Spring crops can be as profitable as most winter plantings in 2018, other than wheat and oilseed rape. CPM looks at some of the alternatives.

By Lucy de la Pasture and Tom Allen-Stevens

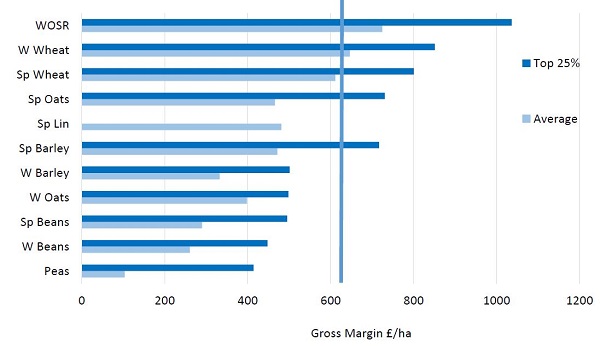

Based on current crop values and input costs, the latest Agrii budgets show naked oats continue to offer the best margin prospects, followed by spring oilseed rape, milling oats, milling wheat and malting barley. Feed barley is again likely to generate the poorest spring cereal margins, although significantly ahead of beans, peas or linseed.

“Gross margins are all about yields,” stresses Agrii’s Paul Pickford. “If they yield well, our figures show spring crops are likely to deliver gross margins not far short of reasonably performing winter wheat and OSR crops.

Agrii budgeting forecast for 2018 spring cropping profitability

Source: Agrii

“This is underlined by the latest three years of actual field-by-field margin data from our Maximising Arable Performance (MAP) benchmarking group showing spring wheat, barley and oats generally outperforming all but winter wheat and OSR.

“Interestingly, the MAP data show the range in the average yield of key spring crops over the years is less than that of the winter staples, suggesting they may also carry less growing risk than often assumed.”

Paul Pickford advises growers to make the most of futures markets and contracts to lock-into prices and specific markets as part of their 2018 spring cropping strategy.

Forecast margins for 2018 are slightly higher than they were for last season due to marginally improved crop values, he notes. “But when considering risk, take into account the supply and demand position of the various crop markets, especially as the highest potential spring cereal margins come from milling or malting crops.

“As well as pushing the traditional £10/t wheat to barley discount to nearer £20/t, increasing national production resulting from the expanding spring barley acreage could well put growing pressure on malting premiums. Strictly limited markets for both naked and milling oats must also be factored into the equation. As must the effect of large Group 1 winter wheat plantings on milling premiums and the availability of human food export opportunities for pulses.

“Under these circumstances, I would strongly advise growers to make the most of futures markets and contracts to lock into prices and specific markets as part of their 2018 spring cropping strategy. While the margin prospects for spring cropping look reasonable at the moment, we know how rapidly markets can change. And these tools allow this area of risk to be reasonably managed.”

With the right modern agronomy, oats offer an attractive spring cropping option for difficult blackgrass ground, believes Agrii R&D manager, Jim Carswell.

“As well as a true cereal break, Agrii trials at Stow Longa show oats are more competitive with grassweeds than other spring cereals. At the same time, they have much greater sowing date flexibility; are noticeably more tolerant of low pH and wet soils than either spring wheat or barley; and leave a much better soil structure for following crops courtesy of their highly fibrous rooting.

“Spring oats today are perfectly capable of delivering a good 8t/ha commercially,” Jim points out. “We’ve seen 2017 yields comfortably over 9t/ha in our national variety trials. Yet even the latest RB209 revision assumes spring oat nutrient offtakes based on just 6t/ha.

Another spring crop which is rapidly gaining ground is soya beans. “The soya area has grown from 80ha three years ago to 2024ha in 2017 and we expect this to double or triple in 2018,” says David McNaughton, director of Soya UK.

At current prices the UK soya crop is producing a very respectable gross margin of £630/ha, commanding a premium of £45-50/t over any origin beans due to the fully traceable and non-GM status of crops grown in the UK.

It’s a market that David believes has the potential to continue to improve, particularly if import tariffs are slapped on soya in the post-Brexit era. “The UK imports 2Mt of soya meal and 1Mt of raw beans. The question is how far can the UK go in supplying this market and I believe that, with some improvement in the UK processing capacity, there’s scope for a home-grown area of soya in excess of 50,000ha.

“The Chinese entered the world soya market in 2007 and are the world’s largest importer at 94Mt, followed by the EU28 countries which collectively import around 30Mt. The demand from China has resulted in more than a doubling in the value of soya, the only commodity that has fundamentally changed in value over the past decade,” he adds.

Soya varieties have improved drastically in recent years, points out David. “This season yields have held up well, with the average being around 2.5t/ha, and performance has been reliable in the face of a challenging year.

“Modern varieties are determinate and have proven themselves able to wait for harvest without any detrimental effects,” he explains, adding that most crops were ready to harvest in late Sept. He also recommends soya as a spring crop ideally suited to those in a blackgrass situation.

“The soya crop is planted in late April to mid-May so there is ample time to stale seedbed. The canopy is also very competitive later in the season.”

Consider the wider rotation

“Gross margins are important to understand, but the decision can’t be purely based on the return of an individual crop. The role that the crop plays in weed control, soil management, and the wider rotation must be considered,” says Wynnstay’s Richard Torr.

“Increasingly spring oats are being used as a break crop, grown either for home use in livestock feed or for milling. The main benefit is that the following wheat crop won’t be susceptible to take-all risk, and it’s an easy crop to introduce into the rotation.

“WPB Elyann is a new variety for this year, that provides an improved kernel content and good specific weight. This means that it’s possible to achieve the specifications required for use in human consumption with a spring variety.”

But if improving soil fertility is a priority, he suggests some more suitable options. “While not as attractive for greening purposes now, spring beans are still likely to be a popular option particularly where OSR has historically been grown. The cost benefits rarely show spring beans to be a high gross margin crop, but beans are an excellent deep rooting, nitrogen-fixing break crop and provide considerable benefits to the following first wheat crop.”

He adds that spring bean variety selection is often based on yield potential, and that there are some new entrants to choose from. “A new variety to consider this year is Lynx, which is a top rated, high yielding crop with very good downy mildew resistance and excellent standing.”

New blackgrass herbicide available this spring

A new blackgrass herbicide will be available to growers this coming spring. Monolith (mesosulfuron+ propoxycarbazone) boasts superior and more consistent levels of blackgrass control in winter wheat crops, believes Bayer’s Ben Coombs.

Monolith gives a significant step up in blackgrass control compared with its predecessor Atlantis (mesosulfuron+ iodosulfuron), he says. In trials, it provided an average of 10% more control of blackgrass than Atlantis. The trial results also show that Monolith is more consistent and overall control never dipped below 50% with Monolith.

In 19 comparative trials, the control from Monolith ranged from 53–95%, while for Atlantis it was 16–94%. All trials took place in fields with blackgrass problems and reflect the kind of blackgrass populations farmers have to deal with, including those with resistance.

“Atlantis performance has declined so growers will want to know how Monolith changes the situation,” explains Ben. “The trial results already show it outperforms Atlantis for control and consistency on difficult populations. Secondly, the chemical composition of Monolith has two actives with grassweed activity that support each other.”

Ben clarifies that if target site resistance is a problem then there won’t be any difference in performance than Atlantis, but he points out that mixed populations of blackgrass always exist in the field and that for any that have EMR resistance, Monolith will give this uplift in performance.

Monolith combines mesosulfuron which is found in Atlantis and propoxycarbazone, the active ingredient in Attribut. Formulated together they make a very potent tool for controlling blackgrass and other common grassweeds such as brome, ryegrass and wild oats, notes Ben.

“The grassweed-only combination means growers can better target broadleaf weed control where it’s needed. It’s really important to use Monolith as part of a full programme of cultural controls and varied actives to help protect the product and to ensure the best results.”

Monolith is for spring application in winter wheat crops. It can be applied from 1 Feb and when the crop is at the first tiller stage until 2nd node detectable (GS21–32). Apart from the timing restrictions, application advice is similar to other Bayer post-emergence herbicides such as Atlantis WG.

“Herbicide uptake is by blackgrass leaves, so it’s essential to have active growth when it’s applied. It‘s also more effective at earlier growth stages of grassweeds, so should be applied as soon as conditions allow. Monolith should be applied as a fine spray at a water volume 200 l/ha and mixed with the adjuvant biopower (1 l/ha),” he adds.

While he appreciates growers aren’t likely to switch all their post-em programme to the new herbicide in one season, Ben is keen for farmers to try out the new herbicide which will be available at a slight premium to Atlantis. “For this season, we’d really encourage farmers to try Monolith on a few of their fields,” he concludes.