With cabbage stem flea beetle and rising costs stacked against it, could it be time to drop oilseed rape from the rotation? CPM travels to a CSFB hotspot and grills the experts.

Opening up plants revealed 15-20 larvae feeding inside the stems and petioles.

By Lucy de la Pasture

Fans of BBC’s Top Gear may remember the Herts village of Ashwell for the infamous ‘biodiesel challenge’ which took place there. But there’s currently a different oilseed rape-related challenge this area faces – it’s a ‘hotspot’ for cabbage stem flea beetle

Roger Huffer farms around 400ha near Ashwell, in a family partnership, and is one of the few growers in the locality who’s stuck with OSR and has been getting good results.

“We’ve been growing the crop for the past ten years and although yields have been decreasing slightly year on year, we’ve been successful in taking all our planted area through to harvest where others have completely lost crops to flea beetle attack,” he explains.

OSR is established on the farm behind the sub-soiler, directly into stubble which is purposefully left long to afford the young plants some degree of protection. Last autumn, a neighbouring small holding was incorporated into the farmed acreage and planted with OSR following a winter barley crop.

“The land had only ever had one previous crop of OSR and we were able to get early entry following the barley crop, planting OSR on Aug 15. It rained soon after and the crop was up early and got away really well with comparatively little damage from adult flea beetles.”

CSFB hotspots

The seed had been treated with a neonicotinoid seed dressing when the derogation eventually came through for special use in the CSFB hotspots. “We didn’t know until very late in the day whether we’d be permitted to use a neonic and when the decision was made, our seed supplier was then only able to dress one variety. That meant our entire OSR area is in a single variety this year which wasn’t what we’d intended.”

All looked in good order until the second week in Jan, after the first real frosts of the winter. That’s when Jon Yeoman, Frontier regional agronomy manager, got the phone call that all was not looking well.

“Some of the leaf petioles had split wide open after the frost. Where larvae must have been feeding, water had then frozen and expanded,” he explains. “Opening up plants revealed 15-20 larvae feeding inside the stems and petioles.”

By the end of April, some plants had died completely, others are stunted and cabbage-like in appearance, with other plants going on to flower. The difference in development between individual plants creates all sorts of difficulties managing the crop.

“We cut back on nitrogen application, applying 150kgN/ha and the crop is so open that fortunately light leaf spot hasn’t been a problem for us,” says Roger Huffer.

The biggest problem of all will be deciding when to desiccate the crop, adds Jon Yeoman. “The crop is all over the place in terms of development. so we’ll have to take a view on the majority when it comes to applying glyphosate. It may be worthwhile going in earlier with a pod sealant to widen the window a little but it’s going to prove difficult not to desiccate some plants too early, which will mean an increased likelihood of red seeds in the sample.”

One of the curious things about this particular block of OSR is that neighbours’ crops and other blocks of the same variety on Roger’s farm, although also affected by flea beetle, are nowhere near as severely damaged. That raises the question, why?

Paul Cartwright, crop production specialist for Frontier, believes that more research needs to be done on flea beetle to answer that question fully. In the meantime, there’s little doubt that flea beetle numbers have increased dramatically over the past three seasons, as a consequence of both the neonic ban and the reduction in pyrethroid efficacy.

“At the moment, we don’t know how far adult flea beetles move. Is the reduction in the acreage of OSR being grown, especially in the hotspot areas, just concentrating pest pressure as adults move to food sources?” he asks.

“High numbers of CSFB are being seen on a wide scale, not just in the traditional hotspots. What does this mean for OSR crops in 2017? At the moment no one can answer that question though it’s logical to assume that high larval numbers may go on to boost adult populations in the autumn if conditions are favourable.”

Although definitive answers to the flea beetle threat are hard to come by, there’s circumstantial evidence that points to an interaction between the timing of pest attack and the developmental stage of the plant.

Noticeable difference

“I’ve just been to visit a field near Ipswich that had three different varieties drilled across it. There was a noticeable difference in the severity of flea beetle effects between the different varieties, which indicates there’s an interaction between the pest and the developmental characteristics of each variety.

“What’s apparent is that plant damage appears to be much more obvious where there’s another stress factor involved – for example patches of gravelly soil, compaction or herbicide stress,” he says.

“Crop effects depend very much on where the damage occurred in the plant. If larvae are feeding low down, then plants are often stunted because of damage to the plants vascular system. If larval feeding is higher up then blind flower sites may be the only external visual symptom,” Paul Cartwright explains.

Having successfully established OSR on a farm where 46% of adult flea beetle were tested as pyrethroid resistant before the season began, Jon Yeoman is less sure that the knowledge or armoury exists to successfully protect against larval damage in the future. What’s more, no one really knows whether the current threat posed by flea beetle is purely down to inadequate previous control or other migratory factors, he says.

“The current crop was treated with a neonic seed treatment and then had two subsequent pyrethroid applications, based around lambda-cyhalothrin, and a later application of Biscaya (thiacloprid) for aphid control (TuYV) and still has been severely damaged. We need to achieve better control of CSFB over the egg-laying period.”

Work is being carried out at Rothamsted Research to see whether the larval stages of CSFB have any pyrethroid resistance, but even if they’re susceptible, there’s still a difficulty in actually targeting the pest.

What is clear is that the risk has changed from one where adult flea beetle was the main threat, to a situation where the larval stage is now threatening OSR production on Roger Huffer’s farm. So how does he see the way forward?

It’s a decision that’s hard to make with no clear indications being given as to whether there’ll be a further neonic derogation for this autumn – something that’s vital to OSR production on his farm, he says.

“We’re going to drop OSR on the heavier soils, where we’ve been growing on a one year in three rotation and concentrate on growing OSR on the lighter soils with a longer rotation,” he says. “We’ve never put on autumn nitrogen before, but this is something we’ll consider doing this autumn.”

There’s no doubt that dropping OSR leaves a big hole in the rotation, so what is Roger Huffer likely to grow instead?

“I’m hoping to increase the sugar beet area and have been discussing this with British Sugar but I’m also likely to increase our acreage of winter beans (currently 40ha),” he says. “One of the biggest downsides to reducing the OSR acreage is that it helps us to spread our workload, being early planted and early to harvest and gives us a relatively early entry for wheat in the autumn.”

The degree of damage from CSFB larvae on the farm is too much for any business to stomach, agrees Jon Yeoman, especially if it proves to be a year-on-year occurrence and not a one-off.

“OSR is a crop where most of the money is spent before Christmas and this crop looked to be doing well. The heavy land has a low level of blackgrass so by the time the extent of the damage was obvious, Astrokerb (aminopyralid+ propyzamide) had already been applied, so abandoning the crop and spring cropping wasn’t even an option,” he adds.

OSR still benefits rotation

When it comes to reconsidering whether OSR still has a future on the farm, there are important aspects of rotational change to factor in when it comes to farm profitability, according to whole-rotation margin studies undertaken jointly by Agrii farm consultancy specialist, Paul Pickford and head of agronomy, Colin Lloyd.

“With escalating weed, pest and disease problems, an increasingly restricted agrochemical armoury and disappointing commodity markets, it isn’t surprising more growers are looking at their rotations far more open-mindedly these days,” says Paul Pickford. “Not least because winter OSR is a relatively risky crop to grow and second wheat a disappointing earner for many.”

“The wheat/wheat/OSR rotation, that’s been the first choice for heavy land across much of the country, is being called into serious question in terms of both blackgrass management and OSR pest and disease control,” adds Colin Lloyd.

“In response, more and more people are looking to widen their rotation and/or re-introduce an element of spring cropping to profit from the advantages our research has long shown from a more integrated ‘beyond-the-can’ approach to blackgrass control in particular.

“The problem is it’s all too easy to throw out the baby with the bath water. This becomes crystal clear from an examination of various rotational options.”

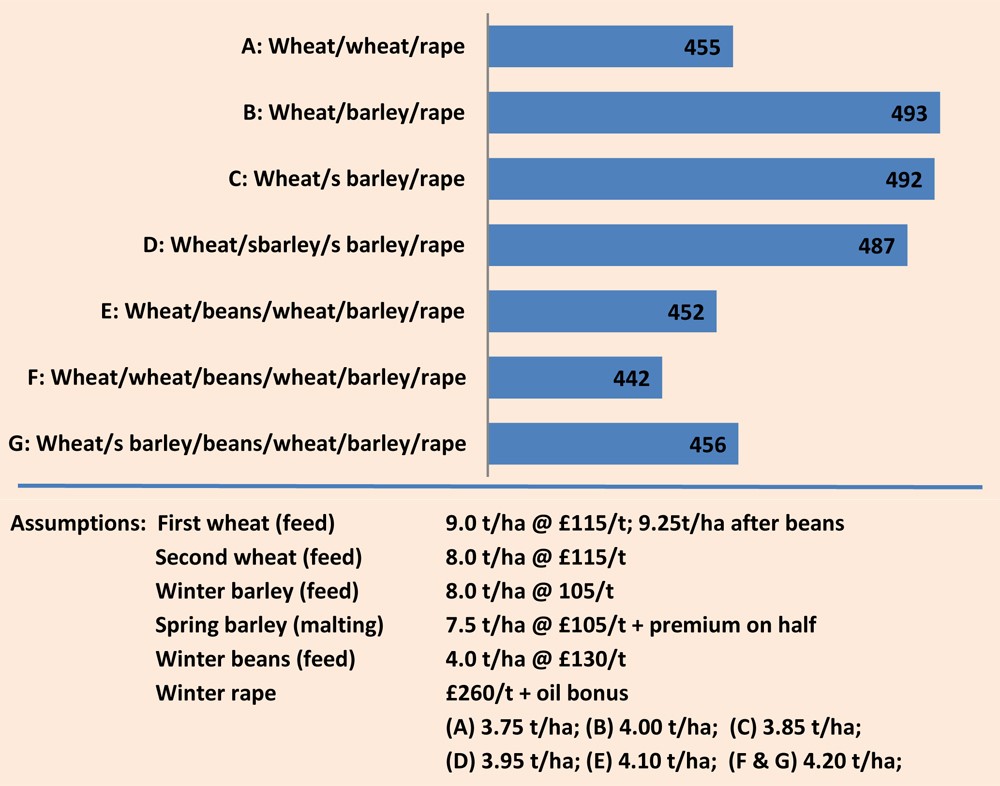

Taking wheat/wheat/OSR as their base, Paul Pickford and Colin Lloyd have explored the financial implications of a number of alternative heavy land rotations using the most up-to-date crop values and costs. In each case, they’ve calculated the average annual margin across the rotation to provide the best profitability comparison.

With a typical 9.0t/ha first feed wheat, 8.0t/ha second wheat (again for feed) and 3.75t/ha winter OSR, their base rotation delivers an average annual margin of just under £455/ha.

Replacing the second wheat with an 8t/ha crop of winter feed barley to achieve an earlier entry for OSR crop and push its performance up to 4t/ha increases the average margin to nearly £493/ha, courtesy of a better margin from the barley as well as extra output from the OSR for the same input cost.

While spring instead of winter barley provides a less good entry for OSR and lower (3.85t/ha) assumed performance, this is made up for by a malting premium on a conservative half the 7.5t/ha crop and lower input costs to deliver an almost identical £492/ha average margin.

Although it should allow OSR yields to be progressively increased, widening the rotation further could become self-defeating on a whole farm basis, the Agrii calculations suggest. This is mainly because an alternative break crop and/or second wheat needs to be introduced, both of which can seriously dilute the margin across the rotation.

For example, a five-year winter wheat/winter beans/winter wheat/winter barley/winter OSR rotation only delivers an average margin of £452/ha, even with a 4.1t/ha crop of OSR and an extra 0.25t/ha from wheat after beans. And a six-year sequence of winter wheat/winter wheat/winter beans/winter wheat/winter barley/winter OSR delivers £442/ha, with OSR yielding 4.2t/ha.

Replacing the second wheat with spring barley improves the annual rotational margin to £456/ha, but this is still only around the original wheat/wheat/OSR level.

“The nub of the problem is that alternative break crops really struggle to match the margins possible from winter OSR, even at rapeseed base prices as low as £250/t,” Paul Pickford believes.

“This is mainly because the markets for peas, beans and other crops are far more restricted. We’ve seen over the past season that extra supplies can really push prices down.

“While we were looking at £155/t for 2016 feed beans last July, we’re currently reckoning on £130/t. Yet they need to be up around £200/t to make them a competitive break. Under these conditions, it seems madness to us that pulse-growing is forecast to increase substantially yet again this season!

“Our studies strongly suggest most growers would be better off accepting the yield-limitation of growing winter OSR every three or four years and making the most of these crops by fine-tuning their agronomy rather than looking to stretching the rotation any further as the solution to OSR concerns.”

For those prepared to grow the crop, Colin Lloyd advises replacing second wheat with winter barley to get the best possible OSR entry for the most reliable autumn establishment. “Although it may not have the later drilling flexibility of wheat in blackgrass management terms, as we’ve seen at Stow Longa, the right winter barley can effectively compensate for this through particular competitiveness.

“The spring barley options – either one or two in a row – can clearly have valuable advantages in spreading workloads as well as managing blackgrass. But the watch-out has to be in any harvest delay. So it’s not a course of action I’d recommend where flea beetle or weather risks make OSR sowing especially time-critical.”

Is OSR a risk worth taking?

It’s been the leading break crop in the UK for decades but OSR has always been a relatively risky crop to grow, with historic problems regarding yield stability and variability in price. CSFB has added to the risks, especially in a crop where the agronomy costs are loaded into the first few months the crop is in the ground (see table).

| Crop | Chance of loss | Cost (£/ha) by Dec | Risk value (£/ha) |

| W Wheat | 1% | 400 – 600 | 4-6 |

| W OSR | 15% | 350 – 500 | 50-75 |

| Exc. rent & finance |

Source: Jack Watts, AHDB Cereals and Oilseeds

Last autumn saw a significant reduction in crop area, as many growers consolidated their OSR acreage to free up the management capability to monitor the crop better and maximise its potential, says Jack Watts, lead analyst for AHDB Cereals and Oilseeds.

“The problem is falling returns and higher risks. For the first time, growers are having to factor in how much of their planted area will go through to harvest. A full indicative net margin analysis of OSR crops in 2017 indicates that, assuming a yield of 3.65t/ha and a price of £250/t, OSR growers are likely to lose £215/ha, even without crop losses.”

That’s a worrying statistic and begs the question, where are the rewards right now? An increase in the price and less variation in yield are two factors which make the future of OSR look rosier but when that’ll happen is uncertain.

“OSR prices are volatile but demand is there. Should prices recover from recent lows, then the balance between risk and reward will improve. For some growers, a focus on producing quality oil to boost the premium and growing HOLL varieties is a way of improving profitability,” he says. “The LEAF Marque scheme is another route to adding premium but these aren’t options for everyone.”

It won’t be long before decisions are being made regarding next year’s cropping and a new twist to the CSFB problem is the massive increase in numbers of larvae seen this spring. Is this going to up the ante when it comes to the risk of growing OSR?

CSFB has certainly contributed to increased risks in growing the crop in some regions, especially since the loss of neonicotinoid seed dressings. In the AHDB CSFB live incidence and severity monitoring, OSR crop losses associated with adult CSFB activity in autumn 2015 have been estimated at around 1% (6,000ha), though to put this in context, a further 18,000ha were reported lost due to other factors and slugs in particular. The knock-on effect of high larval numbers this season is yet to be fully seen.

So where does that leave growers contemplating their options for harvest 2017? Finding the answer to whether OSR should currently be included in the rotation is challenging the industry to think differently, reckons Jack Watts.

“There isn’t a ‘one size fits all’ answer to that question and the risk of growing OSR needs to be assessed on a field-by-field basis. The ability of a business to take risk will be very different depending on individual circumstances; whether an owner-occupier, tenant or contract farmer as well as the availability of cash within the business.

“Then there’s an individual’s perception of risk. Some growers will consider the risk is worthwhile because of the boost OSR gives to their production of first wheats in the rotation. Others may not be able to take that risk,” he says.

The big question is what to grow in place of OSR if growing the crop just doesn’t stack up anymore. “As far as other break crops are concerned, the market for spring beans has also proved challenging after the increase in area planted in 2015, prices having collapsed in line with other commodity markets,” he says, adding that linseed may be an option for a few growers.

“In some cases a spring cropping or fallow option may be a better alternative. It depends on each business’ fixed cost base, how variable is it and can you switch some of it off? Temporarily taking land out of production to assist getting on top of blackgrass, and to build agronomic potential until prices recover, is a serious option when it comes to looking at the overall profitability of some farm businesses,” he concludes.