There are some new kids on the block, high yielding soft wheats are set to rival hard wheat yields with quality premiums to boot. But what makes these new varieties so good? CPM explores growers’ choices and how these vary from north to south.

There’s always a chance you could get a premium if you’re growing a good quality crop.

By Ruth Wills

In early 2000’s soft wheats dominated the UK acreage with varieties like Riband, Consort, Claire, Viscout and later Robigus delivering high and broad market opportunities in distilling some key export markets to Europe and North Africa. In late 2000s there was a marked shift towards hard feed wheat driven by Oakley, JB Diego, Viscout and then Santiago, with the focus on higher yields but often sacrificing specific later maturity. The summer of 2012 caused a reboot with a focus on physical grain quality rather than out and out yield.

More recently, newer varieties coming through has changed this direction again, meaning soft wheat has largely dominated the north of the UK and hard wheat the South. And now the advances in breeding are beginning to show soft varieties at the top of the AHDB Recommended List with LG Skyscraper and LG Spotlight, with attributes to rival the hard wheats.

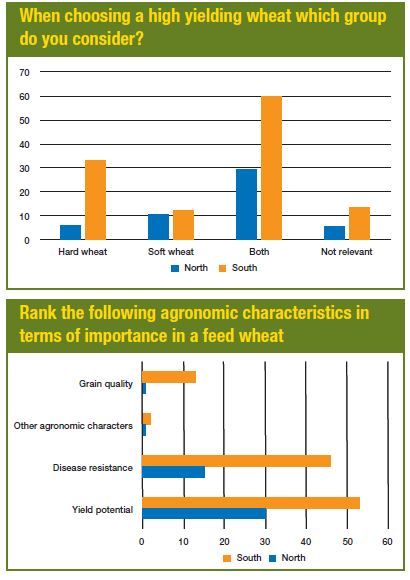

With this background in mind, it comes as no surprise that a recent survey carried out by CPM revealed that 28% of respondents in the South of England favoured hard wheat when looking for a high yielding variety, whereas 20% in the North favoured soft wheat. That said, the majority in both regions would consider both groups. “It’s interesting that 50% of the growers are looking at both groups which may signal a change in direction,” says Ron Granger, arable technical manager at Limagrain. “Growers in Yorks are often growing both, but Scotland is dominated by soft.”

David Leaper, seed technical manager at Agrii, agrees. “We know that Scotland favours soft wheat because that’s where most growers are getting a premium. Around half of all wheat grown in the South of England used to be soft wheats for feed and exports but now those markets have changed and breeders were successful in breeding a higher yielding hard wheat.”

Changing weather patterns over recent years could also be behind the change in direction of growers’ choices, he adds. “In 2012 there was the prolonged wet, dull summer which didn’t favour some of the late maturing and lower grain weights meant a lot of crops failed to find a home. After 2012 we saw a definite shift towards varieties with better grain quality and less focus on out and out yield.”

Despite concerns over whether soft varieties can match the performance of their hard counterparts, many are in fact on a par with and sometimes exceed hard wheat in terms of yield, notes David.

And the survey results reflect that – while 23% of people in the North thought hard feed wheats were higher yielding than soft, 56% were undecided.

Similarly, in the South, 32% believe hard feed wheats to be higher yielding and 42% were undecided. “To me, this reads that there is a perception that soft wheats don’t have quite the yield but aren’t sure. The result from the South backs up the trend that they favour a hard wheat,” adds Ron.

David explains: “Given that farmers know the history – the trend that hard feed wheats were higher yielding, but soft feed wheats have caught up. That myth has been broken a little.”

With tight margins, farmers are looking to minimise the unit cost of production and yield remains key, says David. “But of course, this needs to be taken into account alongside agronomic considerations as well”

Arron Mayhew, grain trader at COFCO, agrees that yield potential and disease are very important for those selling for tonnage, whether they have hard or soft group wheats.

So if there is a 5% yield difference on the AHDB RL, is this significant to growers? The majority of farmers reckon so, regardless of where they are based, with 71% stating it is significant in the South and 62% in the North. “Group 1 or 2 options have a higher market share, but the new soft varieties have 5% higher yield over Groups 1 and 2. It’s time to revaluate, high yield is high value, it’s not going to shift everyone,” says Ron.

Of course, it’s not just about performance – regionality and market demand also weigh heavily on decision making. “Farmers tend to grow for local markets,” explains David. “Whether growers are located near to feed mills, ports for export, biscuit factories or bakers will all dictate what they choose to grow.

“While some feed wheat growers will heap grain without differentiating between hard and soft, most like to keep them separate in case any opportunity arises for a premium however small.”

Recently, there’s been a lot of hype around Group 4 hard feed wheats, with growers opting for higher yielding varieties in response to greater end market demand, says Arron. “A lot of the time it’s a perception thing, and what the breeders are pushing at the time. Traditionally, hard feed wheats have performed better and there has been greater demand from ethanol plants.”

In terms of grain quality, southern growers again favoured the hard group with 43%saying they have the best specific weight and Hagberg, while only 26% said soft varieties came out on top for quality and 17% stating they were unsure

But perhaps surprisingly, growers in the North agreed with the southern 43%. “Many people believe that hard wheats perform better but this is not true – LG Spotlight offers just the same Hagberg and specific weight,” says Ron.

While yield is key, grain size matters almost as much, explains David. “It’s been a key drive across both hard and soft wheats since 2012 and this is where LG Spotlight is a real asset.”

Hagberg falling numbers are underestimated, says David. “A high and stable Hagberg is a good indication the grain is less likely sprout.”

Soft wheat is more susceptible to losing Hagberg if it rains but if there is continued rain then hard wheat will lose its Hagberg as well, says Arron. “People are obviously growing for feed wheat because so few have ranked the grain quality high [11% in the South and 2% in the North], whereas if they were growing for milling it would be higher.”

So which grain quality characteristics are most important to growers? Specific weight came out on top by a long way for both the North and South. “Both LG Skyscraper and LG Spotlight have very good specific weights and are early maturing. Scotland needs a crop which will withstand its weather conditions,” says Ron.

Specific weight and Hagberg are not that important to just feed growers, says Arron. “As long as it meets the 72kg/hl test weight, which is the minimum to find a home for feed wheat.”

When it comes to getting advice on what to grow, the avenues of information and support are endless. However, the survey revealed that the RL was a clear favourite for both regions in terms of where growers gather information about a new feed wheat, at over 50% for both regions. “It doesn’t surprise me; however, I am disappointed that no one looks at the breeder’s data,” says Ron. “A lot of work goes into trials, no one knows more about the variety than the breeders.”

But with the vast amount of time and trial work invested in producing the RL, it’s a good starting place for all growers, says Arron. “AHDB looks at recommendations in other areas, whereas merchants have information on specific markets. Go to AHDB first, then go to your merchants and ask questions.”

Farmers also often talk to neighbours about their choices, adds David.

When it comes to marketing, growers’ opinions on having an additional end-use option is split from north and south. In the South, 41% do consider an additional end-use market such as distilling when choosing their varieties in contrast to 35% saying they didn’t. In the North, 43% of growers stated they do not consider it at all, while 37% do. “This is what we’ve been hearing from southern growers – weighing up characteristics with end-use markets over just standard feed wheats,” says Ron. “In the North a lot of growers grow feed wheat for use on their farm.”

Even so, a lot of people are growing with the potential to add a premium, says Arron. “There’s always a chance you could get a premium if you’re growing a good quality crop.”

David agrees – an out and out feed wheat grower doesn’t take into account other end market; although some will be opportunistic. “This reflects the North and South split – growers in the North are selling to feed mills, but want to keep their options open as it might be taken for distilling, while in the South there are more varied markets.”

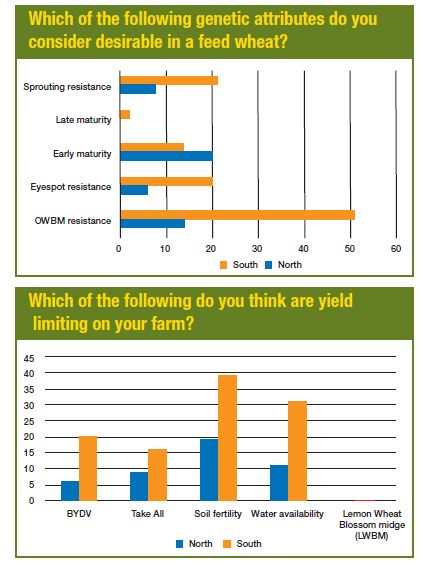

There are also big splits between farmers’ agronomic requirements, depending on their location. Those in the North favoured early maturing varieties whereas those in the South favoured OWBM resistance. “This is as expected as there is less OWBM prevalence in the North, where they are more concerned about early maturing and sprouting,” explains Ron. “Five years ago, the wheats kept getting later and later so we’ve brought LG Skyscraper and LG Spotlight forward.

“Lemon Wheat Blossom Midge (LWBM) was around last year and I think a lot of people have forgotten about it. They talk about the Beast from the East and the drought, but we lost a lot of tillers to LWBM and Orange Wheat Blossom Midge (OWBM) – we need to be aware that just because something is resistant to OWBM doesn’t mean it’s resistant to LWBM.”

That said, Barley Yellow Dwarf Virus (BYDV) is going to be a real threat to early crops; there is growing concern over when to drill, he adds.

David agrees: “There’s a lack of awareness of the pest; LWBM was prevalent last year, but people aren’t aware of the level of damage. Also the number of varieties with OWBM resistance was in serious decline a couple of years ago but fortunately we are getting it back in some of the newer varieties like Skyscraper and Spotlight.”

Yield and disease resistance are at the forefront of growers’ minds, with brown and yellow rust prevalent in the South, and Septoria the biggest issues in the North. But growers don’t see much difference between hard and soft wheats’ disease resistance, with 43% in the South and 48% in the North saying they’re much the same.

Skyscraper and Spotlight have scored well into 80% for untreated yields, which is reasonably good, he adds.

And it’s clear that growers know the importance of disease resistance, adds Arron. “If varieties didn’t have good disease resistance, they wouldn’t grow them.”

Hard and soft are just as good as each other, it’s about picking out varieties that are resistant to septoria or rust, explains Ron. “After losing chemistry like Bravo (chlorothalonil), I believe disease resistance will become more important.”

Water availability topped the list of yield-limiting factors in the South with soil fertility topping the list for the North. “My view is that once we get the soil right, that will improve the water retention. Soil fertility and water are key to the future of crop productivity,” says Ron.

Winner announcement

Congratulations to our lucky winner, Tim Walters, from Hamps who responded to the CPM/Limagrain survey on feed wheat varieties and has won a GoPro HERO7.

Michael Woodhead, Northants and Thomas Edmondson, also Northants, came in as runners up and will each get their hands on an Amazon Echo Dot.

All three CPM readers responded to the survey and completed the tie-breaker question, which asked which qualities make the highest yielding wheat variety on the new AHDB RL stand out. Tim’s answer – “LG Skyscraper – A variety for all soils and rotational positions. OWBM resistance. Distilling potential and good yellow rust resistance” – impressed the judges due to the number of factors taken into consideration for optimum crop performance. The runners up also made reference to LG Skyscraper’s consistent yield and good agronomic package.

The aim of the survey was to explore the most profitable options for farmers when it comes to selecting feed wheat varieties. To take part in the next survey, make sure we have your correct details by emailing angus@cpm-magazine.co.uk