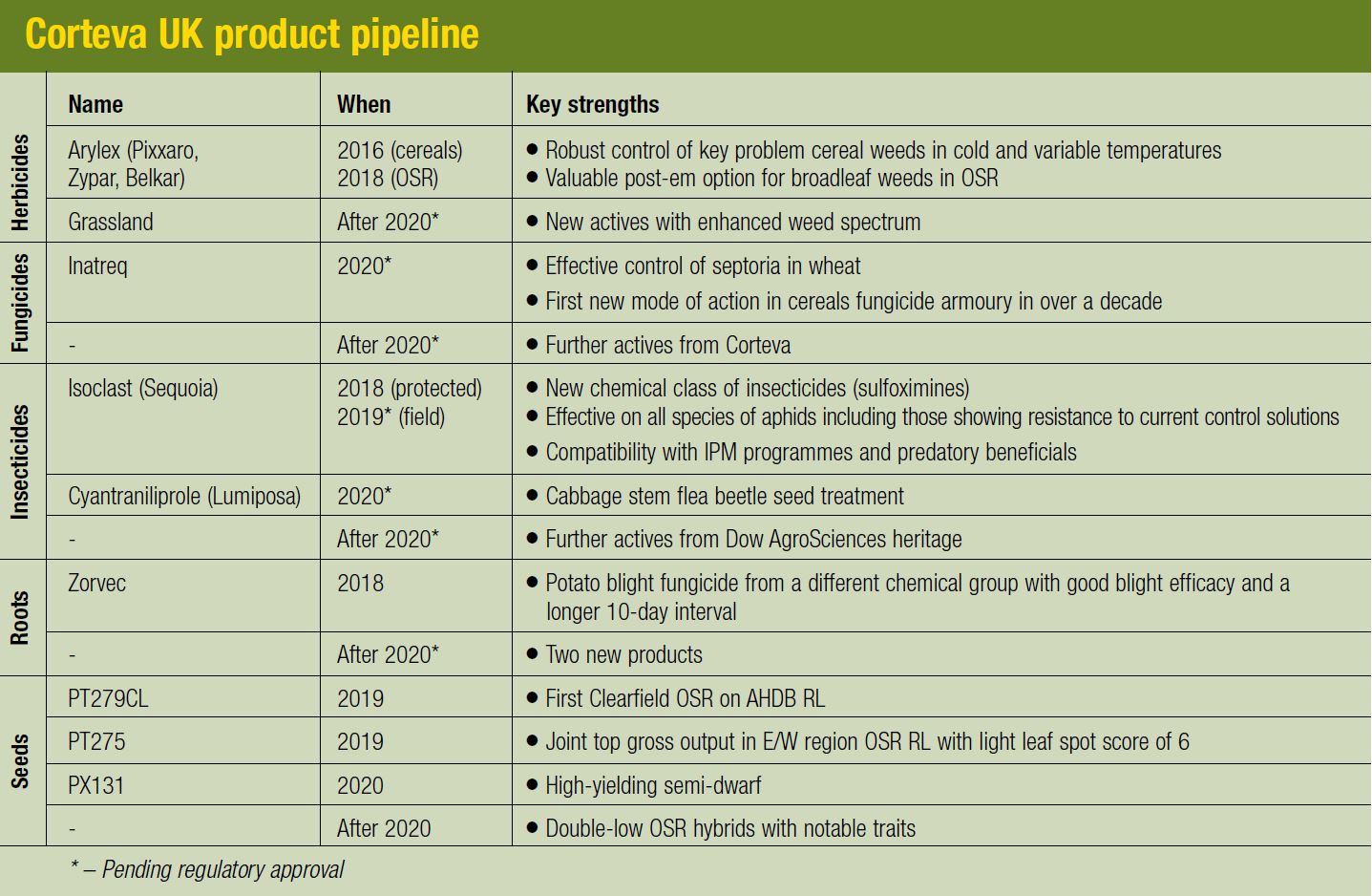

He points to Arylex, Inatreq and Isoclast as three “game-changing” examples in crop protection. The company has the first Clearfield oilseed rape variety to gain a place on the AHDB Recommended List and a new seed dressing to tackle cabbage stem beetle, set for introduction in 2020. What’s more, Zorvec (oxathiapiprolin) brings a different chemical group to blight control.

“What we’re bringing to market now and in the near future form our differentiation,” Adrian continues. “This pipeline is our strength as we build a new business based on integrated solutions, and that’s driven by the talent we have, as well as new people we’re bringing into Corteva.”

The merger that created DowDuPont took place in Sept 2017. In June this year Corteva will officially take on the agricultural division of the combined business. It’s a company with a global turnover of $14bn (£10.6bn) and has a worldwide R&D annual spend of $1bn (£760M), with over 140 research stations and more than 5000 scientists.

Here in the UK, investment in innovation focuses on its R&D field station in Wellesbourne, Warwicks, while there’s a centre of excellence and European Regulatory Centre in Abingdon, Oxon. The company’s UK commercial offices and administration centre are at Fulbourn, near Cambridge.

“Integrated solutions form the future,” Adrian asserts. “We’re strong in seed and genetics, which complement our crop protection portfolio. Digital applications are already being developed, built on the agricultural software company Granular which is now owned by Corteva. We also have a growing presence with seed applied technologies and plan to grow our biologics portfolio too.”

On the seed side, globally the company sits in the top two in maize and soybeans, but currently has a lower presence in UK, he concedes. “Breeding technologies face a challenge in the EU. I believe strongly that growers in the UK should have the tools available in other parts of the world, and if there’s an openness to explore these technologies, it encourages companies like us to invest in the local market and bring them on.”

Adrian cites new breeding technologies such as CRISPR Cas9 as an example. Treated as non-GMO in other parts of the world, the science is advancing fast. But a recent decision by the Court of Justice of the EU to treat gene-edited crops as GMOs threatens to hold back breeding advances available to UK growers.

Arylex, Inatreq and Isoclast form three “game-changing” newcomers in crop protection.

“The regulatory environment in the EU and the position the UK government takes will be critical. Globally, these technologies will push ahead and feed into the drive to produce more food sustainably. Hopefully a science-based approach will be taken in the UK, because it will be needed.

“But it is essential to understand consumers’ concerns and bring along public acceptance. When GMOs were originally commercialised, our industry missed the mark because the data was so compelling to us, we assumed the public would see the benefits. We didn’t listen to their questions nor seek to allay their concerns.”

He believes the industry has learned from that experience, and being a good partner in society forms a core strand of Corteva’s objectives. “As providers of innovations, we have always been involved in the conversation. As Corteva, we can engage with food producers and consumers in a more meaningful way which we couldn’t do as three smaller companies.”

Bigger also means better in the way the company operates and brings value to its farmer customers, Adrian points out. “We have combined resources and will become more efficient. When it comes to discovery targets and production, we can be focused, applying sufficient resource to the solutions we can be sure will deliver real benefit to farmers.”

He also highlights existing strengths within the combined business. “Our plan is to leverage these strengths as we develop our integrated solutions. A good example is in OSR, where we have market-leading products in both crop protection and seed. Future innovations will bring together the talent we have in both areas. I expect seed applied technologies to build in over time, too.”

Corteva’s approach to digital is underpinned by this mission for operational excellence with the new business. “Farmers know us for the reliability of our products – when you put Broadway Star (based on pyroxulam) in the spray tank, for example, you know what level of efficacy this will bring and the value it adds to your business.

“Everyone recognises digital will have an important role in future innovations, allowing farmers to make important decisions quicker based on reliable data. We believe they should expect the same reliability from a Corteva digital solution as they get from a crop protection product that carries our logo. So our strategy is to learn and to listen as we develop products that will remain true to what you get from any Corteva innovation.”

There’s a collaborative nature to this new approach that farmers can expect to see more of in the future. Adrian has plans for Corteva UK to engage more with farmers and with the wider industry than the separate businesses have in the past. The company was a major sponsor of CropTec and the Oxford Farming Conference, and this marks the start of a process of what he calls “bringing the outside in”.

“It forms two strands: there’s an advocacy role, working with government and the likes of the Crop Protection Association and NFU to achieve results that are favourable to both farmers and consumers – we have more resources to make a positive difference here.

“But it’s also about engaging with experts and with farmers themselves. We want to understand with farmers what their needs are as they progress their business and work towards productivity gains.

“Farmers know us for our great products, but in the end, it’s how they’re used that brings the step change in on-farm performance. By working closely together we can jointly achieve a commitment to growing progress.”

Collaboration brings pace to the product pipeline

Corteva lays claim to one of the strongest innovation pipelines among the major agchem manufacturers. For the UK and Europe, the company boasts more major new active ingredients launched recently or within the next three years than most of the competition has to offer.

One of the glistening jewels in this crown is Inatreq. “Cereal fungicides form the biggest segment of the UK crop protection market – around 40% of the total,” notes Adrian. “Inatreq is a new mode of action at a time many products are being withdrawn and fungicide resistance is on the rise. We’re confident it’ll provide a number of significant benefits to growers and quickly take a large share of the market.”

Inatreq is a Quinone inside inhibitor, which means it binds to a different site on the fungal pathogen to all other cereal fungicides on the market, explains cereal fungicide specialist Mike Ashworth.

“There are two reasons to be excited,” he says. “Firstly, it’s a fabulous fungicide, offering outstanding control against septoria. Secondly, growers are losing a lot of active ingredients through regulatory withdrawals or resistance. Inatreq is equally robust against all septoria populations, including those where mutations are making disease control hard with other forms of chemistry.”

Due for launch in the UK next year, Mike says the fungicide is an example of Corteva’s drive to deliver genuinely “game-changing” products to farmers. It follows on from the herbicide Arylex, first seen in cereals in 2016 as Pixxaro (halauxifen-methyl+ fluroxypyr) and followed by Zypar (halauxifen-methyl+ florasulam) in 2017.

Arylex has moved weed control up a gear according to category manager Alister McRobbie. “It overcomes the issue of not being able to treat weeds in cold and variable temperatures. It creates more spraying days without compromising efficacy.”

And it’s not just a cereal herbicide, points out oilseed rape specialist John Sellars. “As soon as growers and advisors saw what Arylex could do in cereals they wanted to know when it would be available in OSR.”

The answer was July 2018, but due to the late approval, the first major sales of Belkar (halauxifen-methyl+ picloram) will come this year. It provides growers with the option of waiting until their OSR crop has established before controlling broadleaf weeds.

“As a post-emergence spray it gives OSR growers peace of mind because they can see the quality of crop establishment before deciding what their herbicide investment should be,” says John.

“With the disappearance of neonicotinoids, plus the poor weather growers have seen during establishment in recent times, Belkar’s a product growers have been crying out for.”

Maize and oilseed rape are the strengths on the seed side of the business. Seed specialist Andy Stainthorpe maintains the Pioneer heritage OSR portfolio has had long-established success in the UK with sales of up to 25% of the hybrid market.

“Since the 1990s, we’ve specialised in double-low hybrids and have a reputation among growers for varieties that top the RL with consistently high yields, stiff straw and high oil content – we were the first to the market with a Clearfield variety, and PR46W21 led the List for many years.”

The company has always had a good dialogue with farmers, building strong ties through its Pioneer Accurate Crop Testing System (PACTS). This is a grower network, set up around 25 years ago, that puts varieties through their paces in large-scale field trials.

“What we’ve lacked in the UK before now is a proper base in this country – Pioneer used to operate from Germany, with a very small team based here. Now we’re sitting down with colleagues across the business coming up with new ideas and we’ve a greater resource to back up the very strong breeding programme we have. There are exciting traits coming through, and coupled with crop protection and seed-applied technologies, we have a very strong offering for OSR and maize growers.”

Mike is also feeling the benefits of this cross-company collaboration. “One of the things that happens is that people of different backgrounds and disciplines sit down together and exchange thoughts – your preconceptions are challenged and you challenge others,” he notes.

“The quality of different ideas that bounce around mean that the innovation coming through really picks up pace in a way I’ve never experienced before. We’ll look back in a few years’ time and note the innovations that sparked to life in those conversations that would otherwise never have seen the light of day.”

Corteva UK product pipeline

Company profile

CPM would like to thank Corteva Agriscience for kindly sponsoring this article and for providing privileged access to staff and materials used to help put the article together.