UK growers have a strong reputation for producing Group 3 wheats of a quality sought after by millers. But a polarised market has squeezed Group 3s to just 5-6% of the total wheat area. CPM investigates what they have to offer.

The newest Group 3 wheats are agronomically competent varieties that yield well and should get market share.

By Lucy de la Pasture

There’s been a bit of a breeding revolution in quality wheats over the past few years. So much so that yields of many of the newer Group 1 winter wheats (Skyfall and KWS Trinity in particular) are not only becoming competitive with feed varieties in terms of yield, but they also open up multiple market possibilities to growers.

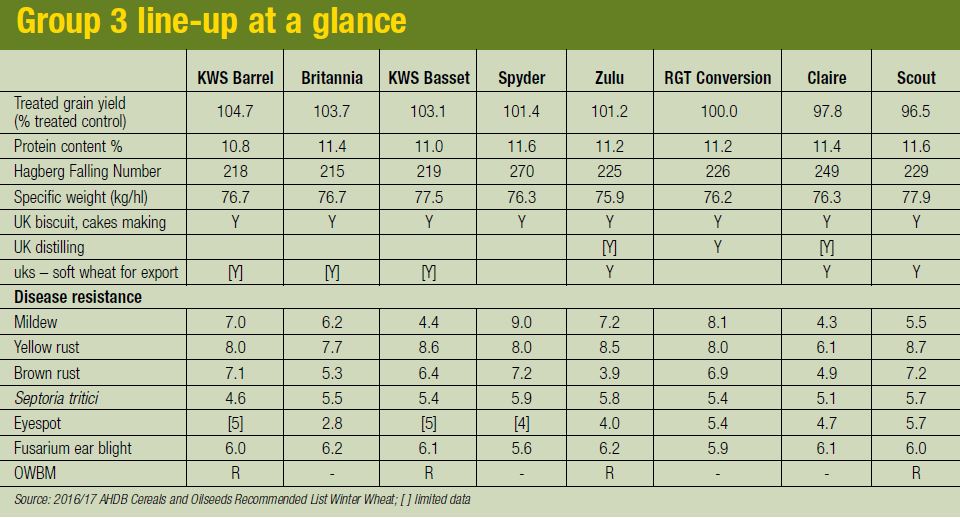

But five of the eight Group 3 varieties on the AHDB Cereals and Oilseeds Recommended List (RL) are recent additions with equally alluring credentials. Limagrain’s Britannia, added in 2015, and newcomers KWS Basset and Barrel have mighty yields and look to have much to offer, with similar market versatility to the newer Group 1 varieties. That begs the question, why aren’t growers putting more in the ground?

The introduction of wheat varieties with market versatility is the most exciting thing to happen in the UK wheat market for a long time, believes AHDB lead analyst, Jack Watts.

“Varieties that can be directed to different markets means growers can delay the selling decision and can adjust agronomic decisions during the growth of the crop, such as late N applications, according to the season, potential of the crop and strength of the marketplace.

Jack Watts reckons new Group 3 varieties will help UK grain production become more marketable both globally and in Europe.

“The newest Group 3s will give the UK additional points of difference and help our grain production become more marketable both globally and in Europe. The quality wheat game has changed and premiums have shrunk, so it’s important not to get hung up on milling premiums but look on them more as an opportunity,” he says.

Outlining the market for Group 3 wheats, Andrew Flux, Frontier’s commercial director reckons that although availability of soft milling wheats has changed over the past few years, market demand for them hasn’t.

“Domestic demand from millers for Group 3 wheats is as strong as ever for use in biscuits, cakes and batters. Requirements differ between end users, with some specifying individual varieties and others just wanting soft milling wheat,” he explains.

“There’s also good export demand from Southern Europe, particularly Spain and Portugal, for quality soft milling wheat for biscuit making.”

Are we producing enough Group 3 wheat in the UK? According to Andrew Flux, the situation isn’t that black and white.

“On the basis that we’re exporting soft milling wheat we must be producing enough for our domestic markets. However, milling is all about grist management rather than just the endosperm characteristics of a variety. It’s a very dynamic market where the blends of flour that go in to make the grist change according to the quality and price of available grain,” he says.

Key influences

Location is one of the key influencers when it comes to capitalizing on the export market. “Most of the Group 3 export movement is going through Tilbury Docks so if you’re growing wheat with good access to Tilbury, you’re in a better position to take advantage of the export market when the opportunity arises,” he adds.

“Having a spread of varieties on the farm with good agronomic compatibility is very important to make the most of market opportunities. The newest Group 3 wheats are agronomically competent varieties that yield well and should get market share. KWS Barrel in particular is looking a reasonable variety which seems to fit end markets and already has a premium against it,” says Andrew Flux.

The domestic markets open to Group 3 varieties are soft milling (biscuits, cakes and batters), distilling and soft feed wheats with an additional opportunity in some regions as uks, soft wheat for export.

Only three of the Group 3 varieties on the RL are suitable for distilling – Limagrain varieties Claire and Zulu and RAGT Seeds’ RGT Conversion, with the sole biscuit-making variety on the RL candidate list, Limagrain’s Bletchley, also showing all-round potential.

As far as their milling quality characteristics go, Claire still sets the gold standard, according to Ian Foot, wheat quality manager at Limagrain.

“Claire is still liked so much among end users because of its combination of good milling quality, bright white flour colour and high dough extensibility (a measure of stretch). When varieties are evaluated for bread-making quality, a key part of the process is the baking and assessment of bread,” notes Ian Foot.

Gluten properties

“The corresponding assessment for biscuit quality involves measuring gluten properties when a dough is stretched under carefully controlled conditions – nobody bakes a biscuit to evaluate suitability as a biscuit-making wheat which means we’re probably losing good varieties in the assessment process.”

One milling market where demand is on the up is batters and coatings. JAS Bowman and Sons produce a full range of dry cereal-based coating systems for frozen and chilled food applications and for them, Group 3 soft milling wheats are the ingredient of choice.

“We’re biased towards soft wheat varieties and if grain meets the Group 3 standard, then we’ll use it,” explains Mark Isaacson, Bowman’s commercial director. “The overall decline in the UK area of Group 3 wheat is a concern, especially as the UK has a unique ability to produce soft milling wheats of the right quality where many other countries can’t.”

Ron Granger, Limagrain arable technical manager, believes the improvements breeders have made in terms of yield potential will help Group 3 wheats recover some of the ground they’ve lost to other classes of wheat over the past three seasons.

“These new biscuit wheats offer growers the same yield potential as the highest yielding feed wheats but with the bonus of additional end market opportunities and premiums in some instances.”

Limagrain’s Britannia joined the RL in 2015 and was the first variety to put yields of Group 3 back on the map. New introductions KWS Barrel and Basset add further strength to the yield competitiveness of the soft milling group.

“Growers don’t want just big piles of wheat, they want consistent quality and premium potential. Claire has been so successful because it covers a range of market opportunities. Zulu doesn’t have the highest yield but offers good grower security, is easy to market and has resistance to orange wheat blossom midge and soil-borne cereal mosaic virus (SBCMV),” he says, adding that pockets of SBCMV are becoming common in the southern counties.

“The quality wheat varieties have also shown to be risk averse especially in high disease-pressure years as in 2014, when good disease resistance maintained yield potential on farm when spray programmes were delayed,” claims Ron Grainger.

“Varieties such as Crusoe have proven to be robust and have out yielded many feed wheats in situations where they’re under high septoria pressure and delayed fungicide programmes were inevitable due to erratic weather situations.”

Candidate variety Bletchley is a new contender from the Limagrain programme in the biscuit sector and offers additional agronomic traits that may also be of interest to northern growers, including early maturity and a full range of market options, like Claire.

Stuart Paul farms around 245ha on the east coast of Suffolk, near Ipswich. He grows 100ha of winter wheat, split in the main between Zulu and KWS Gator, with a smaller acreage of Evolution. Winter wheat is always a first wheat in a rotation that includes oilseed rape, sugar beet, potatoes, spring and winter barley.

Good all-rounder

“Zulu caught my eye when it was in trials and we’ve been growing it on the farm for the past three years. It seems to be a good all-rounder and particularly suits our free-draining sandy loam soil,” he says.

“We’re early to harvest here on the east coast and, if we can establish plants with a good root structure, Zulu’s early maturity fits in, where later maturing varieties wouldn’t do so well on soils that can go droughty through May to July.”

Stuart Paul also finds Zulu suits an early drilling spot, with drilling normally taking place from mid-late Sept on his farm.

“Zulu has its strengths and weaknesses, septoria and brown rust were evident earlier this spring, but then most other varieties were having disease problems too. It’s not a particularly dirty variety and doesn’t cost a fortune for us to grow.

“On this soil I’m happy if we achieve 3.5t/acre (8.65t/ha) and we’re close to Ipswich grain terminal so there are export opportunities. If we can meet the specification for milling premium, that’s an added bonus,” he says