Where better to visit than the birthplace of GM crops, Ghent, to learn about research coming out of its world-leading plant science research facilities 50 years later. CPM reports.

“We’re breeding soy which is adapted to northern latitudes.”

By Mike Abram

It was in 1974 that two Belgian scientists, Marc Van Montagu and Jeff Schell, discovered how to transfer genes to plants, thereby starting the genetically modified crop revolution which has transformed agriculture in many parts of the world.

While that technology has never been used particularly widely on their home continent, it led to the place where they made the discovery – Ghent – becoming a global biotech capital.

It’s a legacy which continues today, with Europe’s largest agricultural biotech campus home to many of the world’s most innovative companies, while both the University of Ghent and VIB Center for Plant Systems Biology have a long-standing tradition of converting basic science into successful commercial technologies.

Perhaps unsurprisingly, the scope of researchers and companies in the Ghent biotech valley has widened as new breeding technologies such as gene editing using CRISPR-Cas9 technology have pushed new boundaries in plant science.

But while innovation in plant breeding remains a key goal for the region, it also uses its resources to push boundaries in other areas such as the creation of next-generation biological products.

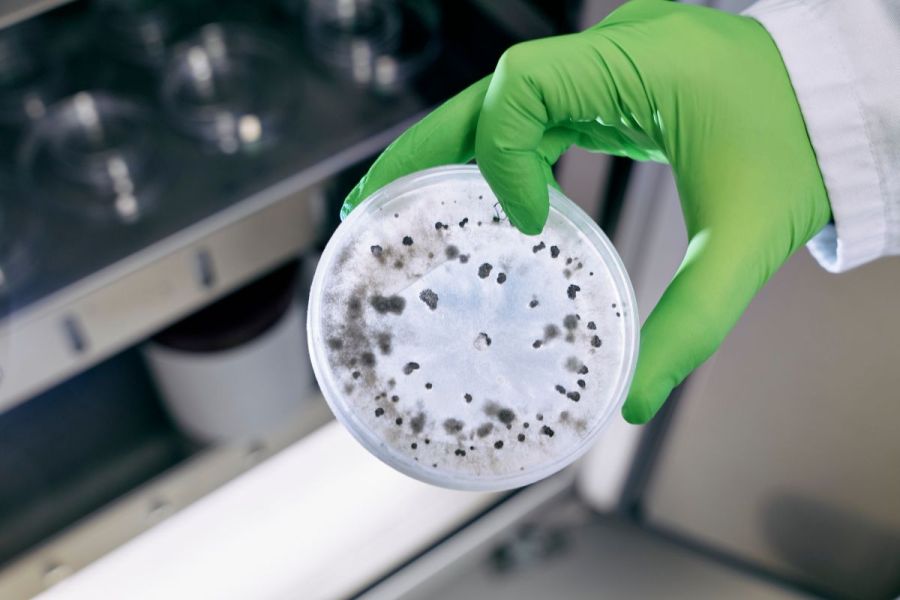

Spin-off companies from VIB (Flanders Institute for Biotechnology) and other institutes are now starting to bring those products to market. One such example is Biotalys, founded in 2013, which is developing novel biofungicides based on antibodies produced by llamas.

“Thirty years ago, the University of Brussels saw that llamas and camels have a very particular immune system,” explains Toon Musschoot, head of investor relations and communications for Biotalys. “This means they create very specific antibodies to fight off diseases.”

That knowledge has been used to develop medicines for humans, animals, and now, through Biotalys, plants. “If you immunise the llama with a certain fungus, for instance, or a part of a fungus cell, the llama’s immune system will create antibodies against this foreign element. We copy these antibodies into proteins which we develop into crop protection products,” says Toon.

The firm uses fermentation to produce the protein in large scale volumes to create a powder which when mixed with water, can be sprayed over crops. Ideally, it has to be sprayed preventatively, adds Toon, and works by interfering with the fungus cell wall which bursts and the fungus dies off.

Protection lasts around 10 days with Toon suggesting the technology should be used in alternation with other pesticides to reduce the risk of resistance.

An initial product, Evoca, targets diseases such as botrytis and powdery mildew in high value fruit and vegetable crops including strawberries, grapes and cucumbers. Further down the pipeline is a product for use in potatoes against late blight which the company is developing in conjunction with the University of Aberdeen.

In total, six products are in progress, with Evoca submitted for registration with both the EU and US authorities. “In time we’d also like to focus on row crops, but to achieve that we have to bring down production costs. Producing through fermentation is still expensive for commodity products, whereas for fruit and vegetables it’s much smaller hectares,” explains Toon.

Another spin-off from VIB and the universities of Ghent and Leuven, Aphea Bio, is also searching for future biological products, whether that be biostimulants, biofungicides, bioinsecticides or bioherbicides.

“We want to help farmers to replace fertiliser use on one hand while also replacing or complementing their chemical crop protection use,” says Dr Isabel Vercauteren, Aphea Bio’s chief executive officer and co-founder.

The firm has developed a platform to isolate naturally occurring microorganisms mainly from soil, but also from plants. “We define a product concept driven by what farmers and the industry require and then develop an isolation campaign, which involves a lot of bioinformatics, metagenomics, microbiology, formulation and production scaling.”

Its first commercial product is a biostimulant for wheat called Activ which is being marketed in Poland by Syngenta, with Italy and Hungary likely to follow. Based on a bacterial strain of the species Stenotrophomonas rhizophila, it helps with the uptake of nutrients, especially nitrogen, with suggested yield increases of 5% even with reduced fertiliser use.

A second pipeline product, Initiv, is for maize and is a fungus strain that provides phosphorus solubilising activity, whereas the firm also has two biofungicides – Virtuosa and Valoria – in regulatory approval.

“These are broad spectrum biofungicides for fruit and vegetables in one instance, but also control diseases like fusarium and septoria in wheat,” says Isabel.

In fruit and vegetables, she claims Virtuosa’s performance is on a par with chemicals and could be used as a replacement. While in wheat, Valoria, a different formulation of the same actinobacteria streptomyces strain is being developed, which she says should be used in an integrated way with conventional fungicides.

As a protectant in wheat, Valoria could be used as a T1 spray – as well as septoria it also has activity against rusts and possibly mildew, with registrations expected first in the US, followed by Europe, adds Isabel.

Further away are potential bioherbicides. To identify these, Aphea Bio screens metabolites produced by microorganisms for herbicidal activity. “We have a portfolio of around 100 different metabolites that are now being tested in the first year of field trials.”

The initial aim is to find a non-selective herbicide, she says. “The tricky thing is to completely characterise the metabolite soup to be sure we understand what the active ingredient is, which we have to know to a certain extent for regulatory approval.”

Approval of bioherbicides is a little more complicated than a biostimulant, she acknowledges. “It’s closer to that of a chemical but should still be quicker due to the nature of the product being inherently lower risk.”

The latest spin-off from VIB is legume breeder Protealis, which is also commercialising research from the Institute of Agricultural Fisheries and Food Research (ILVO). Its key focus is soybean with programmes also looking at yellow peas and fava beans. “We’re breeding soy which is adapted to northern latitudes,” explains Protealis’ Renate Degrave.

Europe is more than 70% dependent on imports of protein-rich crops, with millions of tonnes of soy annually imported from South America which contributes to the destruction of rainforests. “If protein crops were grown on 10% of Europe’s arable land it could become independent of imports from other continents,” she suggests. “But soybean varieties bred up until now don’t typically thrive in our local soil and climate.”

Typically in Europe, soy is grown in southern latitudes such as Spain, Italy and the south of France. But with an evolving food market demanding sustainable, local high-protein plant based foods as well as increasing regulation on nitrogen use and soil health, investment is being made to grow the crop at more northerly latitudes.

As a result, Protealis is using speed breeding techniques to develop varieties which are more suited to the longer day lengths further north, as well as the cooler temperatures, says Renate.

The firm uses facilities where light, humidity and other factors are controlled and adapted, reducing the breeding cycle by producing many generations within a short period. “We can reduce the time by 2-3 years and have varieties that can be harvested earlier.”

But just like the plants have to be adapted to the local environment, so too do the key soil rhizobium bacteria that work symbiotically with the soy plant to form nodules which can fix nitrogen from the atmosphere.

That’s where innovative research led by VIB’s Professor Sofie Goormachtig has helped. Her team uses the principle that every microbe is everywhere, but it’s the environment which enriches them. “There might be rhizobia capable of forming nodules on soybean in Belgium that we weren’t aware of,” says Sofie.

To find out, a project asked 100 citizens to grow soybeans in their gardens with a second round expanding that to 1000 participants, and ultimately 1200 gardens, she says. Sites were distributed across the Flanders region where people grew 1m2 of soybeans. “We connected them through a website and they measured the growth of the plants.”

The project also measured soil parameters such as nutrients before the gardeners brought five plants to Sofie’s lab for the team to look for nodule formation. “From the nodules we isolated bacteria with the idea that there’d be bacterium adapted to our climate,” she explains.

Once isolated, the bacteria could be inoculated onto soybean seed to check for activity, first in the laboratory and then in field trials. “Where the plants grew dark green we knew we had good bacteria,” explains Sofie.

It’s this type of basic research that commercial firms like Protealis are picking up to develop into seed inoculants which can be used more widely in northern Europe climates. Protealis is also developing a proprietary seed coating with the aim of increasing yield and consistency of performance, adds Renate.

Six new varieties have been registered in Belgium, France and Germany by Protealis during the past few years, significantly reducing the yield gap to soy grown further south.

All in the triple zero maturity category suitable for northern Europe, Pro Helicon has a very high protein content in the region of 44% – the highest on the Belgian soybean variety list – and a yield of 108%, while Pro Jacinto has the highest relative yield of 114% at protein of around 40%.

The admission of the varieties onto the list brings profitable soybean cultivation a step closer, believes Renate. “Farmers are still a little hesitant because it’s a new crop for them, but with every variety registered, we’re bringing better performing varieties to the market. There’s a lot of interest.”

Mike Abram visited Ghent as part of a European Network of Agricultural Journalists / EU-FarmBook press trip in July 2024.

This article was taken from the latest issue of CPM. Read the article in full here.

For more articles like this, subscribe here.

Sign up for Crop Production Magazine’s FREE e-newsletter here.