A survey carried out by CPM and CF Fertilisers has shown how growers have used and managed nitrogen fertiliser this season. It’s also highlighted some of the most influential factors that can boost yield and quality while keeping a lid on costs.

It’s tempting to look at lower cost options, but the sacrifice in yield and quality often makes choosing these the wrong decision.

By Charlotte Cunningham

It’s no secret that commodity prices have slipped over the past few years. Margins are tight and there’s a real need to maximise productivity in as cost-effective a way as possible. With farmers understandably looking to cut costs, fertiliser is an obvious area to target – but there’s a balance to be found.

“Fertiliser has the greatest return on investment of all inputs, at around 5:1 on cereals,” explains Allison Grundy, agronomist at CF Fertilisers. “However, efficient use is vital to ensure optimum crop growth. When looking at the most economic fertiliser option on any farm, several factors have to be taken into consideration, alongside the cost of purchase.”

With factors such as weather variability and application method to consider, perhaps one of the biggest decisions growers have to make is whether to opt for ammonium nitrate (AN) or a potentially cheaper urea-based product.

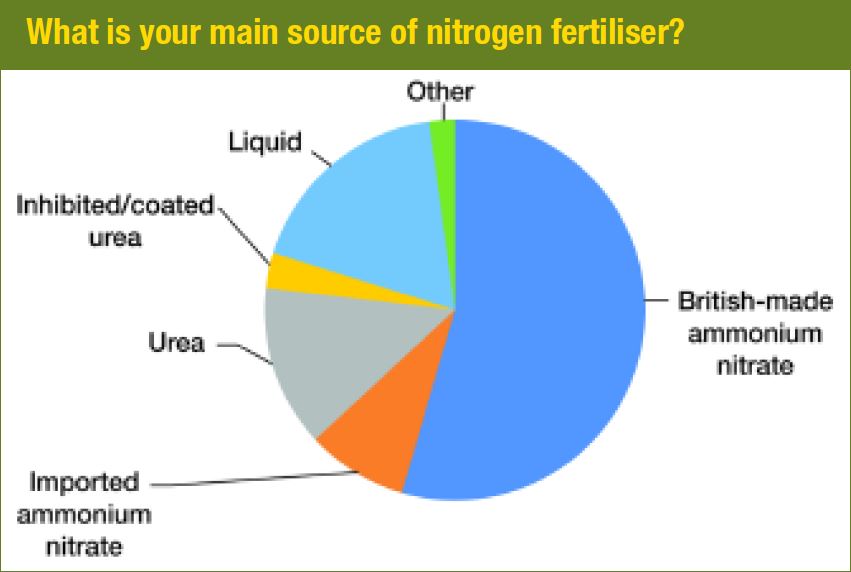

In a recent survey conducted by CPM and CF Fertilisers, 63% of growers said ammonium nitrate trumped all other options as their main source of nitrogen fertiliser (see chart below). The majority also opted for British AN (Nitram), likely due to its proven consistency compared with imported sources, Allison believes.

By contrast, just 14% stated urea as their main source of nitrogen. “The weather is starting to drive decision making when it comes to product choice,” explains Tom Land, agronomist at Agrii. “Poor weather highlights inefficiencies in urea, and although it has a lower unit cost than AN there isn’t a huge amount of difference in terms of cost per ha when you look at the return.”

Allison agrees: “ADAS has calculated that eight times out of 10, urea underperforms against AN. Therefore, a growing number of farmers are just not prepared to take a chance of urea working – regardless of the potentially lower purchase cost.”

When using AN, nitrogen is directly available to the plant as soon it’s applied, she explains, whereas with urea, nitrogen release relies on the complex process of hydrolysis – which itself is dependent on interaction with a soil enzyme (urease) and the environment.

“The inefficiency and variability of these processes is why a proportion of the nitrogen applied as urea can be lost to the air rather than taken up by the plant,” says Allison. “Defra reported an average loss of 22% of total urea nitrogen when applied to winter cereals – economically, this just doesn’t stack up. Bagged fertiliser isn’t 100% efficient, so why add another variable into the mix?”

In trials carried out by Armstrong Fisher this year, straight 34.5% AN produced an additional 0.4t/ha of milling wheat compared with crops treated with urea alone, says Dr Mike Armstrong, managing director at Armstrong Fisher. “AN’s superior performance in terms of yield and quality is one of the main reasons behind its popularity over urea for wheat growers – especially with those aiming for milling specification.”

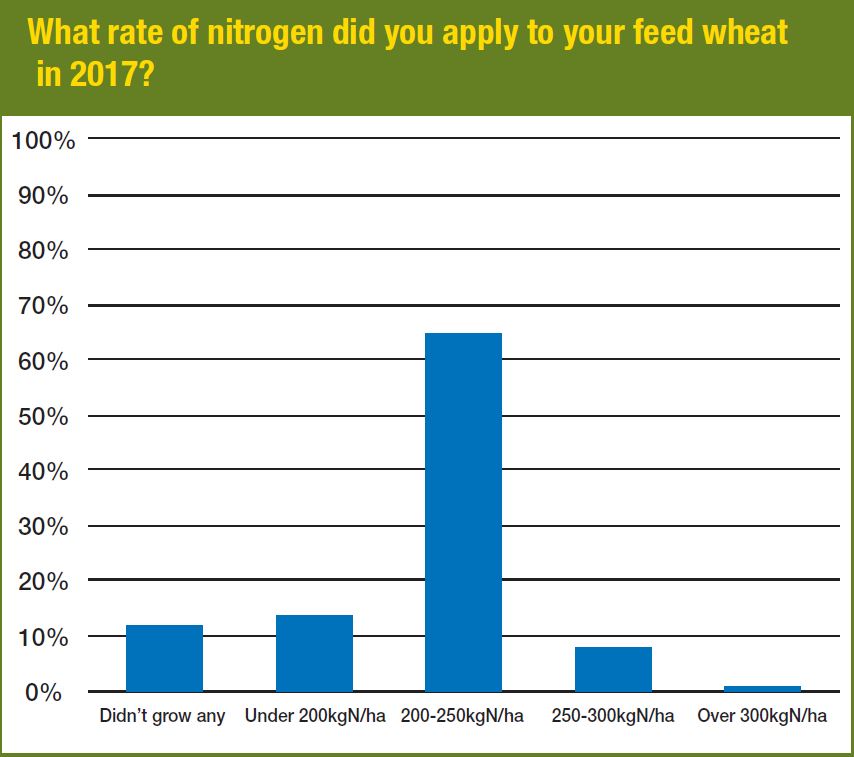

In terms of application rates, over 65% of participants said they applied between 200-250kgN/ha to their feed wheat in 2017, with just 14% using under 200kgN/ha and only 1% applying over 300kgN/ha (see chart below). However, before even beginning to think about how much to apply to wheat crops, knowing exactly what nitrogen is already available in the soil is an essential starting point, explains Allison.

“In recent trials where calculated nitrogen need was compared with existing farm practice, not only were better results achieved with the more precise approach but margin improvements of between £75-150/ha were also recorded.”

When it comes to the physical application process, smaller, more frequent doses are one way to mitigate against dry conditions. “Drip feeding nitrogen to wheat makes access to the nutrient much easier for the plant in comparison with applying large doses in one go,” says Tom. “It’s also advisable to start as early as you can to give a longer time frame over which to spread nitrogen.”

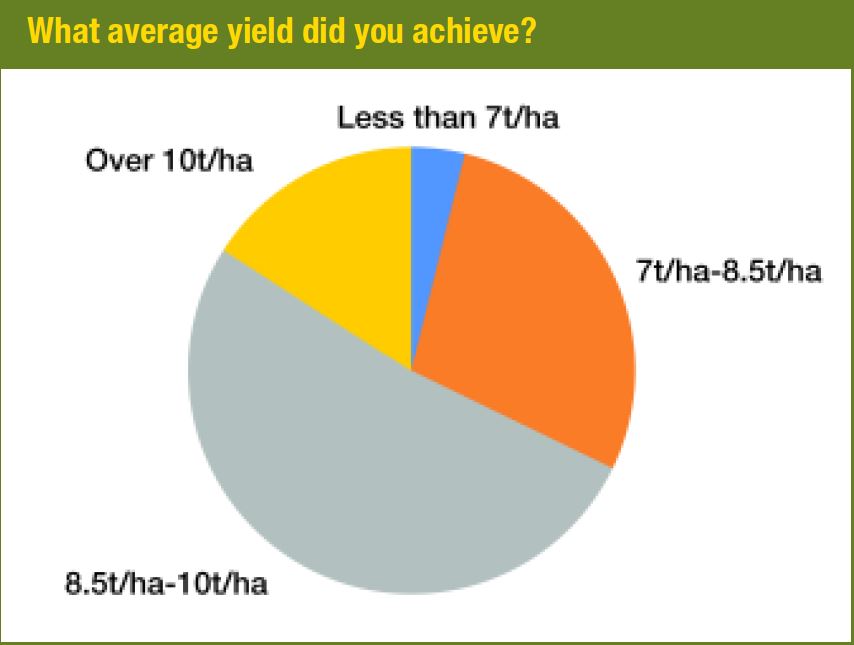

Striking the right balance between the source of nitrogen fertiliser and how much is being applied should result in good yield performance and high quality. When asked about their yields for the 2017 season, most growers achieved between 8.5t/ha and 10t/ha – slightly over the 8t/ha average wheat yield in 2017 calculated by Defra (see chart below).

While applied nitrogen helps promote high yields, assessing whether the crop has the potential to yield well should be considered before applying heavy doses. “It’s uneconomical to put high levels of fertiliser on a crop that’s not going to deliver,” says Tom. “Farmers need look at the yield potential and make a decision on a field-by-field basis – as well as taking into consideration the weather and the cost of nitrogen fertiliser in comparison to the grain price.”

However, a good fertiliser plan is just one part of the bigger picture when it comes to pushing yields, he adds. “Well structured, healthy fertile soil – alongside good variety choice and a sound fungicide strategy – are also really important factors for getting a good-yielding crop.”

Looking at milling wheat, the majority of growers’ crops mainly or entirely hit the contract specification in 2017 – with only 1% missing it altogether. Research has identified the superior performance of AN when it comes to high wheat quality, and including it as part of the fertiliser programme is crucial for those farmers looking to produce the highest quality grain, says Allison. “ADAS researchers have shown that AN in the shape of Nitram gave a 0.4% improvement in grain quality performance compared with urea.”

That may not sound like much, so the question is – is it worth applying extra nitrogen for quality? Most probably, says Tom. “A lot of modern varieties have higher nitrogen requirements and it helps to eliminate all limiting factors.”

As well as nitrogen, other nutrients such as phosphorous, potash and sulphur are crucial to maximise crop performance. Most wheat crops destined for premium markets are likely to require additional sulphur as levels in the air have decreased considerably in recent years, explains Allison. “Sulphur is required for the formation of the long chain amino acids – cystine and methionine – which help add volume and elasticity to dough and are key components of high quality milling wheat.”

Interestingly, the survey revealed that only 6% of participants don’t use sulphur products on their wheat crops (see chart below) – very reassuring, she adds. “It’s very encouraging to see that growers are incorporating it routinely into their management.”

While adequate sulphur levels in the soil may eliminate the need for additional nutrients, this is usually not the case, says Tom. “From the soil samples we see, we’re constantly measuring low sulphur levels in soils.”

For those using sulphur products, the majority of growers opted for British-made nitrogen sulphur though 14% stated urea sulphur as their product of choice, with a further 11% using other products including ammonia sulphate and liquid sulphate.

While growers accept the importance of sulphur, the mixture of methods to apply it suggests there’s still a lot of confusion, says Mike. “It’s tempting to look at lower cost options when margins are tight, but the sacrifice in yield and quality often makes choosing these the wrong decision when looking at the economics of production.”

Independent trials carried out by Armstrong Fisher this year reaffirmed the value of nitrogen sulphur, he adds. “Using a true granular nitrogen sulphur compound followed by straight AN produced an average £114/ha margin gain in winter wheat over comparable urea-based options.”

So, what is the secret to getting the best results from nitrogen fertiliser? When asked, farmers made a broad range of suggestions – from timing to using a high-quality product, but Tom says growers also need to think retrospectively. “Look back on previous seasons and see what did or didn’t work. Compare yields and now much nitrogen was applied and what effect – if any – the weather had.”

Being prepared to adapt plans according to conditions and yield potential is also essential, notes Allison. “Farmers tend to buy their fertiliser in advance and have a pre-prepared application plan, however, by the time the spring comes around circumstances may have changed. Fertiliser is an expensive input – growers must use it as wisely as possible.”

Quality counts on broader bouts

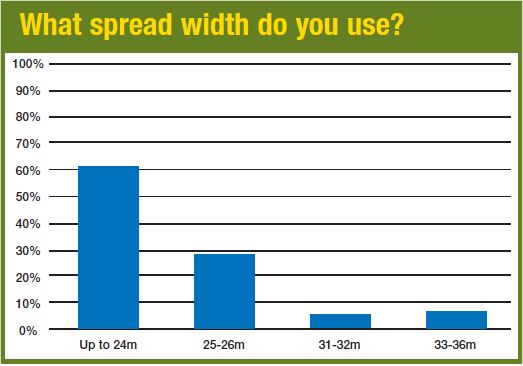

Most growers (61%) are using a spread width of up to 24m, according to the survey results, but a growing number are now going beyond this to maximise efficiencies (see chart below). With kit getting bigger, products need to be compatible, so it comes as no surprise that farmers ranked “spreads evenly to high widths” second when asked about the main benefits of quality ammonium nitrate.

“When you’re spreading at wide widths, you’re at the ultimate capacity of products,” explains Allison. “While ammonium nitrate has proven to be efficient at these vast widths, it’s important not to rely on the spreading manual – this is simply a guide – and to get your equipment calibrated every year.”

Sky high view on crop potential

Congratulations to Charlie Edgley from Kensham Farms, Bucks, who’s the lucky winner of a state-of-the-art DJI Phantom drone for taking part in the CPM/CF Fertilisers survey.

He responded to the survey and completed the tie-breaker question with the reply deemed best by the judging panel. His secret to getting the best from nitrogen fertiliser is “accurate application at correct timings”.

The aim of the survey was to find out what nitrogen fertiliser growers used on wheat crops in 2017 and results they achieved. To take part in the next survey, make sure we have the correct details for you by emailing angus@cpm-magazine.co.uk