As ‘agflation’ and reductions in BPS put unprecedented volatility into arable margins, CPM reports from the first KWS Fit for the Future event in Cambridgeshire, at which the role of soil management and genetics were explored.

The activity of microbes around roots makes the plant laugh, and when it does, it leaks a little goodness into the soil that makes it thrive.

By Tom Allen-Stevens

A yield increase of just 2% will deliver more to the bottom line of the average arable farm than the Sustainable Farming Incentive. As BPS dwindles, farmers will get better returns through focusing on genetics and nurturing their soils than through its public-funded replacement, say experts.

James Webster, senior agribusiness analyst with the Andersons Centre spelled out the effect on arable farms of the transition, ‘agflation’ and the surge in food prices at the KWS Fit for the Future event at Fowlmere, Cambridgeshire, last month.

High input prices will bite as BPS falls back to 50% of its current value in 2024, noted James Webster.

“If you’re going to make a change to your business, this year is the one to make it,” he said, noting that profitability for harvest 2022 is likely to reach levels rarely seen by arable farmers. “But before you plough profits into capital allowances, make sure you have made provision for the large increase in working capital needed.”

James explained that the historical average farm business income for a 214ha cereals business of £56,000 is likely to double for the current harvest year. But he warned that BPS currently contributes 3.6 times the contribution made by farming to the bottom line. “You won’t feel the cut in payments at present as they’re masked by high output prices, but high input prices will bite as BPS falls back to 50% of its current value in 2024.”

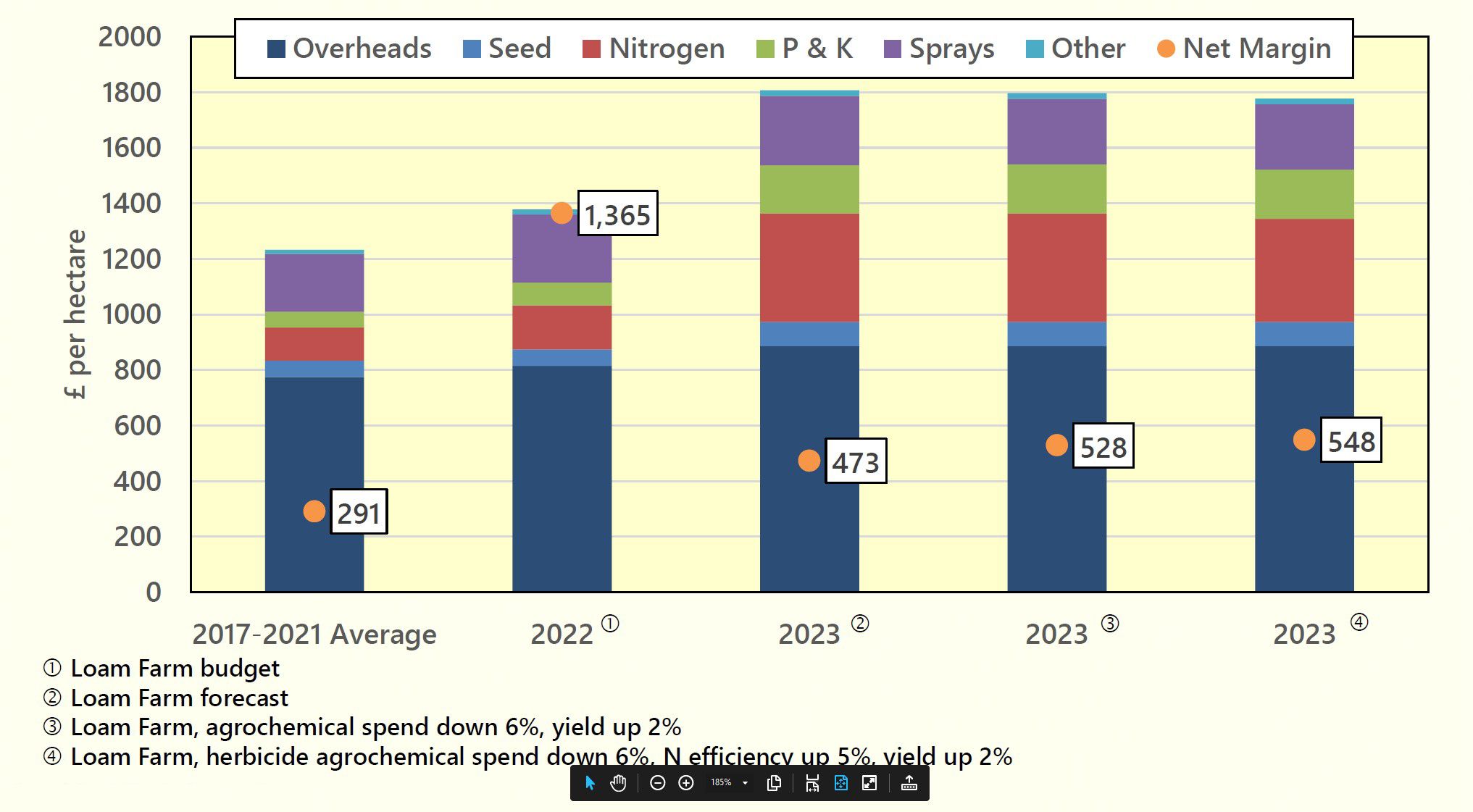

Andersons uses Loam Farm, a model 600ha arable farm, to assess the effect of policy changes on cereal farmers. Funding under ELM schemes going forward will be different, noted James, as there’s a cost attached to the new payments, which start at £22/ha for Introductory level, moving to £40/ha for Intermediate. According to figures prepared for the NFU, Loam Farm will net £18/ha and just £13.50/ha, respectively. The net loss of public funding will be £52,498 for harvest 2023.

A margin from production of over £1000/ha for harvest 2022 will sink back to similar levels to 2021 in the following year, according to projections. But variable costs will have doubled, warned James. “Output prices could fall back, making 2023 a challenging year from a risk perspective.”

James has run three scenarios for the next cropping year on Loam Farm’s feed wheat enterprise – carrying on the status quo, pushing yield by 2% and shaving agchem spend by 6%, and then in addition the effect of raising N efficiency by 5%.

“As Loam Farm does not take account of varietal differences in yield, we started by looking at KWS Dawsum and its +2% yield advantage at 104% of control in the AHDB 2022/23 RL compared with an average of around 102% for Group 4 as a whole.

“Similarly with KWS Dawsum’s untreated yield at 92% of control compared to a Group 4 average of 76.9%, we thought a 6% saving in spray costs was not unreasonable.

“These improvements in feed wheat production alone are greater than the net benefit of entering SFI, at current prices, and show the importance of targeting incremental gains. Even if you don’t get a 2% yield benefit, reducing agchem spend by 6% adds £14/ha to the bottom line,” he noted.

Such improvements resulting from careful varietal choice can be built on from better use of the soil. There’s a wealth of nutrients available through the soil if you can get it working to your benefit, said independent specialist Neil Fuller. From a hole dug in the site at Fowlmere, he showed event attendees some of the elements that work together to produce a healthy, high-yielding crop. This included an earthworm midden revealed about one metre below the surface in the chalk subsoil that he estimated could be hundreds of years old.

“It’s not just good for drainage – the cycling of nutrients they provide is essential,” he said.

The organic matter of the soil is what holds it together, he explained, and prised free a plant to focus on the rhizosphere around the roots. “The thicker plant roots are where the nutrient transfer takes place. Plants put amino acid exudates into the rhizosphere to feed the soil biota. About 75% of mineral nutrients for a crop will come from the top 10cm of soil where these roots are most prevalent, and the work is done through this symbiosis.”

Neil explained that the release of nitrogen and phosphate in particular are related to activity in this area – soil movement through tillage releases an N and P “hit” that can help during establishment. “You don’t get that in no-till systems, so you rely on roots, through cover crops, for example, as your comms platform to stimulate beneficial organisms in the soil.

“I like to think it’s the activity of these microbes around roots that makes the plant laugh, and when it does, it leaks a little goodness into the soil that makes it thrive,” noted Neil.

This activity is essential for nutrient transfer – while nitrate takes just 10 days to move through the top 10cm of soil, ammonia travels the same distance in 90 days, and P will take 30 years to shift unaided through the topsoil. “What’s more, P is highly prone to lock-up in calcareous soils, with 98% of a surface application of triple super phosphate (TSP) locked up in just two days.”

Along with ensuring a thriving soil biota, Neil believes that better timing can offer significant reductions in N applications without reducing yield. It’ll also contribute substantially to a reduction in emissions. “The biggest contributor to an arable crop’s carbon liability is applied nitrogen that fails to get picked up by the plant and is converted into the powerful greenhouse gas nitrous oxide. Preventing just 1kg of this from being lost to the atmosphere lowers the carbon footprint of a crop by 300kg CO₂e.”

The carbon balance in the soil goes a long way towards regulating N uptake, he added, and this is strongly related to how carbon is cycling through the crop. “A high-yielding crop has a substantial daily CO₂ requirement. If it were to draw all this from the air above the crop, it would have to process the equivalent of a 20m column of air per day at the average 420ppm of CO₂ in the atmosphere.

Source: The Andersons Centre, 2022. Loam Farm has 600ha of combinable crops, 240ha owned, 360ha on FBTs, with labour provided by the owner, one full-time employee and a harvest casual.

“CO₂ at soil level where there’s good biological activity, however, is in the region of 2-4000ppm. It’s estimated this is where a high-yielding crop draws most of the carbon it sequesters. So it’s on many levels that soil biology feeds a high-performance crop,” concluded Neil.

Putting the right crop genetics into this soil is the key to getting both the carbon and financial benefits you’re looking for, according to Will Compson and Kirsty Richards of KWS, who talked through some of the leading wheat and barley varieties at the Fowlmere site.

KWS Zyatt, Crusoe and Skyfall remain the options on the AHDB Recommended List of Group 1 winter wheat varieties, expected to take a slightly lower 16-17% market share of the wheat area this autumn, said Kirsty. “There are no stand-out candidates coming through, so those looking for improved genetics may turn to the better traits and higher yields on offer from other wheats.”

With a current market share of 15%, KWS Extase will be the variety of choice for many, combining Group 2 quality with high disease resistance, late autumn vigour and early maturity. “In France it gets top quality spec, but has relatively low water absorption, which is why UK millers put it as a Group 2,” she added.

KWS Palladium is the newcomer in this slot, a KWS Trinity x Zyatt cross, offering many of the benefits of Extase with stiffer straw and the option to drill earlier, noted Will. “It also ripens before Extase, making it the earliest to harvest on the RL and almost Cordiale-esque. Together, Palladium and Extase could take 20% of the market this autumn, which is unprecedented for the Group 2s.”

With just 6.5-7% of the market, the Group 3 wheats are having difficulty competing against the soft Group 4s, where Skyscraper currently dominates, said Kirsty. She pointed out KWS Zealum and Webbum, two RL candidates in the sector. “Zealum in particular offers better Hagberg, standing ability and septoria resistance than Skyscraper. We’ll be keeping a close eye on how these two perform over the next 12 months.”

The hard Group 4 feed varieties take the biggest share of the market, with Champion and KWS Dawsum expected to find favour among growers looking to combine high yield and good agronomics, said Will. “Dawsum is Costello x KWS Kerrin with a high untreated yield, just behind Extase, and with that robust consistency and grain quality we saw with Costello. The small amount we put on the market last year sold out and took 2% of the market. We’re expecting it to take 10% market share this autumn, the second largest wheat behind Extase.”

The “Dawsum-eqivalent” for winter barley growers is RL leader KWS Tardis, said Kirsty. The variety’s expected to take up to 30% of the market and take over from current two-row market leader KWS Orwell.

In the six-row market, newcomer KWS Feeris leads the conventional varieties with a yield just four points behind list leader SY Thunderbolt, and better screening than any of the hybrids on the RL. But it’s the BYDV tolerance that’s the added advantage for this variety, explained KWS’ Olivia Potter.

More than three quarters of growers believe they’ve suffered a yield loss from BYDV, according to a KWS survey, said Olivia Potter, which highlights the key benefit of KWS Feeris.

“A recent survey of growers revealed 78% of them believe they’ve suffered a yield loss from BYDV. Since the withdrawal of neonicotinoid seed dressings, it’s become a key concern. Drilling later to avoid BYDV isn’t really an option with barley, so Feeris offers protection without the need for pyrethroids – important for growers aiming to go insecticide-free on their cereals,” she added.

Growers looking to shield against the high input cost of conventional cereals should consider the benefits on offer from hybrid rye, suggested KWS’ Dominic Spurrier. “You can expect a 7-8t/ha yield for an N application of just 120kg/ha, and it performs well in dry conditions, requiring 25% less water than winter wheat.”

While the wholecrop anaerobic digester market has driven interest in hybrid rye, demand is now coming from the feed-grain market, said Dominic, with pig producers noting the protein-type benefits rye offers over feed wheat. “KWS Tayo, which leads the AHDB Descriptive List, and KWS Serafino are both dual purpose hybrid ryes,” he added.

Fit for the Future

Think back to March 2018. Brexit was probably the external factor preoccupying most growers’ thoughts when it came to the grain market and variety choice in particular.

Tom Allen-Stevens has a 170ha farm in Oxfordshire and leads the British On-Farm Innovation Network (BOFIN). He visited and profiled all 10 of the Fit for the Future growers and chaired the event.

That was the first month CPM teamed up with KWS to explore how crop markets may evolve, and to profile growers set to deliver ongoing profitability. Fens grower Sam Markillie was the first farmer featured, who had the biscuit market firmly in his sights.

At the time, Sam was flying European flags at the end of his drive, but recognised the biscuit market as unique to the UK and with potential for export opportunities. His choice of variety – KWS Barrel – offered “premium without the additional costs”, he added.

Since then, a further nine growers have been profiled. While priorities may have evolved, each have had their own specific requirements of the wheat or barley market and recipe for how to achieve them on farm.

Today, Brexit feels like a relatively minor challenge. Global markets, still reeling from the effects of COVID, have been thrown into turmoil with the Russian invasion of Ukraine. The resolve to tackle climate change has added to the pressures on cereal growers.

It’s with these in mind that KWS and CPM hosted the first Fit for the Future event last month at the company’s product development field at Fowlmere. The aim, both of the event and of the series of articles as a whole, has been to focus on the unique factors affecting variety performance, to optimise this and maximise return on investment. These have served to highlight the value plant genetics can now play in variety selection as many factors are heavily influenced and even fixed by variety choice.

Looking ahead, genetics are likely to play an even greater role in ensuring cropping systems are fit for the future. Varietal resistance will shoulder more of the burden of crop protection as the industry moves away from pesticides, highlighting the essential role of IPM in protecting the genetics. Climate change is not just about crop resilience as the weather changes, but adapting cropping to a low-carbon future in which soils serve to sequester society’s emissions.

What’s more, breeding advances such as gene-editing promise advances at a pace never seen before in farming, and it will up to pioneering farmers to build the systems that will safeguard the new technologies and ensure they are trusted. So it’s probably never been more important to ensure your variety portfolio is fit for the future.

CPM would like to thank KWS for its continued support for Fit for the Future and for privileged access to staff and resources that helps bring the series together. The full series of articles can be found here.

This article was taken from the latest issue of CPM. For more articles like this, subscribe here.