A much better and relatively trouble-free 2022 crop for most and unprecedented rapeseed values have certainly raised the winter oilseed rape growing bar. But with higher input prices and extreme market volatility really upping the ante, CPM gets some much needed, risk-reducing market intelligence from those who should know best.

“We can be sure the market will continue to be volatile with big upside and downside swings.”

By Lucy de la Pasture

Those ‘in the know’ consider ex-farm rapeseed values of £700/t or more to be well behind us. But the consensus is also that crop values – or input prices, for that matter – won’t be dropping back to the sort of levels that used to be considered ‘normal’ for a good while yet.

At the same time, all believe greater volatility will continue to be experienced on both sides of the margin equation. So what does this mean for those with crop in the ground this autumn, hoping for another half-decent set of growing conditions and harvest? What sort of returns and margins can be expected in 2023? And perhaps most saliently, how can genetic and agronomic risk management be balanced with the most effective crop marketing, which can be equally influential to the bottom line?

James Bolesworth explains that both futures and options can help spread the risk when marketing rapeseed.

While the war in Ukraine has largely been largely behind the 2022 surge in rapeseed prices, James Bolesworth, managing director of independent market analysts and advisers CRM Agri, points out that the market had been gaining steadily before this.

“From around €450/t in early 2021, Paris Matif rapeseed prices climbed to nearer €700/t by this February,” he recalls. “After peaking at over €1000/t in late April, they fell back to just over €675/t at harvest and, though declining since, have remained over the €600/t level.

“Looking ahead, we can be sure the market will continue to be volatile with big upside and downside swings. It could easily move higher but has plenty of room to fall further.

“On the one hand, a global recession will dampen both vegetable oil and biodiesel demand, and any reliable opening of the Ukrainian grain sea corridor will obviously increase supply. Add in good oil crop harvests in North America and Australia as well as Europe, and prices could weaken considerably,” he says.

“On the other hand, a less negative world economic climate and continued uncertainties in Ukraine mean a very different outlook and much firmer prices; especially so if there are weather concerns, given global stocks as tight as they are.”

United Oilseeds trading manager Owen Cligg expects the sea change in palm oil supplies – as Indonesia removed the export restrictions it imposed in the spring – to add to the downward pressure on markets in the summer to be short-lived.

“On the positive side, biodiesel demand continues to be stronger than it would have been without restricted supplies of crude oil from Russia,” he explains, noting that any reductions in German and other European biofuel mandates are clearly off the table for a while.

“The importance of rapemeal as an animal feed protein source in Europe also remains a source of market support, as does the reliance of both the EU and UK on imports to fill crush capacity, and Ukrainian uncertainties that are unlikely to go away quickly.

“Overall, I’m more optimistic than pessimistic over price prospects. November ‘23 Paris futures values, which are continuing to trade at over €600/t, suggest support for ex-farm prices of £500/t before bonuses, which typically add 10% to crop returns,” says Owen.

Anthony Speight thinks the market for rapeseed could ease in 2023, but he stresses it wouldn’t take much to change for him to be more bullish.

Senior AHDB market analyst Anthony Speight thinks the market could ease for rapeseed in 2023, but he stresses it wouldn’t take much to change for him to be more bullish. Assuming there isn’t another major weather event in Canada or Australia between now and the start of 2023, he sees rapeseed prices once again being more influenced by soyabeans.

“Despite some dry weather, the American Mid-West soyabean crop continues to look promising,” he reports. “And record Brazilian plantings are on the cards. So, if there is no disaster in the US and the South American crop is as big as predicted, soya prices seem set to weaken and, with them, rapeseed values. We must remember that bull markets depend more on news, but bears need nothing.

“However, the Brazilian crop isn’t safely in the ground yet; big crops only get smaller and we know how rapidly market sentiments can change. Things are finely balanced at the moment. While 2023 rapeseed values are likely to be above historic levels, how much higher is the great unknown. And the one thing we can be sure of is continued volatility.”

The Loam Farm budgets reckon on yields of 3.33t/ha to give a break-even net margin. If Harvest 2023 rapeseed values drop to £500/t, the break-even yield is 3.43t/ha.

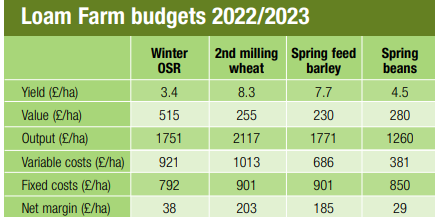

Against this background, Andersons’ latest Loam Farm budgets provide a useful indication of the sort of returns and margins likely and their sensitivity to market changes.

The 600ha all-arable model Loam Farm dropped OSR from its ‘virtual’ cropping in 2021 following a disastrous season in 2020. Andersons’ agribusiness analyst James Webster assesses the prospects for the crop in 2022/23.

“At currently budgeted ex-farm rapeseed value of £515/t and realistic input price expectations, our 2023 Loam Farm budgets show a net margin, after all costs, of £38/ha at our relatively conservative 3.4t/ha yield expectation,” he says.

“This is above the £29/ha we’re forecasting for a 4.5t/ha crop of spring beans. As rapeseed prices have been pressured lately, while grain prices have generally held their ground, it’s noticeably below the margins we anticipate from a second milling wheat or spring barley at Loam Farm.

Key variable cost assumptions – nitrogen £675/t; potash & phosphate £750/t; diesel 105p/litre Fixed costs include labour & power; overheads; and rent & finance. (Source: Andersons, 2022)

“At these costs and values, our break-even net margin yield is 3.33t/ha. And, even if harvest 2023 rapeseed values drop to £500/t, the break-even yield is a very achievable 3.43t/ha.”

Providing crops find sufficient moisture for another good establishment season, achieving the margins available depends, more than anything else, on the most reliable returns from the market. Reducing the marketing risk becomes even more important to offset the increased financial risk from this season’s much higher input costs. The $64,000 question is how best to do this?

“The highest risk in a volatile market almost always comes from selling your entire crop at the one time,” believes Anthony. “Although you could do well, you could also lose out badly.

“For the crop you’ve harvested this year, you can avoid putting all your eggs in the one basket by selling little and often over the coming year on the spot market. Alternatively, if your storage is limited or you don’t want to take the risk yourself, you can commit all or part of your production to a marketing pool.”

2023 Loam Farm budgets show a net margin, after all costs, of £38/ha at Andersons relatively conservative 3.4t/ha yield expectation, says James Webster.

Little and often ‘opportunity’ selling is essentially the approach taken by marketing pools. Overseeing the country’s biggest, Owen stresses that pool marketing allows growers to take advantage of experts trading from a position of knowledge and strength. He advises them to select the type of pool best suited to their particular crop movement needs and cash requirements, pointing out that there are a wide range of alternatives available, with the best ones historically outperforming spot-selling.

“We market all the grain in each of our United Oilseeds’ pools together, paying the average return we secure to each grower less haulage and storage charges and commission,” he explains. “They have the flexibility to commit as much grain as they wish to any of our three pools with different movement criteria.”

For farmers who don’t want to rely on others who they feel may not always have their best interests at heart, the futures market provides a really valuable tool, allowing them to lock into favourable forward prices at any time.

This approach isn’t without risk – mainly that actual production falls short of the futures contract commitment, necessitating buying on the open market to fulfil it which could be costly.

“Selling ahead on a produce of area basis is a popular way of avoiding this risk,” says James Bolesworth. “But it does tend to tie you to a single buyer. Alternatively, it’s important not to sell too much of your crop too far forward. And understanding your costs of production is crucial so you know a futures price that will deliver you a decent margin when you see one.”

Anthony suggests a little and often approach to the futures market. “When you see a forward price that you can live with for the 2023 crop, it might be worth taking advantage of for a small tonnage of your actual crop once you know you’ve got it established.

“Every time you sell you should be locking in a positive margin and by forward selling some, you’re mitigating some of the price risk and volatility. The last thing you want to do is to have to sell at harvest 2023 below your cost of production.”

Owen is thinking along similar lines. “The old adage of selling a third of your crop before harvest, a third at harvest and a third later in the year has much to recommend it. If you get your trading right, you can win hands down. But to do so, you need to understand what you’re doing and be good at it.”

This is where up-to-date market intelligence, advice and training from AHDB or specialists like CRM is so important if you are doing your own marketing, he adds.

“While you can never eliminate risk, there’s a lot you can do to spread it,” adds James Bolesworth. “Alongside futures, we frequently help growers use options as an insurance policy. These involve the right, but not the obligation, to buy or sell at an agreed price on, or before, a particular date and involve no physical grain transaction.

“You can buy a ‘call’ option on the London International Financial Futures and Options Exchange (LIFFE) if you’ve sold your grain but still want to benefit from a higher price should the market then rise. Or you can buy a ‘put’ option if you want to protect unsold grain against falling prices,” he explains.

“In each case, you can exercise your right to sell the option at the agreed price at any time up to the expiry date or let the option lapse, depending on whether the market works in your favour or not. The price you pay for this is the option premium – typically 3-10% of the crop value, depending on volatility.”

“They seem complicated but once you get used to using futures and options, they can be really valuable tools,” says Anthony. “Especially so where markets are as volatile as they seem to be today.”

Extra market security with HOLL

Guaranteed premiums for high oleic low linolenic (HOLL) rapeseed have risen to £40/t or more for harvest 2023 on the back of increased demand from food processors, with serious sunflower oil supply concerns brought on by war in Ukraine.

The fact that these premiums are available on top of all other bonuses in closed loop buy-back contracts gives added security; a security which has been significantly strengthened with two year contracts from United Oilseeds Marketing. This is offered on a produce of area basis, with discounts on seed of the latest HOLL varieties, a free seed replacement establishment scheme, and harvest movement as standard.

“Our contracts with several UK and European crushers serve a high health oil market, which is both under-supplied and keen to reduce its exposure to sunflower,” says Owen. “HOLL growing has been very valuable for our members to date and we see it providing particularly valuable extra security over ‘double low’ production in the medium term.

“With 60% of European rapeseed oil going into biodiesel, we have to remember that the commodity rapeseed market is highly vulnerable to any reductions in biofuel mandates. Currently side-lined while mineral fuel supplies are restricted by the Ukraine-Russia war, these are almost certain to rear their heads again once the pressure comes off.”

While premiums may not be as high as those available for high erucic acid rape (HEAR), Owen points out that these offer no oil or other bonuses. He adds that growing HOLL doesn’t reduce the flexibility to switch back to double-low production like HEAR growing does – with its danger of future erucic acid volunteer contamination.

De-Risking OSR

Oilseed rape looks a much more attractive proposition this autumn with rapeseed prices set to remain firm and CSFB less of an issue than it has been. Following on from last season’s Battling the Beetle series, which explored strategies to combat the threat of cabbage stem flea beetle, CPM has again teamed-up with Bayer to take a more holistic look at removing some of the undoubted risks associated with growing OSR through agronomy, genetics and marketing.

Part of Bayer’s role in providing trusted support to OSR growers and their agronomists, that goes well beyond the robust and dependable varieties that have always been the Dekalb trademark, we hope this helps everyone improve the reliability of their cropping to take the greatest possible advantage of the excellent opportunities for OSR in the rotation.

This article was taken from the latest issue of CPM. For more articles like this, subscribe here.