Feed wheats have dominated the seed market for the past few years but now KWS is encouraging growers to look at quality wheats, launching two new Group 3 varieties, KWS Barrel and KWS Basset to redress the balance. CPM reports.

By Melanie Jenkins

Group 3 wheat varieties have seen a fall in popularity in the past decade, according to seed-certification figures, with high yielding feed wheats taking the lion’s share of the market. Now, however, KWS wants to highlight the benefits of new Group 3s, which have more potential end uses and are matching Group 4 types for yield. KWS Barrel and KWS Basset are at the forefront of this movement towards quality, dynamic wheats, says the breeder.

The biggest risk to our business is the national decline in Group 3 varieties being grown.

Yield is the dominant varietal focus in farmers’ minds, according to Dr Kirsty Richards, value chain manager at KWS. This explains why interest in Group 3 varieties has fallen in recent years: In 2004, Group 3s accounted for 50% of the UK wheat areas but in 2007 this was 31%, and by 2015 this had fallen to 9% as growers switched to higher yielding varieties that produced better gross margins. However, that’s now changed, she says, with recent introductions offering yields on a par with the best of the rest.

Richard Plant at United Biscuits says there’s good demand for Group 3s in the UK. “The biggest risk to our business

Mark Ringrose says the area of Group 3 wheats is likely to grow to meet existing consumer demand and wider marketing opportunities.

is the national decline in Group 3 varieties being grown,” he says.

Mark Ringrose, trading manager at ADM Milling reckons the UK is unlikely to see a return to the volume of Group 3 varieties grown 10 years ago. “However, the area is likely to grow to meet existing consumer demand and wider marketing opportunities.”

Something different

Kirsty Richards says every part of the supply chain is seeking something different in a wheat variety. “But they all benefit from high yield and flexibility in end use. No other classification of wheat offers the same range of market flexibility as Group 3s, but until recently they had lacked the yield to make them competitive on farm.”

Mark Dodds, wheat breeder at KWS, says that Barrel and Basset will fill a gap in the market. Both varieties were entered into National List testing after harvest 2012 as KWS saw quality wheats declining and decided to enter more bread and biscuit wheats than had been entered in the past.

They both have elite parents which have had considerable commercial success, he points out: KWS Barrel is a cross between Viscount and Bantam, through doubled-haploid breeding, while KWS Basset is a cross between Scout and Cassius and was produced through single-seed descent.

“We’re now testing more for end-user characteristics and are trying to re-invigorate the Group 3 sector which gives KWS Barrel and Basset a good opportunity,” says Mark Dodds.

KWS Barrel is the higher yielding of the two, performing particularly well in the North, with a uks for export.

KWS Barrel was added to the AHDB Cereals and Oilseeds Recommended List (RL) in autumn 2015 as a high yielding Group 3 biscuit wheat, says Keith Best, cereals product manager at KWS. “It’s performed well across all regions, particularly in the North where it yielded 8% above its UK average. It’s been consistent across three successive seasons as both a first and second wheat and should be a solid fit on farm whatever the situation.”

KWS Barrel yields 105% on the RL, matching four of the most widely grown feed varieties; Reflection, Evolution, JB Diego and KWS Santiago, which collectively account for about 30% of the UK wheat area. “In addition to yield, it has better all-round agronomy and superior grain quality compared with those varieties,” says Keith Best.

Quality characteristics

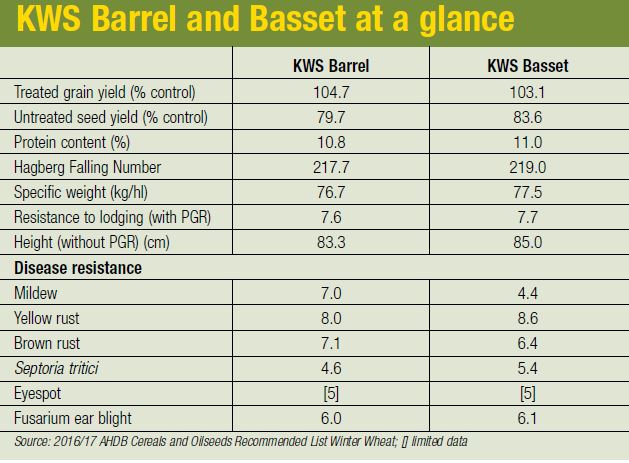

It has an average protein content of 10.8%, a Hagberg Falling Number of 218 and a specific weight of 76.7kg/hl. The quality characteristics are concurrent with a Group 3 variety, but it’ll be its agronomic strengths that appeal to growers concerned with the costs of producing wheat in an era of low commodity prices, he adds.

That said, farmers will need a robust agronomic programme to target a protein in excess of 11% to counter the slightly low protein average, says Mark Ringrose. “The older varieties had higher protein and lower yields and now the newer varieties are the opposite.”

Andrew Newby, managing director at KWS, says the focus for a lot in the industry is moving away from ag-chemical solutions towards a future where seed-breeding technologies are more prominent. “With Group 3 varieties, the only missing piece of the jigsaw was yield.”

KWS Barrel scores a 7 for mildew, 8 for yellow rust, 7 for brown rust, 5 for Septoria tritici and 6 for Fusarium ear blight. It’s also resistant to orange wheat blossom midge, which is a problem in some areas, says Keith Best. “It has a solid, all-round disease package and is short with stiff straw, and has a maturity similar to JB Diego.”

Because variety designations are typically published just before Christmas each year, breeders and seed suppliers are often cautious in the amount of seed they drill for multiplication. KWS therefore calculates that Barrel will take about 1% of the market this year before properly establishing itself in 2017.

“Based on its broad market and grower appeal we estimate that in 2017/18 it’ll account for 4-5% of the market,” says Keith Best. “From here I think it’ll go on to become one of the dominant wheat varieties in the UK.”

It has already been approved for biscuit making and as a uks wheat for export. It’s undergoing further testing for distilling and a decision is expected after this harvest, he adds. “It was very close to becoming a distilling variety last year and we’re hoping that after this harvest it’ll be approved.”

KWS Basset was added to the RL in autumn 2015, as a high yielding Group 3 variety at 103%. It performs particularly well in the Eastern region at 104% but has been consistent across regions, over years and in both first and second wheat slots, according to Will Compson at KWS. It has a protein content of 11%, a Hagberg of 219 and a specific weight of 77.5kg/hl.

“It ticks all the boxes for UK biscuit making and as a uks export wheat,” he says. “In terms of agronomy, it’s a short, stiff variety and is relatively early to mature, similar to JB Diego.” It has a solid disease resistance package, scoring a 9 for yellow rust, 5 for septoria and has OWBM resistance.

KWS Basset is in high demand and if it hasn’t sold out already, it will soon, says Will Compson. “It’s a variety that’ll be playing a big part in the market in the foreseeable future.”

However, Jack Watts, lead analyst at AHDB, warns farmers not to get complacent when it comes to market prospects. “The blow (of lower commodity prices) has been softened by high yields diluting costs, and it’s a fair assumption that we may not get a repeat of the high yields seen in the past two years, particularly with the late spring this year,” he says.

“UK and global prices are at a six-year low, with changes in the short-term future driven by the maize market.” He suggests that with the current state of the market, something has to change to balance things out. “We can solve this by getting more flexible and marketable wheat into the supply chain – which isn’t something we can do by just growing feed wheat.”

Exports are not just about getting rid of wheat stocks, insists Paul Temple, export chairman at AHDB. It’s about having a quality product to sell and having market momentum against competitors. “In my experience, soft wheats are a point of difference and foreign markets are aware of this quality.”

There’s a very real concern that the large quantity of surplus wheat produced last year won’t be shifted through export before harvest. Tom Eaton at Glencore suggests that this may be partly because the UK doesn’t have the right varieties or specification for the international market. With 70% of the UK’s surplus wheat made up of pure feed varieties, the UK could currently be growing the wrong type of wheat, he says.

Cheapest available

To sell this amount of feed wheat overseas, it would have to be the cheapest available in the world, and have a low moisture content. “Would it be easier if that 70% consisted of more milling and biscuit varieties? Spain, Portugal, Ireland, North Africa and Italy all import wheat for human consumption,” he says. “There would have been more opportunities to export between Jan and Mar of this year if there was quality wheat available, especially if that wheat was around 14% moisture. Merchants are offering buy-back contracts for harvest 2017. As a grower, why wouldn’t you want to open up your market options?”

Solid result from Group 3 introduction

Nick and Roger Watts farm around 1000ha near Framlingham in Suffolk and first planted KWS Barrel in 2014 as seed for KWS. A 21ha field was established after herbage seed on 22 Oct, which Nick Watts says was quite late.

“We wanted to put pig slurry on the field before drilling, which is why it was delayed.” It was ploughed, power harrow and drilled using a Väderstad drill, into a heavy clay loam, at a lowish seed rate of 160kg/ha.

There were a few issues with slugs, so pellets were applied in the first week of Nov and then another application on bad patches of the field shortly after.

The crop received a robust fungicide and PGR Program based on a split dose of SDHI at T1 and T2 with no strobilurin inclusion, due to KWS Barrel’s good yellow rust rating. It also had a split dose of clormequat-750 at T0 and T1 but because of its standing ability and the lateness of drilling no Terpal (mepiquat chloride+ 2-chloroethylphosphonic acid) was applied.

The crop had about 240kg/ha of solid N – 160kgN/ha as urea, 20kgN/ha as sulphate of ammonia and 60kgN/ha as ammonium nitrate. The first application of urea went onto the crop on 12 Mar 2015, then an application of sulphate of ammonia on 23 Mar, another of urea on 20 Apr and had a final dose of AN on 20 May.

“We had to keep the rates high along with the pig muck as it was behind grass which tends to lock up N in the turf,” says Nick Watts.

KWS Barrel was harvested on 23 Aug 2015 and yielded 10.4t/ha, had a specific weight of 76.8kg/hl, a Hagberg of 205 and 11.1% protein. Nick Watts says that although it was one of the lower yielding varieties, it did suffer from slug damage.

“It’s also quite hard to grow a high yielding wheat behind herbage seed and in the circumstances I’m very happy with how it did.” Overall the wheats on farm averaged 11t/ha, with second wheats Grafton at 9.6t/ha, KWS Gator at 10.5t/ha, and first wheats Oakley at 11.3t/ha and KWS Kielder at 11.8t/ha.

This year, Nick and Roger Watts are growing KWS Barrel for seed again, as a second wheat on the 21ha plot and a further 83ha commercially on a buy-back soft wheat contract. The 21ha plot was drilled on 13 Oct at 180kg/ha. It has had 240kgN/ha and looks good so far, reports Nick Watts.

The 83ha of commercial wheat is split into two blocks on separate farms. The first block of 40ha was drilled on 28 Sept behind oilseed rape, Väderstad-drilled into a non-inversion tillage system, at a seed rate of 150kg/ha. The crop had a final dose of N in the second week of May, bringing it up to 260kg/ha.

The second plot of commercial wheat covering 43ha was drilled on 26 Sept at 140kg/ha seed rate behind vining peas and Nick says it looks very good behind the peas. He’s expecting both commercial plots to make the soft specification of the buy-back contract with local farming co-op Framlingham Farmers.